1. Gr 11 Accounting - Manufacturing - Activity 1

Summary

TLDRThis educational script delves into the intricacies of manufacturing accounting, emphasizing the importance of understanding cost and stock accounts. It breaks down the cost structures across three departments and explains the calculation of direct labor, indirect material costs, and factory overheads. The script guides learners through practical exercises to determine break-even points and analyze financial changes, offering insights into cost fluctuations and their impact on profitability.

Takeaways

- 📚 Start by thoroughly understanding the theory booklet to grasp the concepts of stock and cost accounts in a manufacturing business.

- 🏭 Recognize that manufacturing involves three departments: Factory, Selling and Distribution, and Administration, each with specific cost accounts to manage.

- 📊 There are five cost accounts to be allocated to the respective departments: Direct Material, Direct Labor, Factory Overhead, Selling and Distribution, and Administration.

- 🔢 Calculate Direct Labor Cost by considering the basic salary, overtime pay, and contributions such as UIF, for all employees involved in the production process.

- 🛠️ Factor in Indirect Material Cost by considering the stock balances from the previous year and the purchases and remaining stock for the current year.

- 📋 Prepare the General Ledger accounts focusing on Work in Process, Finished Goods, and Factory Overhead Cost, as they are crucial for cost accounting.

- 🔄 Understand the Working Process Stock account, which includes direct material, labor, and factory overhead costs, and is used to calculate the cost of finished goods.

- 💼 Factory Overhead Cost includes various expenses like salaries, rent, insurance, and depreciation, which need to be adjusted and allocated correctly.

- 📉 Analyze the Finished Goods Stock account to calculate the cost of sales and the balance at the end of the accounting period, which is essential for profitability assessment.

- 🔄 The Break-even Point is calculated by dividing total fixed costs by the contribution per unit (selling price minus variable cost per unit), indicating the number of units needed to cover costs.

- 📈 Consider factors like inflation, supplier changes, wastage, and carriage costs as potential reasons for an increase in direct material cost per unit.

Q & A

What are the three main departments in a manufacturing business according to the script?

-The three main departments in a manufacturing business are the Factory Department, the Selling and Distribution Department, and the Administration Department.

What are the five cost accounts that need to be sorted into the different departments?

-The five cost accounts are Direct Material Cost, Direct Labor Cost, Factory Overhead Costs, Selling and Distribution Costs, and Administration Costs.

What are the four stock accounts mentioned in the script?

-The four stock accounts are Raw Material Stock Account, Work in Process Stock Account, Finished Goods Stock Account, and Consumables on Hand or Indirect Materials on Hand.

What is the purpose of the Work in Process Stock Account?

-The purpose of the Work in Process Stock Account is to calculate the cost of unfinished goods and to determine the direct material cost, direct labor cost, and factory overhead cost.

How is the Direct Labor Cost calculated in the script?

-The Direct Labor Cost is calculated by taking the basic salary of each employee, multiplying it by the number of employees and the number of months in a year, adding the overtime pay (overtime hours per employee multiplied by the overtime rate), and including the contributions to UIF (Unemployment Insurance Fund).

What is the significance of understanding the cost accounts and stock accounts in a manufacturing business?

-Understanding the cost accounts and stock accounts is crucial for proper cost management, accurate financial reporting, and making informed business decisions in a manufacturing business.

How is the Indirect Material Cost calculated for the year in the script?

-The Indirect Material Cost is calculated by considering the balance of indirect materials on hand at the beginning of the year, adding the purchases of indirect materials during the year, and then subtracting the balance of indirect materials on hand at the end of the year.

What is the role of the Factory Foreman in the context of the Factory Overhead Cost Account?

-The Factory Foreman's annual salary, including UIF, is part of the Factory Overhead Cost. It contributes to the total factory overhead expenses.

What is the formula to calculate the break-even point as mentioned in the script?

-The break-even point is calculated by dividing the total fixed costs by the contribution per unit, which is the selling price per unit minus the variable cost per unit.

Why might the direct material cost per unit increase in the current financial year?

-Possible reasons for an increase in direct material cost per unit could include the effects of inflation, increased prices of raw materials, higher storage costs, obtaining raw materials from new suppliers, increase in wastage, or increasing carriage costs.

How does the script suggest comparing the profitability between two financial years?

-The script suggests comparing the break-even points and the number of units produced and sold for each year to determine if the business made a profit or a loss and to assess changes in profitability.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Gr 11 - Accounting - Partnerships - Activity 1

Gr 11 Accounting - Adjustments - Activity 3

#part1 Ch 17 Investment - Akuntansi Keuangan Menengah 2

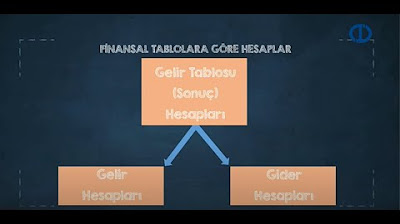

FİNANSAL MUHASEBE - Ünite 2 Konu Anlatımı 1

Basic Cost Concepts...with a touch of humor | Managerial Accounting

CONTABILIDADE PÚBLICA PARA CONCURSOS - AULA 02 - PARTE 02/03 - NOÇÕES DE PCASP

5.0 / 5 (0 votes)