Um player está muito vendido e o preço sobe, e ele começa comprar - É o stop dele?

Summary

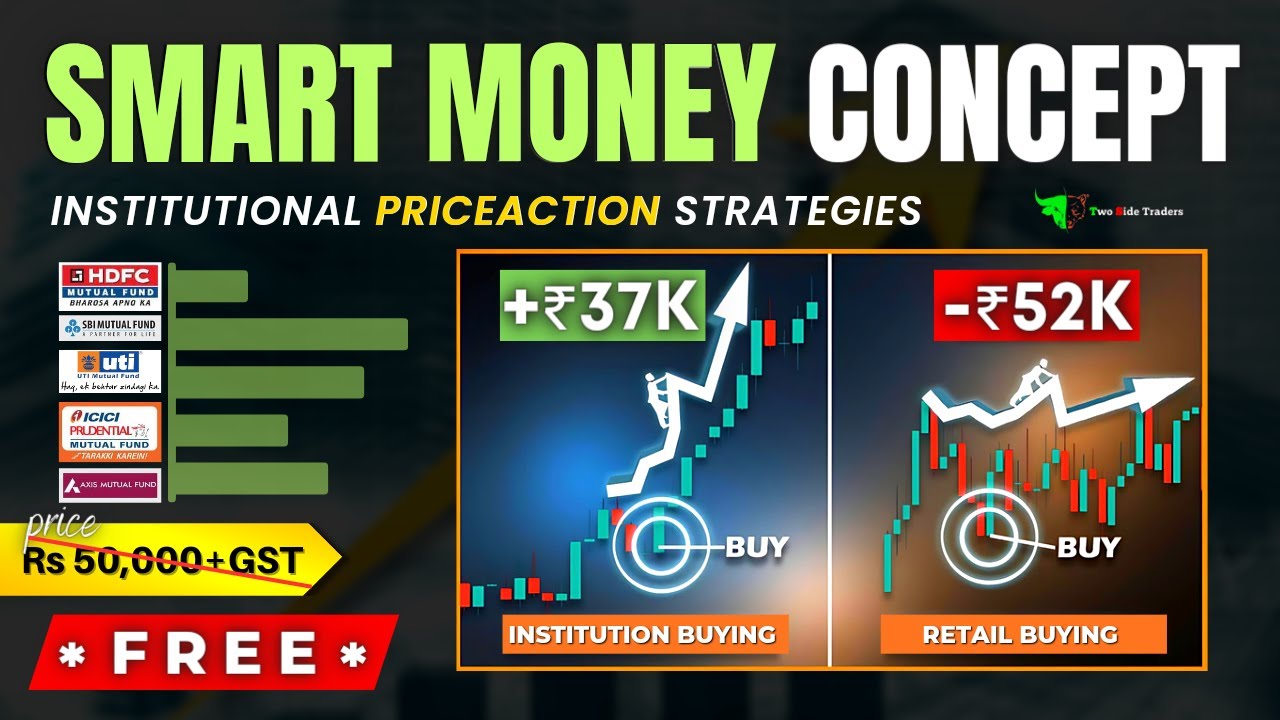

TLDRIn this trading-focused video, André Hanana addresses a common misconception about stop-loss strategies in the market. He emphasizes the importance of not assuming that a single entity is behind significant market movements and highlights the diversity of investor horizons. André uses specific examples from trading data to illustrate how different players, such as retail investors and institutional funds, operate with varying strategies. He warns against misinterpreting market signals and provides insights into identifying genuine stop-loss actions versus algorithmic trading patterns.

Takeaways

- 📈 The video discusses the complexities of trading, emphasizing that not all market activity can be attributed to day trading or a single trader's actions.

- 🤔 It's incorrect to assume that because a brokerage has a large client base, it's the only one operating, as there are many players in the market with different time horizons.

- 🚫 Avoid making assumptions about the identity of the buyer or seller based on market movements, as it's not always the same person who sold and then repurchased.

- 🧐 Understanding the different types of market participants, such as retail, semi-professional, and institutional traders, is crucial for accurate market analysis.

