Do THIS Before EVERY Trade you Take: Profitable Trading Checklist 😅📈

Summary

TLDRIn this video, Nick discusses essential checklist items for traders before taking any trade. He emphasizes the importance of checking one's mental state, having a clear reason for entering a trade, understanding the risk involved, planning an exit strategy, and considering upcoming news that could impact the market. These steps are crucial for treating trading like a business and making informed decisions.

Takeaways

- 🧠 Always check your mental state before taking a trade to ensure you are level-headed and focused, avoiding emotionally driven or intoxicated decisions.

- 📝 Have a clear reason for every trade you enter, similar to how businesses document transactions, to ensure you are trading with purpose and not just on a hunch.

- 📈 Understand the entry point and the reasons for entering a trade, such as technical factors or fundamental analysis, before committing to a position.

- 💰 Determine the risk you are willing to take on each trade, considering your comfort level and the potential impact on your trading account.

- 🚫 Have a plan for managing risk, including using stop losses or other techniques to limit losses if the trade goes against your expectations.

- 🏁 Develop an exit plan for both favorable and unfavorable outcomes, knowing when to take profits or cut losses based on predetermined criteria.

- 🔄 Use trailing stop strategies to lock in gains as the trade moves in your favor, ensuring you have a clear exit strategy when the trade turns.

- 📉 Be prepared for the possibility of being wrong in your trade analysis, acknowledging that even the best traders can be incorrect and having a plan for managing losses.

- 📆 Consider upcoming news and events that could impact the market or asset you are trading, especially if you are a short-term trader focusing on intraday or short-term charts.

- 📈📉 Be aware of the potential for significant market movements due to scheduled news or events, and adjust your trading strategy accordingly to manage risk.

Q & A

What is the first checklist item Nick suggests to consider before taking a trade?

-The first checklist item is to check your mental state to ensure you are not emotionally driven, intoxicated, or making impulsive decisions that could lead to poor trading choices.

Why is it important to have a reason for entering a trade according to Nick?

-It's important because trading should be treated like a business, where every action has a detailed reasoning behind it, including documentation and invoices for business transactions. This approach helps in making informed and strategic decisions.

What does Nick recommend for new traders to help them understand their trading decisions?

-Nick recommends journaling the reasons for every trade before taking it, as it's a good way for new traders to get a better understanding of their trading motivations and strategies.

What is the third checklist item discussed by Nick in the video?

-The third checklist item is determining the risk involved in a trade, understanding how much you are willing to risk, and being comfortable with that risk before entering a position.

Why is it crucial to have an exit plan when trading?

-An exit plan is crucial because it helps traders know when to get out of a trade, whether it's due to a stop loss, a trailing stop, or other criteria, ensuring they can lock in gains or limit losses when necessary.

What is the significance of considering upcoming news when trading short-term?

-Considering upcoming news is significant for short-term traders because it can significantly impact the market, causing sudden movements that might affect their trades, especially if they are not prepared to deal with such events.

What does Nick suggest as a strategy for managing gains in a trade?

-Nick suggests using a trailing stop strategy, where the stop loss is moved up as the trade goes in your favor, allowing you to lock in gains and protect profits.

What is the importance of acknowledging potential losses before entering a trade?

-Acknowledging potential losses is important because it helps traders to be prepared for the possibility of being wrong, manage risk effectively, and maintain a realistic perspective on trading outcomes.

What is the role of mental state in making trading decisions, as emphasized by Nick?

-The mental state plays a crucial role in making trading decisions as it affects the rationality and clarity of thought, which in turn influences the quality of trading choices and the ability to stick to a trading plan.

Why does Nick compare trading to running a business in terms of decision-making?

-Nick compares trading to running a business to emphasize the need for detailed reasoning, documentation, and a strategic approach to every trade, similar to how business transactions are handled.

What is the purpose of having a clear entry point before discussing risk in a trade, according to Nick?

-Having a clear entry point before discussing risk helps traders to have a specific reference point for their risk assessment, making it easier to determine how much they are willing to risk and to plan their trades accordingly.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

An Easy ICT Scalping Strategy (CHECKLIST included)

6 Simple habits that will improve your productivity and focus

ICT Forex - What New Traders Should Focus On

TOEFL Home Edition 2024 – 8 Things You MUST Know for a Good Experience

Trading Course Day 2: Indication

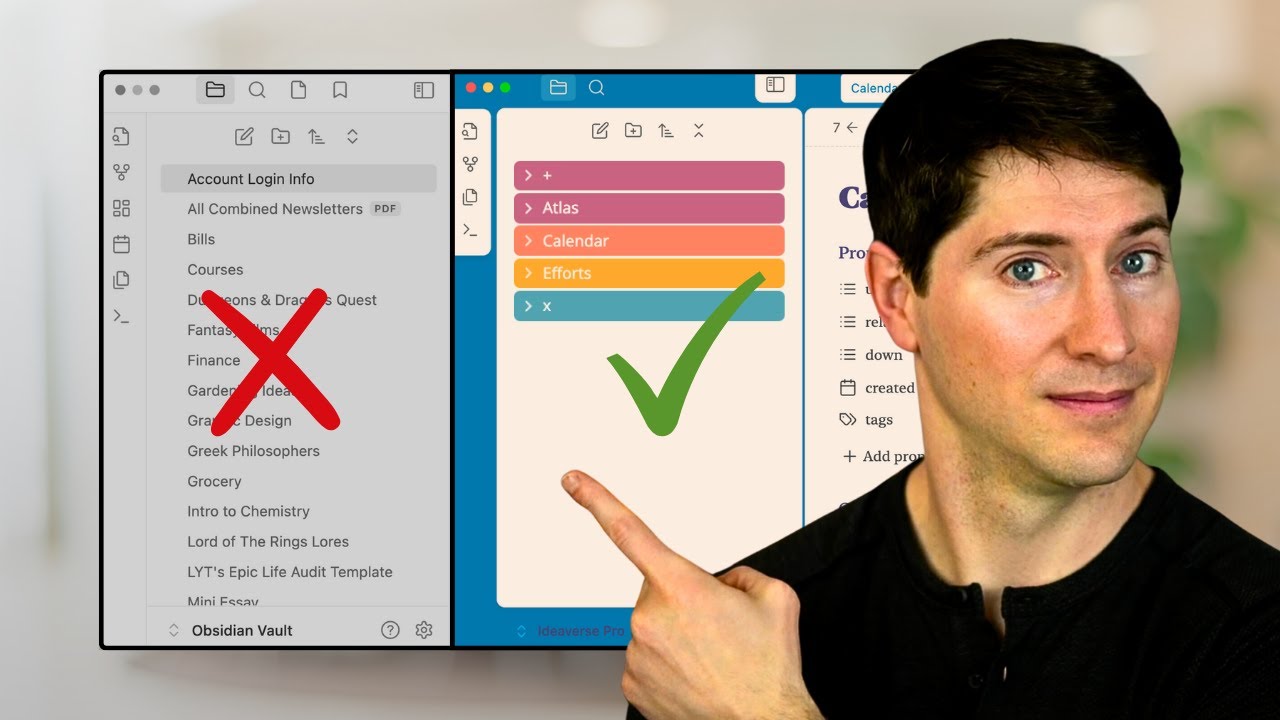

What Nobody Tells You About Organizing Folders in Obsidian

5.0 / 5 (0 votes)