What Is a Financial Advisor?

Summary

TLDRThis video script explores the role of financial advisors, highlighting the importance of specialized financial professionals in managing personal finances. It distinguishes between various titles such as stockbrokers, financial planners, and investment advisors, emphasizing the value of certifications like CFP® and ChFC®. The script advises seeking unbiased guidance tailored to individual financial goals and circumstances, advocating for a strategic approach to planning for an uncertain financial future.

Takeaways

- 🤔 Personal financial situations are unique and may require specialized financial professional services.

- 🧑💼 A financial advisor is a general term for professionals who help manage money, including more specific roles like stockbrokers, financial planners, and investment advisors.

- 💼 Stockbrokers buy and sell stocks and securities on behalf of clients, usually for a fee or commission.

- 📈 Financial planners take a holistic approach to financial planning, covering estate, retirement, insurance, and personal finance.

- 💼 Investment advisors specialize in creating and managing investment portfolios based on clients' goals, timeline, and risk tolerance.

- 🏷 The CERTIFIED FINANCIAL PLANNER™ (CFP®) certification holds professionals to strict ethical and fiduciary standards.

- 🏅 Chartered Financial Consultant® (ChFC®) is another distinguished certification with slightly different requirements from CFP.

- 📋 Registered Investment Advisors (RIAs) are registered with regulatory bodies and focus on investment advice for securities.

- 🏠 Working with a financial professional can benefit anyone, whether for investment planning or specific financial situations like buying a house or education funding.

- 🛣 Everyone can benefit from financial guidance, including insurance, tax, and debt counseling, or for building a long-term financial roadmap.

- 🔍 Choosing a financial advisor should be based on their skills, experience, and ability to provide unbiased advice tailored to individual circumstances.

Q & A

What is the role of a financial advisor in personal finance?

-A financial advisor helps individuals manage their money, providing guidance on investment, retirement planning, insurance needs, and personal finance. They act as a general descriptor for more specific titles such as stockbrokers, financial planners, and investment advisors.

What is the difference between a stockbroker and a financial planner?

-A stockbroker buys and sells stocks and other securities on behalf of clients, usually for a fee or commission. In contrast, a financial planner takes a more holistic approach, considering estate planning, insurance, personal finance, and may have more specialized training.

What does an investment advisor typically do?

-An investment advisor specializes in creating and managing an investment portfolio based on clients' goals, timeline, and risk tolerance, assisting in building, managing, and transferring wealth.

What is the significance of the CERTIFIED FINANCIAL PLANNER™ (CFP®) certification?

-The CFP certification is a respected designation in the financial industry, requiring candidates to have a minimum amount of financial planning experience and pass a comprehensive board exam covering various financial topics. CFP professionals are held to strict ethical and fiduciary standards.

How does the Chartered Financial Consultant® (ChFC®) certification differ from the CFP® certification?

-While both ChFC and CFP designations are distinguished in the financial industry, they have slightly different requirements for candidates but are similar in practice.

What is a registered investment advisor (RIA) and what are their responsibilities?

-A RIA is a financial professional registered with the Securities and Exchange Commission and/or a state securities regulator, focusing on investment advice around stocks, bonds, mutual funds, and other securities. They recommend investment actions based on market conditions and client goals and may also provide other financial planning services.

Why might someone consider working with a financial professional?

-Individuals may benefit from a financial professional's guidance when working on an investment plan, dealing with specific financial situations like buying a house or funding education, or needing help with insurance, tax guidance, debt counseling, or building a long-term financial roadmap.

What should one look for in a financial advisor?

-When choosing a financial advisor, one should look for someone with the skills and experience best suited for their circumstances. The advisor should be able to assess financial needs and provide unbiased advice to help achieve goals and plan for the future.

How does a financial advisor help in building a long-term financial roadmap?

-A financial advisor helps in building a long-term financial roadmap by assessing a client's current financial situation, setting clear financial goals, creating a strategy to achieve those goals, and regularly reviewing and adjusting the plan as needed.

