The Best ICT 1 Minute Strategy That Gets You FUNDED Quickly (INSTANTLY PROFITABLE)

Summary

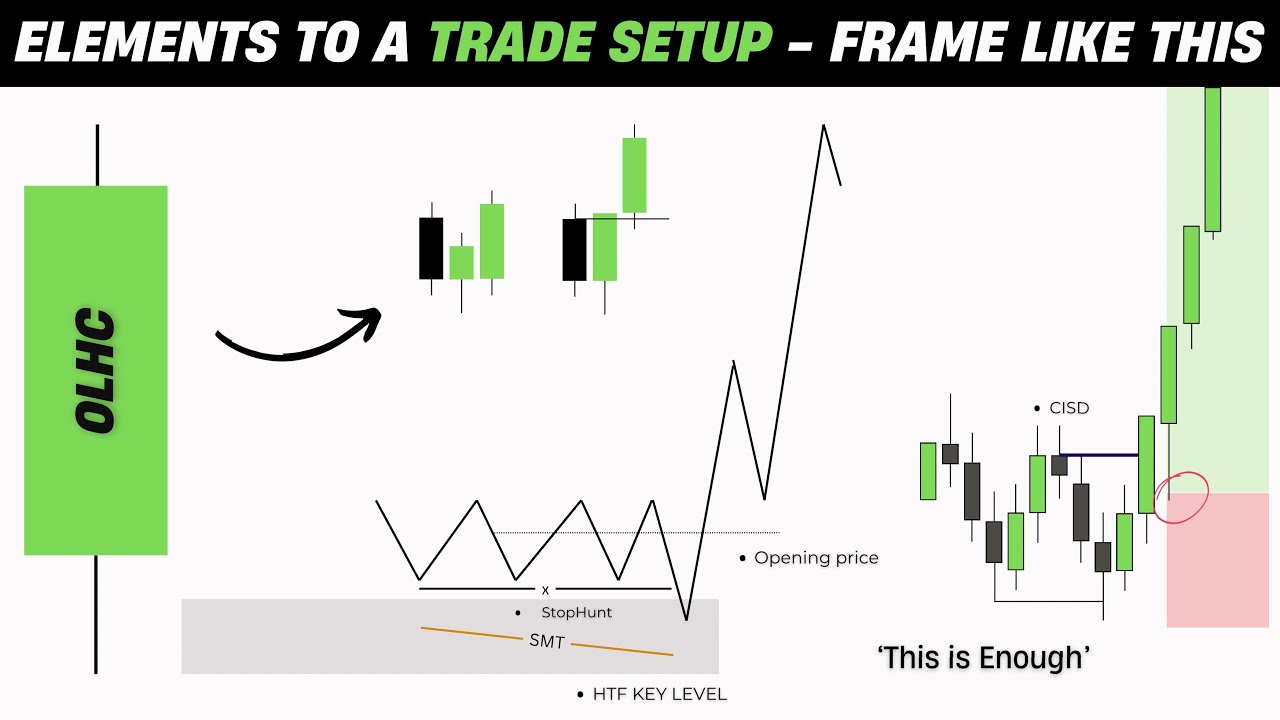

TLDRThis video introduces an enhanced ICT 1-minute entry strategy for trading, focusing on order flow and retracement techniques to secure better entries and avoid stop-outs. The presenter shares personal tweaks to the 2022 model, emphasizing the importance of identifying fair value gaps and liquidity grabs for high win rates. The detailed explanation includes a step-by-step guide on executing trades with a focus on risk-to-reward ratios, aiming to help traders overcome challenges like passing funded account tests.

Takeaways

- 😀 The video introduces an improved ICT 1-minute entry model and strategy for trading, particularly for passing funded accounts and avoiding stop-outs.

- 📈 The model is based on following order flow, waiting for a retracement to a discount or premium, and trading into an hourly fair value gap (FVG), targeting high liquidity areas.

- 📊 The framework involves identifying the highest high during an uptrend to establish the range and then calculating the discount and premium zones, which are 50% of the range apart.