- 💡 The video highlights the importance of recognizing that not all trades are day trades and that different investors have different investment horizons.

- 📊 The speaker uses specific examples from trading data to illustrate points about market behavior and the actions of different types of traders.

- 🛑 The concept of 'stop loss' orders is introduced, explaining that not all traders will sell when the market moves against them, depending on their trading strategy and risk tolerance.

- 🔍 The video provides insights into how to differentiate between trades made by large individual traders versus those made by algorithmic trading by analyzing order size and frequency.

- 🌐 It's noted that global allocators may not be as concerned with short-term market fluctuations in a specific market like Brazil, as it's a small part of their overall portfolio.

- 📉 The speaker warns against the common mistake of assuming that all market participants will 'stop out' when the market moves against them, which is not always the case.

- 💡 The video concludes by emphasizing the importance of careful analysis and not overgeneralizing the actions of market participants based on limited observations.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is trading, specifically focusing on the analysis of trading patterns and behaviors of different market participants, and the importance of not misinterpreting market signals.

Who is André Hanana, and what is his role in the video?

-André Hanana is the speaker in the video script. He appears to be an experienced trader or educator who discusses trading strategies and market analysis, emphasizing the need for correct interpretation of market movements.

What is the significance of the 'stop' in trading as mentioned in the script?

-The 'stop' in trading refers to a stop-loss order, which is a tool used by traders to limit their loss on a position. It is significant because it helps traders to manage risk and avoid significant financial damage if the market moves against their position.

Why is it incorrect to assume that a single client is operating through a brokerage?

-It is incorrect to assume that a single client is operating through a brokerage because brokerages often have multiple clients with varying trading strategies and behaviors. The market movements reflected in a brokerage's activity could be the result of many individual decisions, not just one client's actions.

What is the difference between retail and professional traders as described in the script?

-Retail traders are individual, non-professional traders, while professional traders are more experienced, operate more consistently, and trade larger sizes. The script emphasizes that not all market participants are day traders and that different investors have different time horizons.

Why is it a misconception to think that everyone in the market is a day trader?

-It is a misconception because different market participants have different trading strategies and time horizons. Some may be long-term investors, arbitrageurs, or high-frequency traders (HFTs), and their actions are not solely focused on making profits within the day.

What does the script suggest about the importance of understanding market microstructure?

-The script suggests that understanding market microstructure is crucial because it helps traders to identify the different groups of market participants, their operating modes, and their reasons for trading, which can provide a more accurate interpretation of market movements.

What is the role of RLP (Registered Limited Partner) in the context of the script?

-RLP refers to a type of entity that can operate through a brokerage. The script mentions that some brokerages may have active RLPs, which can influence the trading activities attributed to the brokerage, but it is not always the case, especially with brokerages that do not have active RLPs.

How does the script differentiate between different types of market participants based on their trading patterns?

-The script differentiates market participants by analyzing their trading volumes, the frequency of their orders, and the type of brokerage they use. For example, large manual orders through certain brokerages might indicate a large retail trader, while smaller, automated orders might indicate algorithmic trading by institutions.

What is the 'vacuole of liquidity' mentioned in the script, and why is it significant for traders?

-The 'vacuole of liquidity' refers to a gap or void in the market's liquidity created by large aggressive orders. It is significant for traders because filling this gap can indicate a potential opportunity, especially if the market has moved significantly away from a trader's average entry price.

How can traders avoid misinterpreting market signals as described in the script?

-Traders can avoid misinterpreting market signals by understanding the different types of market participants, their trading behaviors, and the context of their trades. They should also be cautious about assuming that all market activity is driven by day traders or that all market participants will react to price movements in the same way.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Fai trading ? Il potere passa dalla mente (Breve lezione)

My favourite Option buying set up (Option buying series)

Selling Base Config

How Operator TRAPS New Traders | *FREE Advance Price Action Trading | Smart Money Concepts In Hindi

Схема построения технического анализа. Урок 1-1

O melhor sistema de scalp para criptomoedas que você vai encontrar no youtube

5.0 / 5 (0 votes)