When The Housing Crash Will Happen

Summary

TLDRThis video explores the perplexing state of the U.S. housing market, where home values have skyrocketed despite higher interest rates and a looming recession risk. It delves into the factors driving this counterintuitive trend, such as homeowners reluctant to sell due to low mortgage rates, a shortage of inventory, and an uptick in new construction. The video also examines Warren Buffett's recent move to cash out of homebuilder stocks and speculates on whether he possesses insider knowledge. Ultimately, it provides insights into potential scenarios for the housing market in 2024, offering guidance for buyers, sellers, and investors navigating this complex landscape.

Takeaways

- 📈 Despite higher interest rates and economic uncertainty, the total value of US homes jumped 5% in the past year, the biggest gain in nearly a year.

- 🏠 Homeowners are reluctant to sell their homes due to low existing mortgage rates, creating a shortage of homes for sale.

- 🔑 Mortgage rates falling to around 5.5% could be enough to push homebuyers into purchasing homes.

- 📉 Warren Buffett recently cashed out his substantial investment in major US home builders, raising questions about his outlook on the housing market.

- 🏗️ New home construction is helping to fill the void in housing supply, with builders accounting for one-third of total market inventory.

- 💰 Homebuilders have a unique advantage in being able to offer incentives and buy down mortgage rates to entice buyers.

- 🌐 Suburban areas have seen the biggest comeback in home price increases, while high-priced cities have fallen out of favor due to remote work and affordability issues.

- 📊 Experts predict housing prices could rise by up to 5% in 2024 or fall by up to 8% in a worst-case scenario, depending on various economic factors.

- 🔑 Lower mortgage rates could lead to increased competition among buyers, potentially fueling higher prices and multiple offers.

- 🏘️ Multi-family housing like condos and apartments could be a more affordable solution to the housing supply shortage.

Q & A

What is the main topic of the video script?

-The video script discusses the current state of the US housing market, including the recent increase in home values, factors contributing to the rise, and potential future trends and scenarios.

Why did the total value of US homes increase by $2 trillion over the last year?

-The script cites three main reasons: 1) a shortage of homes for sale as homeowners are reluctant to sell due to low mortgage rates, 2) home values hitting a low about a year ago, causing the market to rebound, and 3) an increase in new home construction.

What did Warren Buffett recently do with his investments in homebuilder companies?

-Warren Buffett cashed out his substantial investments in three major US homebuilders (DR Horton, Lennar, and NVR), potentially making a $250 million profit in just 7 months.

What could realistically cause housing prices to fall significantly?

-According to the analysis in the script, for housing prices to fall significantly, there would need to be either a 50% reduction in demand or a doubling of the housing supply, which is considered unlikely in the short term.

How could lower mortgage rates potentially impact the housing market?

-Lower mortgage rates could increase demand by allowing buyers to qualify for larger loans, potentially leading to more competition among offers, reduced contingencies, and higher prices.

What is the script's overall outlook for the housing market in 2024?

-The script presents various forecasts, with some analysts expecting home prices to rise by up to 5% in 2024, while others predict a more modest increase or even a slight decline, depending on economic conditions and mortgage rates.

What solution does the script suggest to address the housing shortage?

-The script suggests that increasing the construction of multifamily housing, such as condos and apartments, could be a reasonable solution to build more affordable housing and meet the demand.

What advice does the script offer for potential homebuyers?

-The script recommends shopping around for the best mortgage rate, avoiding getting attached to one property, locking in a fixed-rate loan, and only buying a home that they plan to live in for at least 7-10 years.

How does the script assess the potential impact of a recession on the housing market?

-The script suggests that a recession alone is unlikely to cause a significant drop in housing prices, as homeowners are unlikely to sell due to low mortgage rates, and a large portion of homeowners do not have mortgages.

What does the script identify as the biggest component of household wealth for middle-income Americans?

-The script states that house prices are the biggest component of household wealth for middle-income Americans, according to the chief economist of Cerica.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

For Oom Piet - Poem Analysis

FEDERALES TENIAN EN LA MIRA A CDOBLETA

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

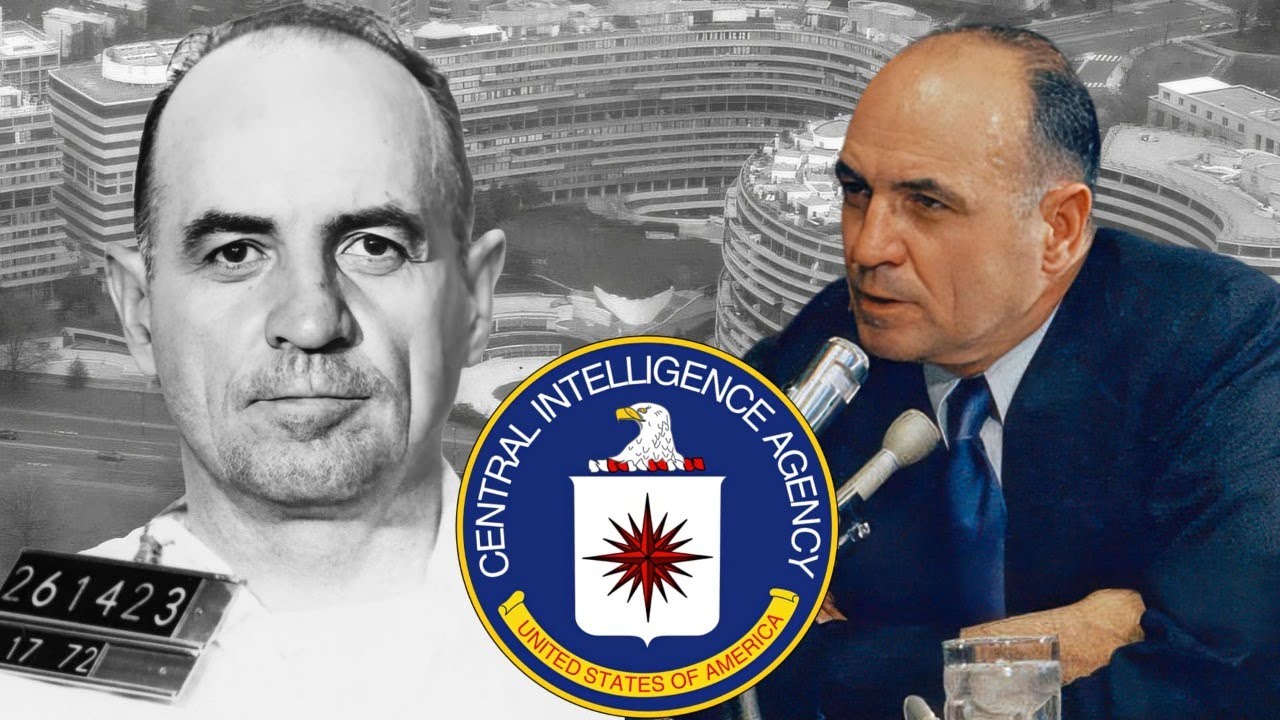

James W McCord: CIA Asset and Watergate Burglar Unveiled

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

We FINALLY Proved Why Ice Is Slippery

5.0 / 5 (0 votes)