반등했지만 침체는 해결된 게 없습니다(ft.ISM오류)

Summary

TLDRThe video script discusses the volatile stock market reactions to recent economic indicators, focusing on the ISM service PMI which brought temporary relief but also uncertainty. It highlights the unusual foreign investor behavior in the Kospi, the panic selling of Samsung Electronics, and the potential impact of interest rate fluctuations between Japan and the U.S. The speaker suggests that the market's panic might be due to interest rate 'spasms' rather than a true economic downturn, and emphasizes the importance of considering various perspectives beyond news headlines when investing in stocks.

Takeaways

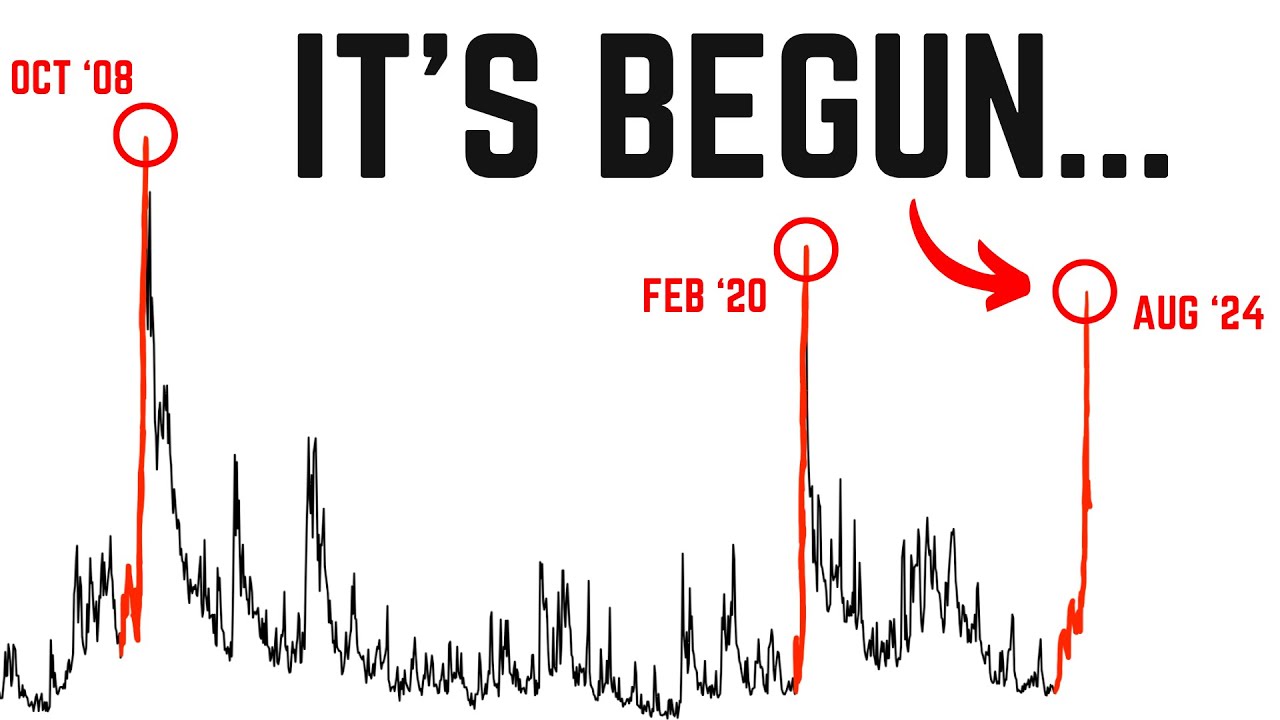

- 📉 The market panicked due to a sudden drop, but later found relief after the ISM service PMI recorded 51.4, indicating better-than-expected service industry performance.

- 🔄 The manufacturing sector performed worse than expected, while the service sector did better, leading to a fluctuating stock market that could change interpretations from day to day.

