【大手事務所 or 個人事務所】税理士業界未経験者が就職するならどっち?

Summary

TLDRThe video covers the pros and cons of working at large vs small tax accountant firms for beginners. Large firms offer higher salaries, training programs, and potential for growth, but can be busy with less hands-on work. Smaller, private firms allow handling entire processes start-to-finish and close mentoring, but have variability in work culture and compensation. When job searching, large firms have more complex hiring processes while private firms can make quick offers, so balancing speed and fit is important.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The BEST Beginner's Guide to Investment Banking! (Compensation, Hours, Lifestyle, Pros & Cons)

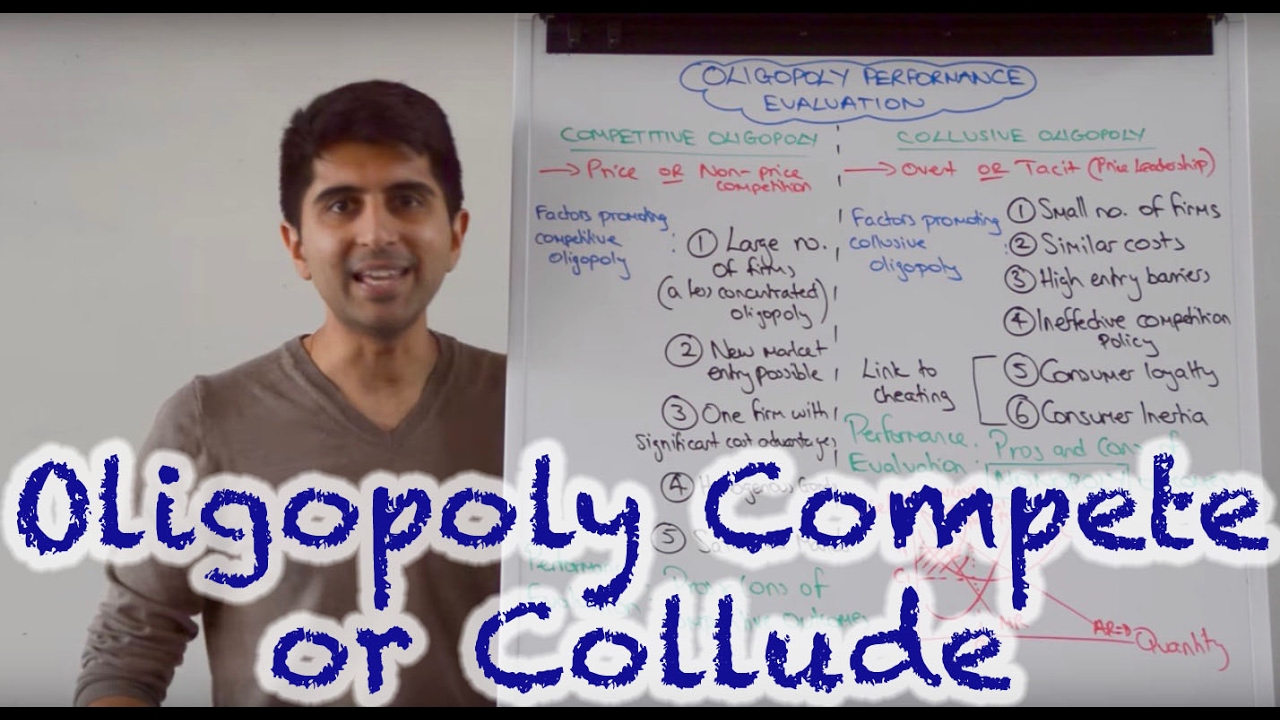

Y2 25) Oligopoly Behaviour - Competition or Cartel?

【即やるべき】「こんなに差が付くなんて…」個人事業主必見。確定申告後すぐにやった方が良い節税の事前対策について解説!

Bookkeeping Basics for Small Business Owners

7 Passive Income Ideas - How I Make $2,000+ Per Day

MACAM-MACAM SISTEM & TEHNIK HIDROPONIK

5.0 / 5 (0 votes)