Secrets of an Order Flow Leg

Summary

TLDRThis video script delves into the concept of 'narrative' in trading, emphasizing its importance alongside price direction prediction. It explains how to identify and trade from Price Direction (PD) Rays, including swing points, fair value gaps, and areas. The script introduces the terms 'First Line of Defense' (FLA), 'Overlapping Defense' (ODD), and 'Last Line of Defense' (LOT) to assess the strength and probability of trading opportunities. It also highlights the significance of higher time frames in determining market movements and the role of order flow in understanding market direction and potential trading scenarios.

Takeaways

- 😀 Understanding the direction of price is crucial for trading, but it's only the first part of being a good trader; narrative is equally important.

- 📈 Narrative helps in identifying where the price is moving from and provides context for potential trading opportunities.

- 🎯 The concept of PD Ray (Price Direction Ray) is used for both targeting trades and determining from where to trade, enhancing trading strategy.

- 🔍 Order flow analysis is vital as it reveals not just the direction of price but also potential continuation points, indicating high or low probabilities for trades.

- 🌐 Trading should focus on the highest probability scenarios, as different fair value gaps can have varying chances of success despite appearing similar.

- 📊 Probabilities in trading are paramount, with the aim to always trade scenarios with the highest likelihood of profit.

- 🕰 The significance of time frames in trading; higher time frames (monthly, weekly, daily) indicate the actions of larger institutions and are thus more influential.

- 🔑 FLA (First Line of Defense), A (Overlapping Defense), and LOT (Last Line of Defense) are tools for dissecting and evaluating the strength of an order flow lag.

- 🛑 FLA is the first point of resistance or support encountered during a price retracement, with the best scenario being a fair value gap as the FLA.

- 🔄 Overlapping Defense occurs where two PD Rays overlap, such as a fair value area and a fair value gap, indicating a stronger potential for price continuation.

- 🏁 The Last Line of Defense is typically the swing point, which can either be a point to trade from or towards, depending on the context of the order flow.

Q & A

What is the main focus of the MMC series' first four videos?

-The first four videos of the MMC series focus on understanding the direction of price action, determining whether the market is going higher or lower, and identifying the PD Ray to trade towards.

What is a PD Ray and why is it significant in trading?

-A PD Ray is a point or level that traders target in the market. It is significant because it represents a potential swing point or fair value area that the market may move towards, and it helps traders to identify potential entry and exit points.

What role does narrative play in trading according to the video?

-Narrative in trading refers to understanding the context from which the market is moving. It helps traders to determine not just the direction of the market (the PD Ray to trade towards), but also the starting point of their trades (the PD Ray to trade from).

How does order flow analysis contribute to identifying a good trade setup?

-Order flow analysis contributes by revealing the intentions behind price movements. It helps traders to understand the strength and weakness of price action, and to identify high probability trade setups based on the presence of fair value gaps, fair value areas, and swing points.

What are the three components of an order flow lag?

-The three components of an order flow lag are the swing point, the fair value gap, and the fair value area. These components help traders to understand potential retracement levels and the strength of the market's movement.

Why is it important to consider the time frame when analyzing order flow?

-Considering the time frame is important because higher time frames (monthly, weekly, daily) represent the actions of larger institutions and are typically stronger indicators of market direction. Analyzing order flow in higher time frames can provide more reliable and significant trade signals.

What does 'FLOT' stand for and what does it represent in the context of order flow?

-FLOT stands for 'First Line of Defense'. It represents the first point of resistance or support that the market encounters during a retracement, which is often the fair value gap or area.

What is the significance of an 'overlapping defense' in an order flow lag?

-An overlapping defense occurs when two PD Rays overlap, typically the fair value area and the fair value gap. It signifies a high probability area for the market to continue its movement, as it represents a convergence of potential support or resistance levels.

How does the concept of 'probabilities' relate to trading strategies discussed in the video?

