Session 3 - 02 ATO Repayment Plan Budgeting & Cashflow

Summary

TLDRThe video script discusses financial management concepts such as the Australian Taxation Office (ATO), GST, B.A.S.S., and the importance of timely tax payments. It touches on repayment plans for businesses in financial distress and the significance of cash in business transactions. The speaker also covers budgeting, its role in setting targets and governance, and the importance of accurate financial forecasting for maintaining cash flow, which is essential for a company's survival. The script emphasizes the need for strategic financial planning to avoid bankruptcy and the benefits of direct debit for improving cash flow.

Takeaways

- 🇦🇺 The Australian Taxation Office (ATO) allows businesses to lodge their Business Activity Statements (BAS) monthly or quarterly through the BAS portal.

- 📅 Businesses in financial trouble can enter into a repayment plan with the ATO, which involves interest charges and equal repayments spread over a period, such as 18 months for a $50,000 tax debt.

- 💡 The speaker suggests that the government should not be in the business of extending credit to businesses that continue to operate in a manner that leads to further debt without changing their practices.

- 💰 Cash is often referred to as paper money and paying employees in cash can imply tax evasion, but paying for legitimate expenses in cash is not illegal as long as it is properly accounted for.

- 📊 A budget is a financial plan set at the start of the financial year, outlining targets for sales and spending, and is used for governance and strategic planning within a company.

- 📈 The speaker's company creates budget templates that dynamically adjust based on input variables, providing a more accurate and useful tool for financial planning.

- 🔄 Balance refers to the ending amount in an account, such as a bank or credit card, and is an important figure in financial statements.

- 💼 Reimbursement is a process where employees are reimbursed for business expenses they have paid out of pocket, which are still considered business expenses for tax purposes.

- 📋 Deductions are expenses that can be subtracted from a company's revenue to calculate the taxable income, and they also apply to personal tax situations.

- 📝 A trial balance is a report that lists the opening and closing balances of all general ledger accounts, ensuring that the company's financial records are accurate.

- 💧 Cash flow is described as the lifeblood of a company, emphasizing its importance for survival, even over profitability, as it represents the actual money coming into the business.

- 📉 The speaker's company offers cash flow forecasting services to help clients predict and manage their financial health, including strategies to improve cash flow, such as direct debit payments.

Q & A

What is the purpose of the ATO's repayment plan?

-The ATO's repayment plan allows businesses that can't afford to make their tax payment by the due date to enter into a repayment arrangement. This plan is similar to getting credit, where the business pays the tax owed in installments plus interest over a set period.

Why might the speaker believe that the government's repayment plan is not always beneficial for businesses?

-The speaker believes that allowing businesses to continue accruing debt without changing their operating methods doesn't do them any favors. It may lead to more debt without addressing underlying issues in their operations.

What is the general understanding of 'cash' as mentioned in the script?

-Cash generally refers to money, particularly paper money. Paying employees in cash to avoid taxes is illegal, but paying bills in cash is legal as long as it's done legitimately.

What is a budget, and why is it important for companies?

-A budget is a financial plan that a company prepares at the beginning of the financial year to set targets for revenue and spending. It helps in setting strategies, measuring performance, and delegating authority within the organization.

How can budgets be used in corporate governance?

-Budgets allow the board to delegate authority to the CEO and other executives. For example, a CEO may have the authority to spend within the budget but must seek board approval for expenditures beyond the budget.

What is a balance in financial terms?

-A balance is the ending amount on a financial statement, account, bank, or credit card.

What is a reimbursement and how is it handled in a business context?

-A reimbursement occurs when an employee pays for a business expense with their own money and then gets paid back by the company. It's handled through various systems depending on the company's policies.

What is a tax deduction?

-A tax deduction allows a business to subtract certain expenses from its revenue, reducing the taxable income. For example, if a business earns $100,000 and has $80,000 in expenses, it only pays tax on the remaining $20,000.

What is a trial balance?

-A trial balance is a report that lists all general ledger accounts with their opening and closing amounts, providing a summary of the company's financial position.

Why is cash flow considered the lifeblood of any company?

-Cash flow is the money coming into an organization, necessary for paying expenses. Even a profitable business can fail if it lacks sufficient cash flow to meet its obligations.

