ASTS Stock (AST SpaceMobile stock) ASTS STOCK PREDICTION ASTS STOCK Analysis ASTS news

Summary

TLDRThe video discusses the rise in Space Mobile's stock price following the FCC granting a license for space-based operations. The company is developing a space-based cellular network to provide broadband services for smartphones in the US. The initial license allows for the launch and operation of three frequencies to support various satellite operations. The presenter highlights a potential breakout in stock price, advising viewers to set a stop loss and watch for volume to confirm a bullish trend, with the stock currently holding strong despite market downturns.

Takeaways

- 🚀 Space Mobile shares are rising after receiving a space license from the FCC.

- 📈 The stock market is closing soon, with the stock currently at $22.10.

- 🔍 Resistance is noted at $23.28; breaking this could push the stock to $25 and potentially $30.

- 🕰️ Historically, the stock hit a high of $23 but has struggled to reach it again until now.

- 📊 A breakout opportunity is present; it's advised to set a stop-loss to mitigate risks.

- 🛰️ The FCC granted a license for space-based operations, enabling a space-based cellular network.

- 🌍 The goal is 100% nationwide coverage of the continental U.S. with premium cellular spectrum.

- 💰 The company anticipates increased revenue as more users switch to its network.

- 📉 Despite market downturns, the stock held its position, indicating strong support.

- 🔄 Trading strategies include buying on pullbacks or MACD crossovers, focusing on bullish momentum.

Q & A

What caused the rise in Space Mobile's stock price?

-The rise in Space Mobile's stock price was caused by the U.S. Federal Communications Commission granting the company an initial license for space-based operations, which paves the way for the development of a space-based cellular network.

What is the significance of the FCC license for Space Mobile?

-The FCC license is significant because it allows Space Mobile to launch and operate three different frequencies that support Gateway feeder link, Telemetry tracking, and control operations for its first five commercial satellites. This milestone is crucial for the company's goal of providing 100% nationwide coverage from space across the continental United States.

What are the potential price targets mentioned for Space Mobile's stock if it breaks past $23?

-If Space Mobile's stock breaks past $23, the potential price targets mentioned are $25 and possibly $30.

Why is there resistance at the $23 price level?

-There is resistance at the $23 price level because the stock previously hit this high before pulling back and has not reached this level again until now. Breaking this level could signal a significant breakout.

What does the speaker recommend if someone didn't buy the dip in Space Mobile's stock?

-The speaker recommends playing the breakout strategy if someone didn't buy the dip, while also setting a stop loss to avoid holding the stock if it drops back down significantly.

What is the importance of setting a stop loss when trading on a breakout?

-Setting a stop loss is important when trading on a breakout because it protects the trader from significant losses if the stock fails to continue its upward momentum and instead declines.

What historical price point does the speaker reference as a key level for Space Mobile?

-The speaker references the $23 price point as a key level, which the stock had difficulty surpassing in 2021 before pulling back.

What is the speaker's strategy for trading Space Mobile's stock?

-The speaker's strategy for trading Space Mobile's stock involves watching for a breakout above key resistance levels, setting a stop loss, and using indicators like the MACD crossover to identify buying opportunities.

What does the speaker suggest could happen if Space Mobile's stock breaks out above $23?

-The speaker suggests that if Space Mobile's stock breaks out above $23, it could potentially reach $25 or even $30, given the bullish momentum and historical price action.

What advice does the speaker give regarding market volatility and stock dips?

-The speaker advises being cautious during market volatility and suggests waiting for pullbacks or buying during MACD crossovers on lower time frames to take advantage of dip-buying opportunities.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

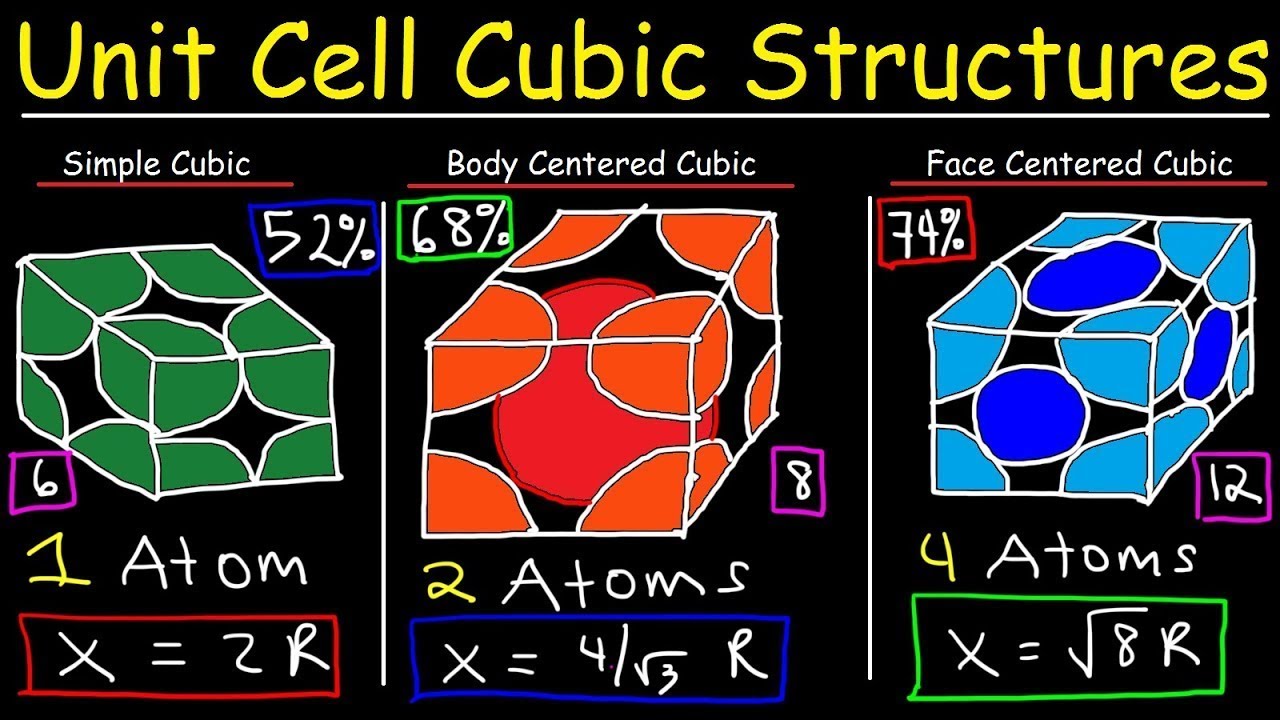

Unit Cell Chemistry Simple Cubic, Body Centered Cubic, Face Centered Cubic Crystal Lattice Structu

Massive News for AST Space Mobile Stock Investors! | ASTS Stock Analysis

TAF Interview 6 - Cobra Gold กับการสร้าง Space และ Cyber ของกองทัพไทย

DJI AVATA 2, la VERITA' su FCC e SBLOCCO VELOCITA'

Why Tesla Stock is going to hit $400 way sooner than most people think...

Apakah Ada Minyak di Luar Angkasa?

5.0 / 5 (0 votes)