What is the importance of unbiased guidance in financial planning?

-Unbiased guidance is crucial in financial planning as it ensures that the advice given is in the best interest of the client, without any conflicts of interest, allowing for objective recommendations that are tailored to the client's unique financial situation and goals.

How can a financial advisor assist with insurance needs?

-A financial advisor can assist with insurance needs by evaluating a client's current insurance coverage, identifying potential gaps, and recommending appropriate insurance products to protect the client's assets and financial well-being.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

FRUGAL LIVING BIKIN CAPEK?! BERSAMA EL RUMI & THEO DERICK | CIMB EPS 4

CÓMO hacer una buena PLANIFICACIÓN FINANCIERA ⏳💸 Finect Talks

The 7 Laws of Money (in 60 seconds) - Money Wisdom - Matthew Kelly - 60 Second Wisdom

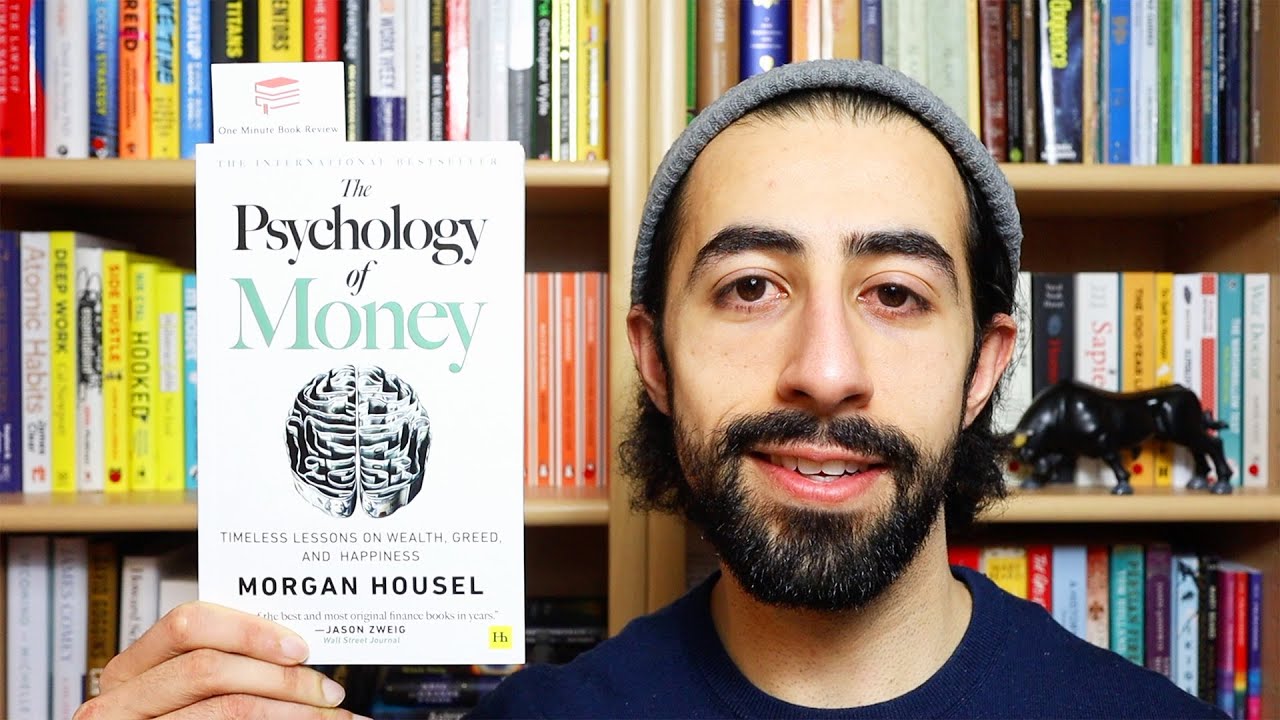

'The Psychology of Money' | One Minute Book Review

Pemberdayaan Masyarakat

Cara Mengelola Keuangan Usaha kecil Anda

5.0 / 5 (0 votes)