Sugar Stocks To Buy |शुगर सेक्टर को मिली राहत, गन्ने के रस/ Juice से बनेगा Ethanol | Balrampur Chini

Summary

TLDRThe script discusses the Indian sugar industry's potential following the government's decision to remove caps on sugar production for ethanol, allowing manufacturers to divert more sugarcane to ethanol production. It highlights Balrampur Chini as a significant private sector manufacturer, emphasizing its expansion plans and alternative products like heavy beet molasses and single-use plastic alternatives. The discussion also covers market trends, suggesting Balrampur Chini and DCM as undervalued stocks with growth potential, especially with the upcoming sugar season and the company's focus on ethanol blending.

Takeaways

- 📈 The Indian sugar industry is expected to benefit from the government's decision to allow sugar mills to divert more sugarcane towards ethanol production.

- 🚀 The government has removed the previous cap of diverting 177,000 tons of sugarcane for ethanol production, opening the door for mills to supply as much as the oil marketing companies demand.

- 🌾 The new policy aims to increase the production of ethanol from sugarcane, which could potentially boost the sugar industry's profitability.

- 📉 Last year, sugar production was reduced to around 8-9%, and the government was cautious about not increasing the price of sugar to avoid negative impacts on the economy.

- 🛑 The previous cap was set to prevent excessive diversion of sugarcane towards ethanol, which could have affected sugar production and prices.

- 🔄 The removal of the cap is expected to have an impact in the next one to two months, as the new sugar season starts from October to November.

- 🚜 Companies involved in ethanol production from sugarcane can now also use heavy molasses (B and C molasses) for ethanol production, with around 2.3 million tons approved for this purpose.

- 📊 The government's target is to achieve around 20% ethanol blending by 2025, and the recent policy changes are seen as a significant step towards this goal.

- 📈 Balrampur Chini, one of the second-largest private sector sugar manufacturers, is highlighted as a potential beneficiary of these policy changes.

- 💹 The script suggests that Balrampur Chini and DCM are good stocks to consider for investment, especially for long-term portfolio inclusion.

Q & A

What is the main theme discussed in the script related to the sugar industry?

-The main theme discussed in the script is the Indian government's initiative to push for ethanol blending in sugar production, with a focus on Balrampur Chini Mills' role in this initiative.

What was the previous cap on sugar-to-ethanol diversion set by the government?

-The previous cap set by the government was to divert sugar equivalent to 177,000 tons only for ethanol production, beyond which no diversion was allowed.

What is the significance of the government removing the cap on sugar-to-ethanol diversion?

-The removal of the cap allows sugar companies to divert as much sugar as the oil marketing companies are willing to buy for ethanol production, which is expected to boost ethanol blending and meet the government's target of 20% blending by 2025.

How does the script suggest the impact of this policy change on sugar companies like Balrampur Chini Mills?

-The script suggests that this policy change is a positive development for sugar companies like Balrampur Chini Mills, as it allows them to divert more sugar to ethanol production, potentially increasing their revenues.

What is the role of B and C molasses in the new policy for ethanol production?

-The new policy allows sugar companies to use heavy B and C molasses for ethanol production, which is expected to improve the efficiency of ethanol production from sugar.

What is the government's target for ethanol blending by 2025?

-The government's target is to achieve approximately 20% ethanol blending in petrol by 2025.

What is the current status of Balrampur Chini Mills in terms of stock performance?

-The script indicates that Balrampur Chini Mills has been performing well in the stock market, with a recommendation for investors to consider it as a part of their portfolio.

What is the significance of Balrampur Chini Mills' expansion plans mentioned in the script?

-Balrampur Chini Mills is planning an expansion worth 1000 crores in Bihar, which will involve setting up new facilities and could potentially increase the company's production capacity and market presence.

What is the script's advice regarding investment in sugar stocks like Balrampur Chini Mills?

-The script advises that investors should consider sugar stocks like Balrampur Chini Mills for their portfolios, especially given the positive developments in the ethanol blending policy.

What is the script's view on the future of sugar stocks in the context of the current market situation?

