StoneCo Is Still Cheap, Still Growing, and I'm Still Buying! (Q4 & FY 2023 Earnings Review)

Summary

TLDRStoneCo, a Brazilian financial technology company, reported earnings with a stock drop following the announcement. Despite a 10% after-hours decline and a 6.8% drop, the stock has risen 82% in the past year. The company's founder, André, is stepping down as chairman but remains involved. StoneCo's competitive advantage lies in its vast reach, serving over three million small businesses across 5,000 cities in Brazil. The firm is also focusing on customer satisfaction and transitioning to a platform model to serve various needs beyond payments. Strategic shifts include offloading less profitable customers and concentrating on key verticals, aiming for sustainable growth and profitability.

Takeaways

- 📉 StoneCo's stock price fell significantly after reporting earnings, but the speaker isn't concerned about the short-term dip.

- 🚀 Over the past year, StoneCo's stock has seen an impressive 82% increase despite recent declines.

- 🤵 The founder of StoneCo, André, is stepping down from his board and chairman roles, which has caused some market apprehension.

- 🌐 StoneCo has a vast reach, operating in over 5,000 cities and serving more than three million small businesses in Brazil.

- 🏆 The company prides itself on superior service, boasting a quick response time of less than five seconds for customer support.

- 💡 There's speculation about the future role of generative AI in StoneCo's operations, potentially handling customer service and saving costs.

- 🛍️ StoneCo is transitioning towards a platform model, aiming to serve a variety of business needs beyond payments.

- 🎯 The company is sharpening its strategic focus, implementing zero-based budgeting and cost management methods, and offloading less profitable customers.

- 📈 StoneCo's payment client base is growing rapidly, with a 37% year-over-year increase and 3.5 million customers using their devices.

- 💰 The company is focusing on profitable growth, with adjusted net income and EBIT growing faster than total revenue.

- 🔄 StoneCo's banking service is showing strong growth, with a 50% increase in client deposits and a 3x increase in active clients.

Q & A

What was the recent stock performance of StoneCo after reporting earnings?

-StoneCo's stock was down about 10% after hours following the earnings report and approximately 6.8% by the end of the day.

What significant change is happening within StoneCo's leadership?

-The founder of StoneCo, André, is stepping away from his role as chairman of the board. He will, however, remain involved in the company and will elect the next chairman.

How has StoneCo's stock performed over the past year?

-Over the past year, StoneCo's stock has seen an increase of 82%.

What is StoneCo's competitive advantage in the marketplace?

-StoneCo's competitive advantage includes a vast reach with over three million small businesses using their services, presence in 5,000 cities covering 99% of the service GDP in Brazil, superior service with quick response times, and a focus on key verticals like retailers, gas stations, food stores, and drug stores.

What is StoneCo's strategy for moving towards a platform model?

-StoneCo aims to transition from being solely a payments company to a platform that can serve various needs, from ERP software for a gas station to banking and credit services, thus expanding their offerings beyond payments.

How is StoneCo focusing on efficiency and strategic priorities?

-StoneCo is implementing zero-based budgeting and cost management methods, reshaping its organizational structure, and offloading less profitable customers to focus on key verticals and profitable growth.

What is StoneCo's approach to customer engagement and take rate?

-StoneCo aims to increase customer engagement by encouraging users to make money their way and by slightly increasing the take rate, with a guided increase towards 2.5%.

How has StoneCo's banking service performed recently?

-StoneCo's banking service has seen significant growth, with client deposits increasing by 50% and active clients tripling between 4Q 2022 and 4Q 2023.

What is StoneCo's current cash position?

-StoneCo has a cash position of 5.1 billion RIS, which is equivalent to about 1 billion US dollars of net cash on the balance sheet.

What is the speaker's view on StoneCo's revenue growth and valuation?

-The speaker conservatively estimates StoneCo's revenue growth to be 21% over the next 12 months and considers the company to be very cheap, trading at roughly two times sales.

