X*Y = K thật vi diệu| Quan IT | DeFi 101 #3

Summary

TLDRThis video delves into the concept of 'constant K product' in the context of decentralized finance, specifically within automated market makers (AMMs). The presenter explains that 'constant K' is a foundational principle, where 'K' remains unchanged, and is pivotal for AMMs. The video explores the mathematical formulas and theories behind liquidity pools, including adding or removing liquidity and how it affects token prices. It references a whitepaper from 2018 that formalizes the 'constant K' model for decentralized exchanges, aiming to maintain market equilibrium by adjusting token prices based on supply and demand. The presenter also plans to implement a constant K product AMM in future videos, promising a deeper dive into coding and practical applications.

Takeaways

- 😀 The video introduces the concept of 'constant K product', a fundamental idea in the world of decentralized finance (DeFi).

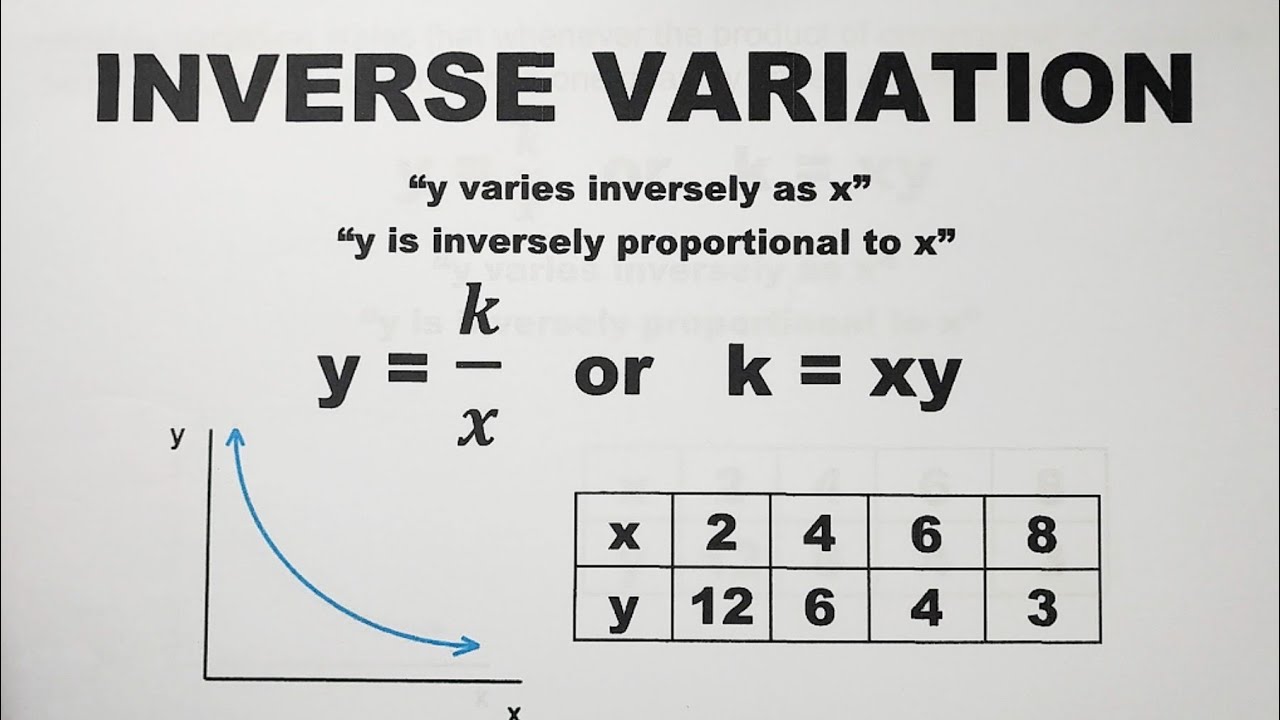

- 📚 The 'constant K product' formula is simply x * y = k, where 'k' is a constant value, and this formula is the basis for many DeFi protocols.

