The Next 48 Hours In The Stock Market Will Make Millionaires

Summary

TLDRThe script discusses the critical nature of the next 48 hours in the stock market, emphasizing the importance of staying informed to navigate potential market fluctuations. It highlights the debate between analysts about whether the current market recovery is genuine or a 'fake bounce' prior to a deeper drop. The upcoming CPI data release is identified as pivotal, with potential to validate or refute market predictions. The speaker advises investors to prepare for volatility, suggesting strategies like dollar-cost averaging and focusing on fundamentally strong companies, while also considering risk management tactics like selling winners or setting stop losses.

Takeaways

- 📉 The market's performance in the next 48 hours will be crucial for determining if the current recovery will continue or if it's a fake bounce leading to further declines.

- 📈 Analysts like Tom Lee predict a rally starting in October, November, or December, while others like the chief Market technician of BTI warn of a significant drop ahead.

- 📅 Wednesday is highlighted as a pivotal day due to the release of CPI data, which will influence market direction and the Fed's interest rate decisions.

- 💹 The Federal Reserve is expected to cut rates in September, with the extent of the cut potentially influenced by the CPI data.

- 📊 Historically, the market's performance during a Fed rate cut cycle has been mixed, with an average drop of about 6% and a subsequent 25% increase in the S&P 500 after the cuts conclude.

- 📉 As of August, the S&P 500 is down 3.2%, and further drops may trigger panic selling among investors on the fence.

- 🤑 The speaker's community adopts a contrarian approach, being more 'greedy' when others are fearful, and planning to increase the pace of dollar-cost averaging if the market drops significantly.

- 💼 Companies with strong fundamentals, like ASML, CrowdStrike, and Tesla, are being watched for potential investment opportunities if their stock prices drop further.

- 🚫 The speaker advises against panic selling and emphasizes the importance of having a plan and being prepared for various market scenarios.

- 💼 For risk-averse investors, strategies like selling a portion of winners for insurance or setting stop losses can be considered to mitigate potential market crashes.

- 📚 The script underscores the importance of historical context and probabilities in market behavior, but emphasizes that a solid plan and discipline are essential for long-term success.

Q & A

What is considered crucial for investors in the next 48 hours according to the transcript?

-Staying informed and understanding market movements to avoid negative outcomes is crucial for investors in the next 48 hours.

What was the percentage drop of the S&P 500 from the end of July to August 5th?

-The S&P 500 experienced a 6% drop from the end of July to August 5th.

What does the partial recovery on August 12th indicate according to the transcript?

-The partial recovery on August 12th indicates a 3% recovery, but it is uncertain whether this bounceback will last or if it's a fake bounce leading to further market decline.

What are the two camps with opposing views on the market's future direction mentioned in the transcript?

-One camp, including Tom Lee, Golden Sex, and RBC, believes a rally will start in October, November, or December. The other camp, including Caner Fitzgerald and JP Morgan's Jamie Diamond, believes the market is in for a larger drop and a fake bounce.

Why is the CPI data release on Wednesday considered very important?

-The CPI data release on Wednesday is important because it will determine whether the market will follow the bullish or bearish camp's predictions for the next few months.

What is the impact of the Federal Reserve's decision to cut rates on the market?

-The Federal Reserve's decision to cut rates will likely have a significant impact on the market, as it can influence investor sentiment and economic conditions, potentially leading to either a bullish or bearish market reaction.

What is the historical impact of the Federal Reserve starting a rate cut cycle?

-Historically, the impact of the Federal Reserve starting a rate cut cycle is mixed, with varied outcomes in the past, and it does not necessarily lead to a significant market rally.

What is the strategy suggested for investors if the market experiences a significant drop?

-The strategy suggested is to double down on dollar-cost averaging (DCA), especially if stocks drop below 20% of their 52-week high, and to focus on buying companies that are fundamentally strong and discounted.

What are some examples of companies mentioned in the transcript that have seen significant discounts?

-Examples of companies mentioned with significant discounts include ASML, which is down almost 30%, CrowdStrike, down 36%, and Tesla, down 22% in the past month.