What is the speaker's investment strategy regarding StoneCo?

-The speaker intends to hold StoneCo for the long term, with a focus on its guided growth until 2027, and may consider profit-taking or continuing the investment journey based on future guidance and market conditions.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Mercado olha tombo do petróleo, balanços e fiscal: Minuto Touro de Ouro

This Stock Could Become My #1 Holding

JULY 29TH CHANGES EVERYTHING FOR UNITEDHEALTH GROUP! (UNH Stock Analysis!)

GIGANTE DO AGRO BRASILEIRO QUEBROU E FIAGROS DERRETEM | O Que Fazer Com Seus Investimentos Agora?

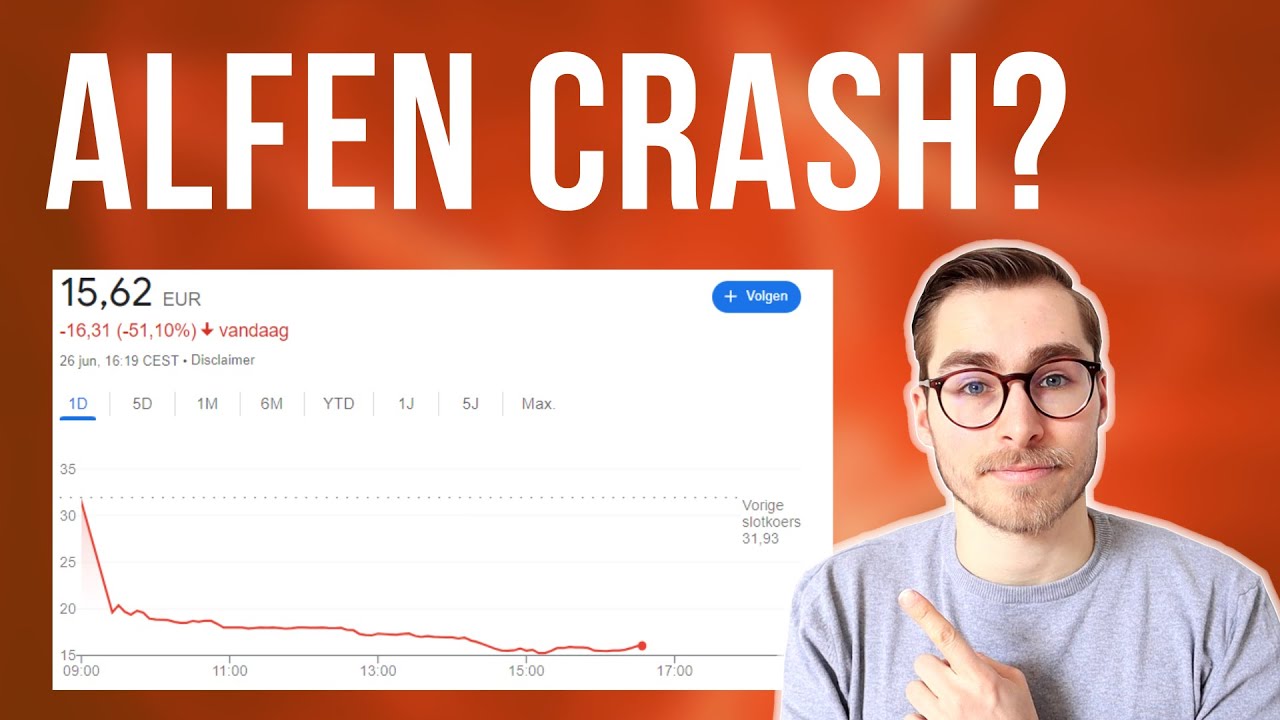

Wat is er aan de hand met ALFEN?

We Need To Talk About Rocket Lab Stock After This Massive Run!

5.0 / 5 (0 votes)