- 🌟 A key aspect is buying in a discount during a bullish scenario and selling in a premium during a bearish scenario, using the hourly FVG as the entry and target point.

- 🔍 The video emphasizes the importance of identifying a 'liquidity grab' within the hourly FVG, which is a significant price movement that can indicate a shift in market structure.

- 📝 The presenter shares a personal tweak to the 2022 model, which involves waiting for a liquidity grab before entering a trade, to improve win rates.

- 📉 The strategy includes identifying 'swing lows' and 'swing highs' to measure momentum and potential entry points, avoiding false signals from non-swing lows.

- 🚀 The video provides a detailed example using the AUD/USD hourly chart, demonstrating how to identify and execute a trade using the model.

- 🔑 A 'displacement' in the market, indicated by a heavy price movement, is a crucial signal to look for gaps below a 50% level for potential entry points.

- 🎯 The model suggests placing buy limits at the first gap identified below the 50% level, with a stop loss below the candle's low for risk management.

- 📈 The potential risk-to-reward ratio can be significant, with the example given highlighting a 1 to 4 ratio, emphasizing the strategy's profitability.

- 📚 The presenter encourages viewers to take notes, learn from the content, and apply the strategy to their trading to overcome challenges like passing funded account tests.

Q & A

What is the main focus of the video?

-The main focus of the video is to discuss the ICT 1 minute entry model and strategy for trading, which is designed to improve entry points and avoid being stopped out in funded accounts.

Why should viewers subscribe to the channel if they are new?

-Viewers should subscribe to the channel if they are new because 81% of the viewers who watch the videos are not yet subscribed, and the content is enjoyed by the majority of viewers.

What are the key elements of the ICT 1 minute entry model?

-The key elements of the model include following order flow, waiting for a retracement to a discount or premium, and trading into an hourly fair value gap (FVG) with the target being the high left on the retracement towards the hourly FVG.

What is the difference between the 2022 model and the tweaked model presented in the video?

-The tweaked model presented in the video has some modifications to the 2022 model, which the presenter found to be more personally effective, although the specific tweaks are not detailed in the transcript.

What is the significance of a 'liquidity grab' in the context of the model?

-A 'liquidity grab' is significant because it indicates a shift in market structure, providing a potential entry point for trades after breaking a swing low or high within the fair value gap.

How does the presenter define a 'swing low' in the context of the model?

-A 'swing low' is defined as a candle with a low, followed by two higher lows next to it, which helps in identifying the momentum and potential entry points within the model.

What is the importance of the 'hourly fair value gap' in the model?

-The 'hourly fair value gap' is important as it serves as a target for trades, representing the external range liquidity that traders aim to reach after trading into internal liquidity with a retracement.

How does the presenter suggest improving the win rate of trades using the model?

-The presenter suggests waiting for a liquidity grab when already inside the point of interest or hourly fair value gap, which can improve the win rate by identifying shifts in market structure more accurately.

What is the role of 'time distortion and accumulation' in the model?

-Time distortion and accumulation refer to the process of price moving within a range, where short positions accumulate on dips and long positions on rises, with traders setting stop losses that can be triggered by price movements.

How does the presenter use the 50% level in the model?

-The presenter uses the 50% level to determine the discount or premium for trades, looking for gaps below this level on the one-minute chart to place buy limits for long trades.

What is the potential risk-to-reward ratio for trades using the model, as mentioned in the video?

-The potential risk-to-reward ratio for trades using the model can be as high as 1 to 4, as demonstrated by the example where a buy limit is placed with a stop loss below a certain low and a target at an external range high on the 1-hour chart.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Why Valid Order Blocks Fail in Forex Trading, Exploring the Order Flow Trading Strategy

BEST 5 Minute Crypto Scalping Strategy (Simple)

ICT Gems - Selecting High Probability Market Structure Shifts

ICT Forex - The ICT ATM Method

ICT Concepts - Elements To A Trade Setup

How to Make 2X Gains Daily Using THIS Fibonacci Retracement Strategy

5.0 / 5 (0 votes)