penyelesaian sengketa perbankan - aspek hukum dalam perbankan

Summary

TLDRThis lecture discusses legal aspects in banking, focusing on the resolution of banking disputes. It explains that disputes can arise from different interests between parties, including issues like breach of contract or illegal actions. The lecturer outlines two main forms of dispute resolution: non-litigation (such as negotiation, mediation, and arbitration) and litigation (court proceedings). The differences between handling disputes in conventional and Islamic banking are highlighted, as well as the legal frameworks governing these processes. The emphasis is on choosing non-litigation methods for quicker, less formal, and cost-effective solutions.

Takeaways

- 📜 The script discusses legal aspects in banking, particularly focusing on dispute resolution in banking.

- 🤝 It differentiates between disputes within conventional banking and Islamic banking, noting that their resolutions may vary due to different principles.

- 📊 The causes of banking disputes can be due to non-performance or breach of contract, often initiated by the customer's inability to fulfill obligations.

- 🏛 Two main types of dispute resolution are highlighted: non-litigious (out-of-court) and litigious (in-court).

- 🏢 Non-litigious resolution is encouraged as it can be less formal, quicker, and potentially less costly than litigation.

- 👥 Alternative Dispute Resolution (ADR) methods such as negotiation, consultation, and mediation are presented as effective ways to resolve disputes amicably.

- 📝 Litigious resolution involves formal court proceedings and may require a significant amount of time and resources.

- 📋 The script mentions specific laws and regulations governing dispute resolution in both conventional and Islamic banking, including Indonesian laws.

- 👨⚖️ Different courts have jurisdiction over different types of disputes, such as civil courts for conventional banking disputes and religious courts for Islamic banking disputes.

- 📍 The location for filing a lawsuit is determined by various factors, including the residence of the defendant or the location of the dispute.

- 📝 The importance of evidence in court proceedings is emphasized, with various forms of evidence being discussed, such as written documents and witness testimonies.

Q & A

What is the main topic discussed in the script?

-The main topic discussed in the script is the resolution of disputes in the banking sector, including both conventional and Islamic banking.

What are the two types of disputes mentioned in the script?

-The two types of disputes mentioned are disputes between banks (interbank disputes) and disputes between banks and customers or debtors.

What are the two methods of dispute resolution discussed in the script?

-The two methods of dispute resolution discussed are non-litigious resolution (alternative dispute resolution) and litigious resolution (court-based resolution).

What is the significance of 'wanprestasi' in the context of banking disputes?

-'Wanprestasi' refers to a breach of contract or failure to perform, often by the customer, which is a common cause of disputes in the banking sector.

What is the role of the court in resolving banking disputes?

-The court plays a role in litigious resolution, where disputes are resolved through legal proceedings in either state courts for conventional banking disputes or Islamic courts for Islamic banking disputes.

What is the alternative dispute resolution (ADR) mentioned in the script?

-Alternative Dispute Resolution (ADR) refers to methods of resolving disputes outside of the court system, such as negotiation, mediation, and arbitration, which are less formal and can be quicker and less costly.

What are the advantages of using non-litigious methods for dispute resolution?

-Non-litigious methods offer advantages such as being less formal, potentially quicker, less costly, and focusing on finding a mutually agreeable solution rather than determining a winner or loser.

What are some of the factors that can cause banking disputes according to the script?

-Some factors that can cause banking disputes include breach of contract, failure to fulfill obligations, and illegal actions as stipulated in the law.

How does the script differentiate between disputes in conventional banking and Islamic banking?

-Disputes in conventional banking are resolved in state courts under specific laws, while disputes in Islamic banking may be resolved in Islamic courts or through other mechanisms outlined in Islamic finance laws.

What is the importance of understanding the different courts' jurisdictions in banking disputes?

-Understanding the different courts' jurisdictions is important because it determines the appropriate legal avenue for resolving disputes, whether it be state courts, Islamic courts, or other specialized tribunals.

What are the potential outcomes of a court-mediated settlement attempt during a trial?

-If a settlement is reached during court mediation, it can be formalized into an agreement that serves as a basis for the judge's decision. If no agreement is reached, the case proceeds to a full judicial examination and decision.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Minggu 14 Penyelesaian Sengketa Bisnis

Hukum Perbankan 3 - Kredit dan Analisa Kredit - Devi Yustisia, SH., M.Kn FH UNUD

Banking Law Part 1 The Concept

Advokasi EkSya 11 - Murabahah dan Sengketa di Pengadilan Agama

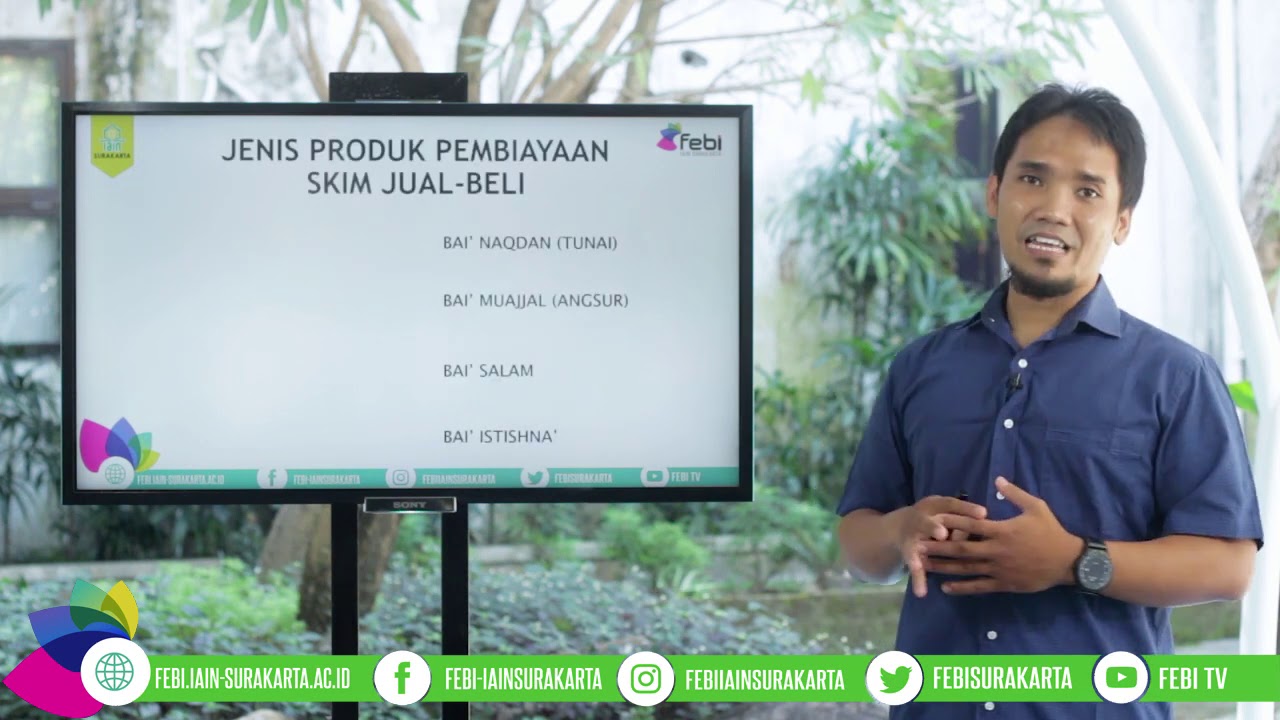

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Economic Crimes || Criminology UGC NET || UNIT - I

5.0 / 5 (0 votes)