- 🤔 The speaker suggests that there might be some unusual signs in the market, hinting at potential changes in market trends despite the current upward movement.

- 📈 The speaker finds it challenging to point out oddities during an uptrend because it goes against the general sentiment, but believes it's essential to share these observations.

- 🤝 The script mentions a discrepancy between foreign investors' actions and the market's performance, with a significant net selling position in KOSPI during a rebound.

- 📱 Samsung Electronics, a key stock, showed weakness despite an early surge, indicating that foreign investors are not participating in the rebound, having sold large volumes during the panic.

- 💹 The market's reaction to interest rates is crucial; the speaker feels that interest rates can create a 'waterfall' market drop or a 'change area' where the market gradually falls while people are still trading.

- 🇯🇵 The script suggests that Japan's interest rate hike and the potential for further increases in the U.S. might have caused the market drop, rather than a genuine economic downturn.

- 📊 The service PMI index has been highly volatile and often deviates significantly from predictions, casting doubt on its reliability as a leading indicator.

- 🌐 The rapid change in interest rate spreads between Japan and the U.S. could lead to a swift market reaction, with implications for corporate profits and the potential for a downturn.

- ⏳ The speaker emphasizes the importance of timing and the degree of interest rate adjustments, suggesting that the market will continue to be sensitive to economic signals and potential policy changes.

Q & A

What triggered the market panic yesterday?

-The market panic was triggered by a sudden drop followed by the release of the ISM services PMI at 51.4, which led to a relief rally.

How did the manufacturing and services sectors perform compared to expectations?

-The manufacturing sector performed worse than expected, while the services sector performed better than expected.

What unusual activity did foreign investors exhibit in the KOSPI market?

-Foreign investors sold 1.5 trillion won worth of KOSPI stocks but balanced it by buying 12,000 futures contracts. Today, however, they sold stock futures during the rebound.

How did the performance of Samsung Electronics differ yesterday and today?

-Yesterday, foreign investors sold 1.58 million shares of Samsung Electronics, causing panic. Today, they sold over 2 million shares, showing they did not participate in the rebound.

What are the characteristics of a market drop caused by interest rate issues according to the speaker?

-A market drop caused by interest rate issues is sudden and strong, making it difficult to respond, similar to a fastball.

What are the characteristics of a market drop caused by economic recession concerns according to the speaker?

-A market drop caused by economic recession concerns is gradual and deceptive, like a breaking ball, making it seem like the market can be handled while it slowly declines.

What does the speaker think about the ISM services PMI as an indicator?

-The speaker believes the ISM services PMI is not a reliable leading indicator due to its frequent large deviations from predictions and its highly volatile nature.

What historical examples did the speaker provide to illustrate market reactions to interest rate changes and economic recessions?

-The speaker mentioned the market reactions in December 2015 to the first Fed rate hike, leading to a 19% drop, and the market reaction in 2018 due to US-China trade tensions and recession fears, leading to a 20% drop over three months.

What are the current market concerns regarding interest rates and economic recession?

-The current concerns are the sudden appreciation of the yen due to Japan's unexpected rate hike and the rapid changes in US rate expectations, causing market instability.

What does the speaker suggest about interpreting market news and making investment decisions?

-The speaker suggests not getting overly influenced by market news and instead considering various opinions to make objective investment decisions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The 2024 Recession Just Started... (Do THIS Now)

बाजार अचानक CRASH क्यों हुआ?😭🔴 Why SENSEX NIFTY DOWN TODAY⚫ STOCK MARKET CRASHED REASON🔴 CHINA SMKC

השבוע של סין של נתוני האינפלציה ושל השיאים שנשברים

FRB高官の利下げ見通しがでました(3月1日 #PAN米国株)

El Momento Que Estábamos Esperando Ha Llegado.

Worldwide Economic Struggles in the Interwar Period

5.0 / 5 (0 votes)