Why Are Black Americans The Poorest People In America

Summary

TLDRThis video addresses the historical and systemic factors contributing to the financial disparity between Black and White Americans, tracing from slavery to Jim Crow laws and redlining. It emphasizes the importance of understanding this history to inform solutions. The speaker proposes strategies for change, including personal financial responsibility, ownership of appreciating assets, intentional money management, reducing entertainment spending, supporting Black-owned businesses, and active participation in the stock market and real estate to build wealth for future generations.

Takeaways

- 😀 The video discusses the financial disparity between Black people and other ethnic groups in America, aiming to provide historical context and solutions.

- 🏛 The script outlines the impact of slavery from 1619 to 1865, which prevented Black people from owning property and receiving wages, laying the foundation for wealth inequality.

- 🔄 The Reconstruction era after the Civil War briefly offered opportunities for Black people to own land and get educated, but these were soon curtailed by oppressive tactics and Jim Crow laws.

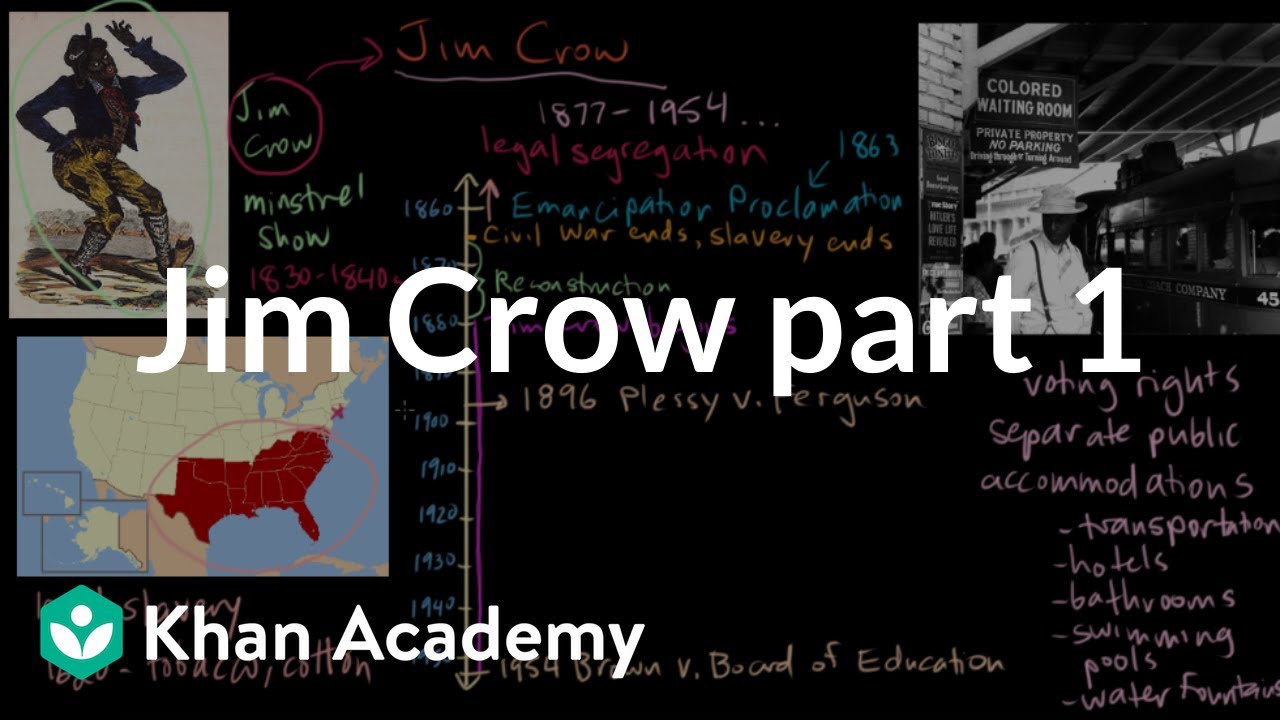

- 📜 Jim Crow laws, in effect until the mid-1960s, were likened to a second form of slavery, restricting Black people's economic and social mobility.