What is the purpose of cash flow forecasting?

-Cash flow forecasting helps predict future financial positions, allowing businesses to make informed decisions, plan for potential cash shortages, and secure funding in advance if necessary.

How did the speaker's company improve its cash flow?

-The company improved its cash flow by switching all clients to direct debit payments, collected weekly. This ensured a steady flow of income and reduced delays in payment.

What role does a finance manager or CFO play in managing cash flow?

-A finance manager or CFO not only deals with past financial data but also forecasts future cash flow, devising strategies to maintain business viability and avoid financial problems.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

3.5 What is a Tax Invoice

Session 2 - 05 ABA files + Other Bank and Economic terms

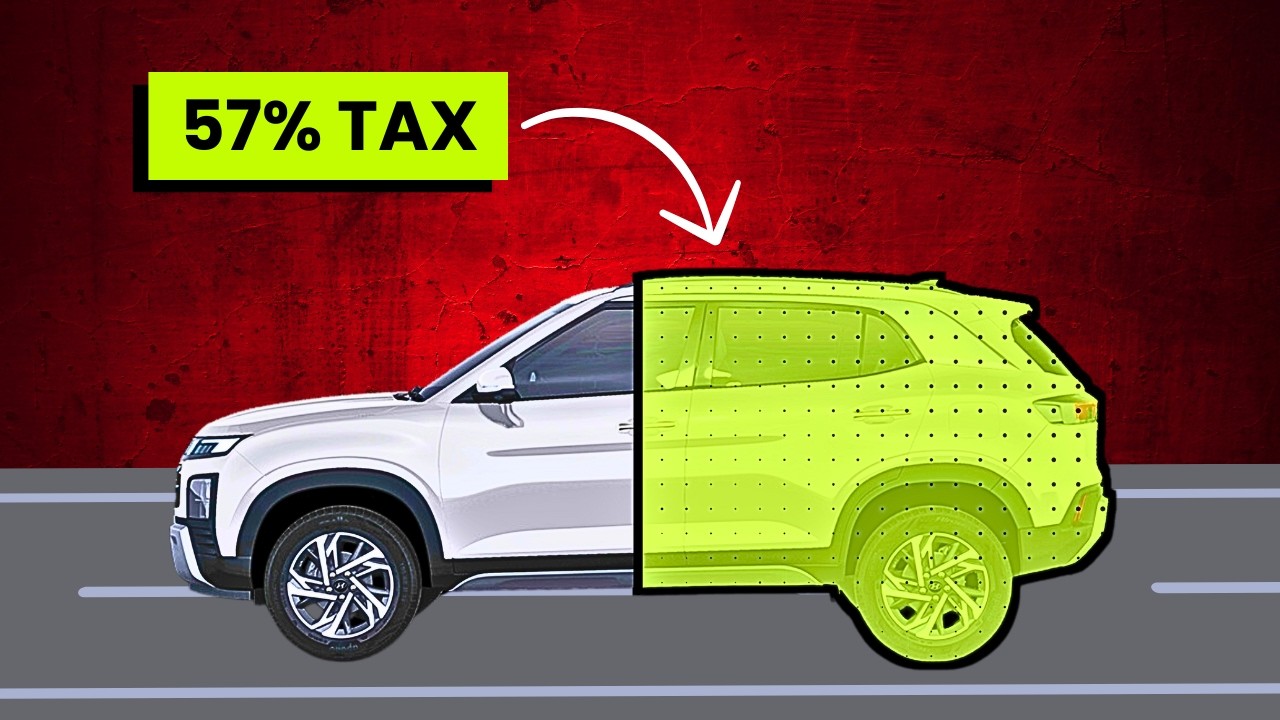

Why are Cars so expensive? | Truth about Indian Car Prices

Fraudsters swindled $105m from the ATO, now the luxury proceeds are up for sale | A Current Affair

ADVANCE TALLY & G S T | IMPORTANT QUESTION 💯 | 2023 BCOM SEM 2

Real Estate में GST कितना लगता है | Real Estate में GST कैसे लगता है | GST on Real Estate Business |

5.0 / 5 (0 votes)