- 🔗 The video references a white paper titled 'Formal Specification of Constant K Product', which was published in 2018 and is foundational for understanding the concept.

- 💡 The formula x * y = k is used to facilitate token swaps in decentralized exchanges, ensuring that the value of 'k' remains constant during transactions.

- 📈 The video explains how the 'constant K product' model adjusts token prices based on supply and demand, preventing any token from being completely depleted in a liquidity pool.

- 💼 The script discusses the process of adding (minting) and removing (burning) liquidity from a pool, and how it's managed through the issuance of liquidity tokens.

- 📊 The video touches on the mathematical formulas behind liquidity provision, including how to calculate the amount of liquidity tokens (LP tokens) one receives for adding liquidity.

- 🔢 It also delves into the calculations for token price determination when swapping, using formulas that take into account the changes in token amounts (Δx, Δy) and the constant 'k'.

- 📝 The script mentions that the white paper is quite complex, but the presenter aims to simplify it for the audience, emphasizing the importance of understanding the underlying math.

- 👨🏫 The video concludes with a promise to implement a constant K product AMM (Automated Market Maker) in a future video, indicating a practical application of the discussed theory.

Q & A

What is the main concept introduced in the video?

-The main concept introduced in the video is the 'constant K product', which is a fundamental principle used in decentralized finance, particularly in automated market makers (AMMs).

What does the 'constant K product' formula represent?

-The 'constant K product' formula is represented as x * y = k, where x and y are the quantities of two tokens in a liquidity pool, and k is a constant value. This formula ensures that the product of the two token quantities remains constant.

Why is the 'constant K product' formula important in AMMs?

-The 'constant K product' formula is important in AMMs because it provides a mechanism for price discovery and ensures that the pool maintains a balance between the two tokens, adjusting prices based on supply and demand.

What is the purpose of the 'white paper' mentioned in the video?

-The 'white paper' mentioned in the video is a formal specification of the 'constant K product' model. It explains how the x * y = k formula is applied in decentralized exchanges for token swaps and how it handles liquidity provision and removal.

How does the video explain the process of adding liquidity to a pool?

-The video explains that when adding liquidity, participants deposit tokens into the pool and receive liquidity tokens in return, which represent their share of the pool. The amount of liquidity tokens received is calculated based on the deposited amounts and the total pool size.

What is the significance of the liquidity tokens mentioned in the video?

-Liquidity tokens are significant because they represent a user's share in the liquidity pool. They allow users to earn fees from trades that occur within the pool and can be redeemed to remove liquidity from the pool.

How does the video describe the process of removing liquidity from a pool?

-The video describes removing liquidity as the process where liquidity providers can withdraw their share from the pool by burning their liquidity tokens, which allows them to get back their original tokens in proportion to their share.

What role do fees play in the 'constant K product' AMM model?

-Fees play a crucial role in the 'constant K product' AMM model as they incentivize liquidity providers to participate. The fees collected from trades are distributed to liquidity providers as a reward for their contribution to the pool.

How does the video simplify the complex mathematical formulas associated with the 'constant K product'?

-The video simplifies the complex mathematical formulas by breaking them down into more understandable components and using visual aids like graphs to illustrate the relationship between token quantities and prices.

What is the next step the video suggests after explaining the 'constant K product'?

-After explaining the 'constant K product', the video suggests implementing a constant product AMM and coding smart contracts, which will be the focus of subsequent videos.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

What Are AMMs? How Automated Market Makers Revolutionize DeFi | Blum Academy

What is Uniswap - A Beginner's Guide (2024 Updated)

Self-Attention

Inverse Variation - Constant of Variation and Equation - Grade 9 Math Second Quarter

#15 String Interpolation | Angular Components & Directives | A Complete Angular Course

Что такое DeFi или децентрализованные финансы? Обзор с анимацией

5.0 / 5 (0 votes)