-The concept of probabilities relates to the likelihood of a trade setup playing out as expected. Traders aim to focus on high probability scenarios, where the market behavior aligns with the most favorable conditions for a trade to be successful.

What is the purpose of the case study mentioned in the video?

-The purpose of the case study is to provide practical application of the concepts discussed in the video. It encourages traders to analyze their charts using the principles of FLOT, overlapping defense, and last line of defense to better understand high and low probability trade setups.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Do yourself a favor; learn Order Flow.

How to KNOW where price will ALWAYS go - DOL simplified!

Tanda Candlestick akan berbalik arah ( Penutupan harga) - Startegi trading Support resisten

SMT Exposed (Unlock Time In Trading)

Liquidity Concepts Simplified (SMC Trading Strategy Masterclass)

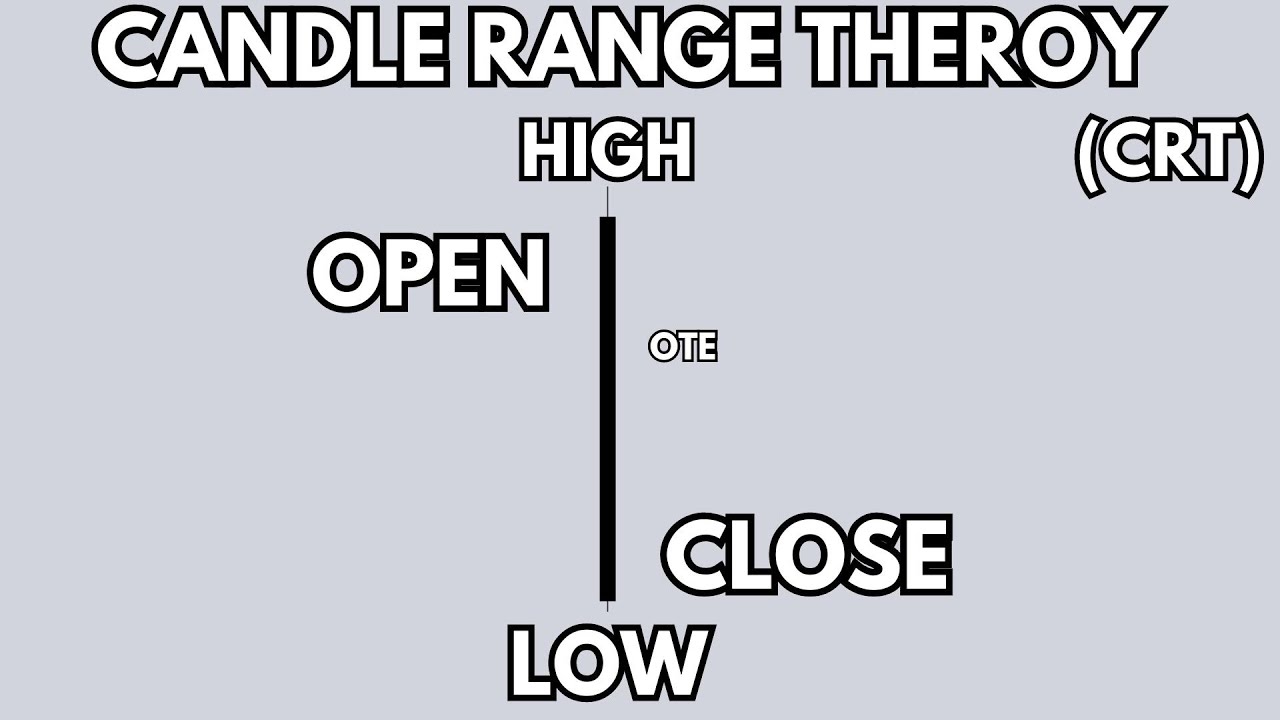

Candle Range Theory | CRT | The NEW Silver Bullet For Struggling Traders

5.0 / 5 (0 votes)