What is the long-term outlook for the S&P 500 after the Federal Reserve finishes a rate cut cycle?

-Historically, the S&P 500 has shown an increase of 25% in the 12 months following the completion of a rate cut cycle by the Federal Reserve.

What are some strategies for risk-averse investors to consider during market volatility?

-Risk-averse investors can consider selling a portion of their biggest winners for insurance, setting stop losses on certain companies, or consolidating their holdings into their top-performing assets.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

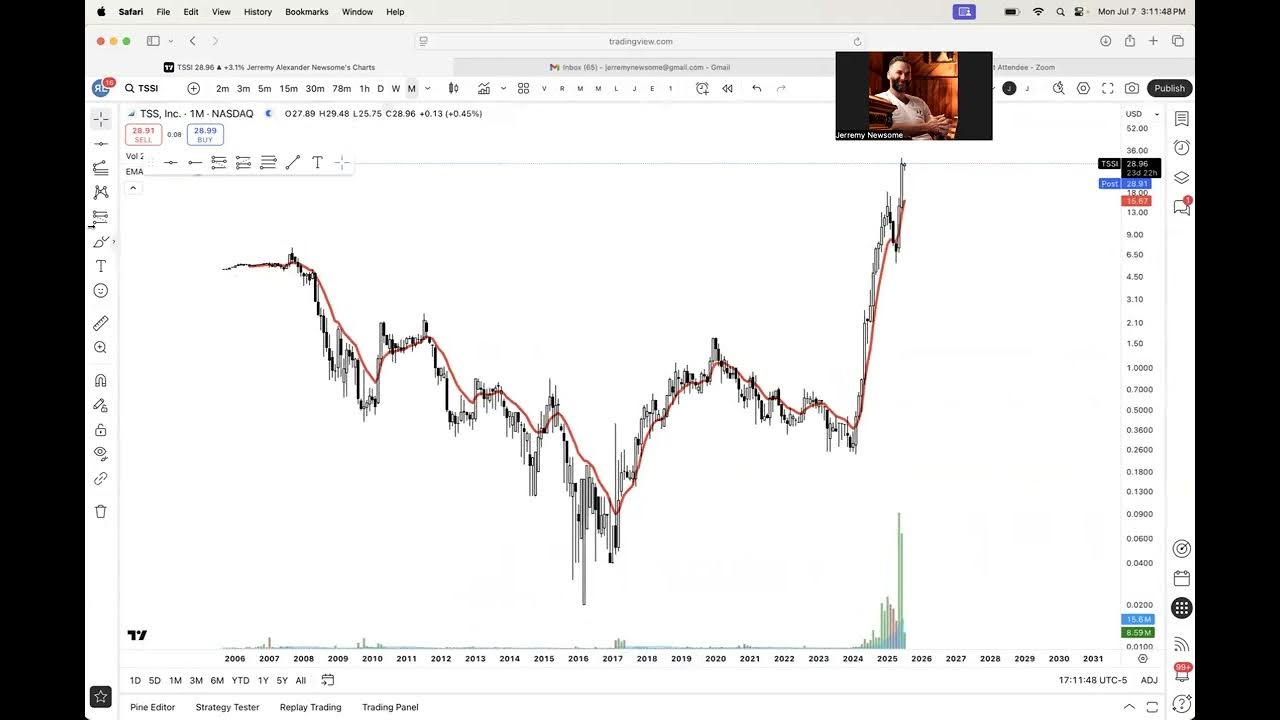

Top Tuesday Trade Ideas for July 8th, 2025

Bear हुआ खतरनाक | सबकी बैंड बजाने को तैयार

HANYA SATU KATA, BUY!! JADI KAYA DARI TRADING SAHAM SOON

Ken Fisher Talks Dollar Devaluation, Timing the Market, Private Credit Markets and More

ACHTUNG! KAUFT ODER VERKAUFT NICHTS BEVOR IHR DAS NICHT GESEHEN HABT! [Trump macht ernst...]

Bond market should be raising eyebrows here / what this means for our bags

5.0 / 5 (0 votes)