How To Trade The Fair Value Gap + liquidity | Maximizing Profits

Summary

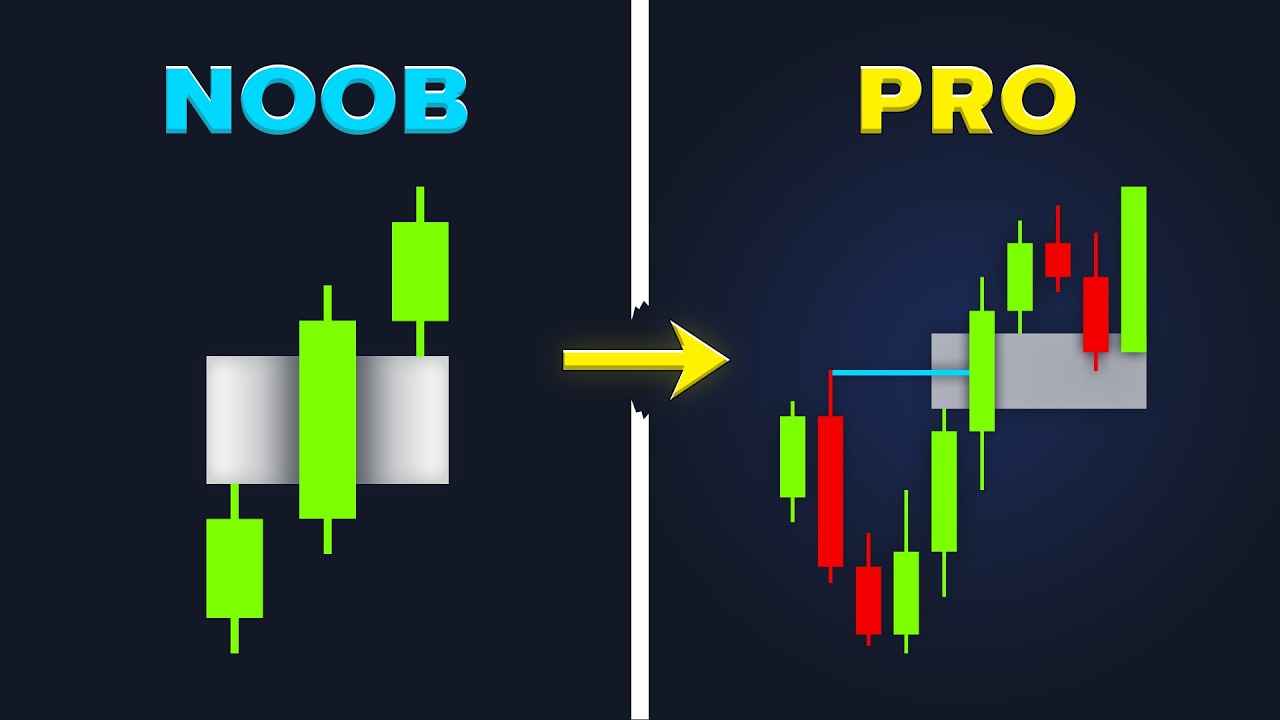

TLDRThis video introduces a high-win-rate trading strategy involving fair value gaps (FVGs) and liquidity zones. Large institutional orders cause sudden price movements, forming FVGs. Prices tend to revert to these levels as remaining orders execute. Successful trading requires a clean FVG area with three consecutive bullish or bearish candles, a change of character overlapping the FVG, and a liquidity zone forming just before the price reaches the FVG. The video emphasizes the importance of proper entry points and market analysis, warning against entering trades prematurely.

Takeaways

- 💡 Fair Value Gaps (FVG) occur when large institutions cause sudden price movements due to significant buying or selling orders, creating an imbalance in the market.

- 🔍 Prices often return to FVG areas because not all of the large institution's orders are executed, requiring a return for the remaining orders to be completed.

- 🛑 The importance of liquidity zones is highlighted as they form where buyers and sellers meet, creating consistent highs and lows that activate stop-loss orders.

- 📊 For a valid FVG entry area, it should consist of three consecutive bullish or bearish candles, indicating a strong trend before the gap.

- ✅ The strategy requires a change of character that overlaps with the FVG area, indicating a significant market shift that aligns with the gap.

- 🚫 A liquidity zone must form just before the price reaches the FVG area to confirm the entry point, adding significance to the FVG area.

- 📍 The entry point for a trade using this strategy is marked by the change of character candle overlapping the FVG area, with the first candle of the FVG as the stop loss.

- 📉 The failure of a trade can occur if the price has previously interacted with the FVG area, as shown by candlestick shadows in the liquidity zone.

- 🚀 Smart money traders look for structural breaks and order blocks, using them as entry points and anticipating stop-loss triggers for profit.

- 🔄 In cases of multiple FVGs, the overlapping area with a change of character is considered the entry point, but all conditions must be met.

- 🛑 Avoid entering trades when conditions are not met, even if a change of character overlaps with an FVG, as it can lead to losses.

Q & A

What is the main topic of the video?

-The main topic of the video is a trading strategy involving fair value gaps (FVG) and liquidity, which has a high win rate.

What causes a fair value gap (FVG) to form?

-A fair value gap forms when large institutions enter substantial buying or selling orders, causing prices to rise or fall sharply without a gradual adjustment, creating an imbalance.

Why do prices usually return to the fair value gap areas?

-Prices return to the fair value gap areas because not all orders from large institutions are executed due to the sudden influx of money, and prices must return for the remaining transactions to become active.

What is the significance of liquidity in the context of fair value gaps?

-Liquidity is significant because it provides the necessary counterparties for transactions to occur. A liquidity zone is created by establishing consistent highs and lows, which encourages traders to place orders and stop-losses to become active as the price reaches the desired area.

What are the initial conditions required for entering a trade with this strategy?

-The initial conditions include the formation of an FVG area consisting of three consecutive bullish or bearish candles, and the FVG area should be formed after a change of character that overlaps with the FVG area.

What is the final confirmation for entering a trade with this strategy?

-The final confirmation is the establishment of a liquidity zone just before the price reaches the fair value gap area, which adds more significance to the value gap area.

What is the entry point for a trade according to the strategy?

-The entry point is considered at the change of character candle that overlaps with the fair value gap area.

How is the stop loss determined in this strategy?

-The stop loss is determined by the first candle forming the fair value gap.

Why did the buy trade fail in the example provided in the script?

-The buy trade failed because the price had previously reached the fair value gap area, as indicated by the interaction of candlestick shadows in the liquidity zone with the fair value gap area, making the area no longer suitable for entry.

What is the correct entry strategy according to the video?

-The correct entry strategy involves three consecutive bullish candles, a change of character overlapping the fair value gap area, and a liquidity zone. One should place a buy order and wait without rushing into a trade.

What should be done if the change of character does not overlap with any of the fair value gaps?

-If the change of character does not overlap with any of the fair value gaps, it is advised not to enter the trade, as it may result in a loss.

What is the advice for traders practicing this strategy?

-Traders are advised to delve into practice, repetition, and backtesting to explore this strategy on the chart, and to take liquidity zones seriously to identify the proper entry point.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Ryze Model They Don't Want You to Know...

FVG Trading Strategy Explained (Fair Value Gaps)

FVG Hidden Secrets (Strong vs Weak)

Why FVGs Are All You Need to Become Profitable in 2024

The Ultimate Guide to Fair Value Gaps: Inversed Fair Value Gap (IFVG) Trading Strategy Explained!

Best Fair Value Gap Trading Strategy

5.0 / 5 (0 votes)