-The script suggests that sugar stocks, particularly Balrampur Chini Mills, are likely to continue their upward trend in the market, and investors are advised to hold their positions for a considerable amount of time to benefit from this trend.

What is the script's recommendation for trading in Balrampur Chini Mills stock?

-The script recommends that investors should consider taking a delivery-based position in Balrampur Chini Mills stock, with a potential target of 650 and a stop loss around 575.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Ethanol's Final Verdict: Is There Enough Sugar for Production?

How Brazil Dominates Sugar Production Without Burning Fields | Big Business | Business Insider

🔴 ETANOL: TUDO O QUE VOCÊ PRECISA SABER SOBRE A PRODUÇÃO DE ETANOL 🔴

Fermentation of Yeast & Sugar - The Sci Guys: Science at Home

Govt May Relook At Restrictions On Sugar Exports Only By The End Of CY24: Elara Sec | CNBC TV18

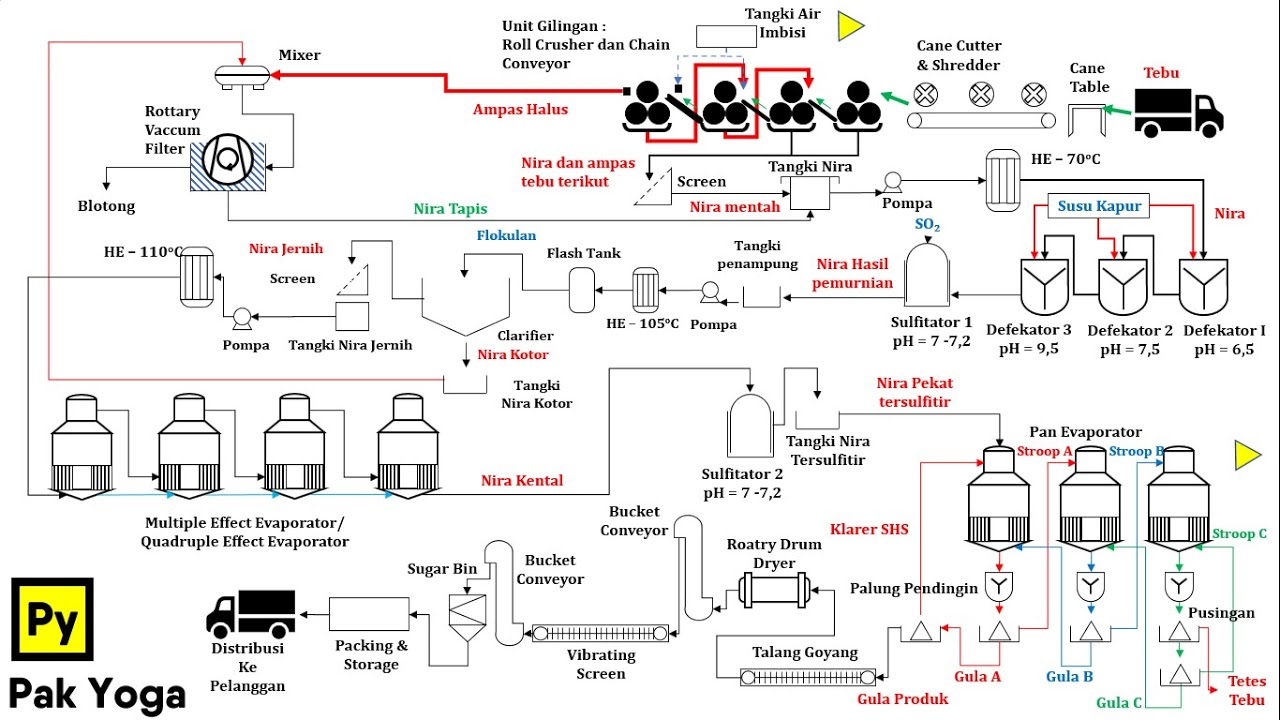

Kimia Industri - Diagram Alir Proses Pembuatan Gula tebu

5.0 / 5 (0 votes)