- 🏘️ Redlining and restrictive covenants were practices that prevented Black Americans from buying property in certain areas, further limiting wealth accumulation through homeownership.

- 💼 The script points out the systemic racism that still affects Black people's wages and opportunities, contributing to the wealth gap.

- 🚫 The speaker emphasizes not waiting for the system to change but taking personal control over one's financial situation.

- 💰 The importance of ownership is highlighted as a means to build wealth and break free from economic constraints.

- 🛍️ The script advises reducing consumption and focusing on production and ownership to create appreciating assets.

- 💳 Being intentional with money is encouraged, including saving, budgeting, and investing for retirement.

- 🎭 The video calls for a reduced focus on entertainment and materialism, which can detract from wealth-building activities.

- 🤝 Supporting Black-owned businesses is presented as a way to strengthen the community's economic power.

- 📈 Engaging in the stock market and real estate is suggested as a means to accumulate appreciating assets and build wealth for future generations.

Q & A

What is the main focus of the channel where the video script is from?

-The main focus of the channel is financial education, financial freedom, and helping people improve their financial situation, particularly in real estate.

Why does the speaker believe it's important to discuss the topic of black people being the poorest in America on this channel?

-The speaker believes it's important because the channel is about money, and addressing financial inequality is relevant to its mission of promoting financial literacy and empowerment.

What historical period is mentioned in the script that had a significant impact on the financial status of black people in America?

-The script mentions slavery from 1619 to 1865 as a significant historical period that impacted the financial status of black people in America.

How did the speaker summarize the impact of slavery on black people's ability to accumulate wealth?

-The speaker summarized that slavery was a system designed to keep money out of black people's hands, preventing them from building and passing down wealth for nearly 250 years.

What was the Reconstruction period, and how did it briefly affect black people's financial situation?

-The Reconstruction period was a time after the Civil War in 1865 when black people were given rights, including the opportunity to own land, get educated, and make better wages, which was a brief moment of progress before new restrictions were imposed.

What are Jim Crow laws, and how did they affect black people's financial situation?

-Jim Crow laws were a set of legal restrictions that limited black people's rights and opportunities, effectively reinstituting a form of slavery and severely impacting their ability to earn higher wages and accumulate wealth.

What is redlining, and how did it contribute to the wealth gap between black and white Americans?

-Redlining was a practice where banks and financial institutions selectively chose who to lend money to, often excluding black Americans from certain areas, making it difficult for them to buy homes and build wealth through homeownership.

What is the wealth gap between black and white families in America, and how has it remained consistent over time?

-The wealth gap is significant, with black families having 25 cents for every dollar of wealth that white families have. This gap has remained largely unchanged over the past 20 years.

According to the script, what are some of the systemic issues that have kept black people behind financially?

-Systemic issues include historical events like slavery and Jim Crow laws, redlining, restrictive covenants, and mass incarceration, all of which have contributed to a lack of wealth accumulation and higher debt among black Americans.

What are some of the personal actions the speaker suggests to help bridge the wealth gap?

-The speaker suggests focusing on ownership, being intentional with money, consuming less and producing more, supporting black-owned businesses, and being active in the stock market and real estate to accumulate appreciating assets.

How does the speaker frame the discussion about the financial situation of black people in America?

-The speaker frames the discussion as an educational and solution-oriented conversation, not about blame or division, but about understanding history and taking actionable steps to improve the financial situation of black Americans.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Warning! How White People Keep Black People Poor To This Day! | Black History | Black Culture

Does Slavery Still Exist in America? 13 Facts from 13th | Netflix

Jim Crow part 1 | The Gilded Age (1865-1898) | US History | Khan Academy

Origins of the Jim Crow Era - One Minute History

REPARATION Payments Approved: An Increase From $350k to $151 Million For Each African American!

Reparations for Foundational Black Americans: Racial Justice | Amir El | TEDxYouth@BrooklynLab

5.0 / 5 (0 votes)