個別股票評論及焦點 watchlist (8-Aug-2021)|學習方法的看法

Summary

TLDRIn this video, Chart-reader CUP shares his weekly stock reviews and watchlist, emphasizing that his content is for educational purposes and not financial advice. He discusses the futility of buy/sell alert services, citing the MPA experience and the importance of learning and applying trading methods personally. He also provides insights into his current stock positions, market performance, and strategies, highlighting the need for active learning and personal growth in trading.

Takeaways

- 📈 The speaker emphasizes that their stock commentary and watchlist are for educational purposes and not financial advice, urging viewers to do their own research and assess risks before investing.

- 📊 They do not provide specific buy or sell points like many paid services do, instead focusing on sharing their actual trading actions in real-time on Discord to ensure the authenticity of their discussions.

- 💡 The speaker explains that providing a 'buy now, sell now' service is fundamentally flawed, as it often leads to collective buying or selling that can manipulate the market and result in losses for followers.

- 🎓 They highlight the importance of learning the underlying methods and strategies of trading, rather than just following buy/sell signals, to achieve long-term success in the market.

- 🏆 The speaker mentions their experience with a high-profile trading alert service, noting that despite the service's reputation, they stopped using it after a few months due to its inherent issues.

- 📚 The speaker advocates for active learning and teaching as the best ways to truly understand and internalize trading knowledge, rather than passively consuming content.

- 💼 They discuss the balance between sharing educational content and maintaining a livelihood, mentioning that while they do charge for their services, the focus is on providing value and fostering a win-win situation.

- 📉 The speaker provides specific examples of stocks they are currently holding or have recently traded, discussing the reasons behind their decisions and the current market conditions.

- 📈 The script includes analysis of various stocks and sectors, noting which have performed well recently and which have not, with a focus on understanding the market dynamics behind these movements.

- 💡 The speaker discusses the concept of 'active learning' and how teaching others can reinforce one's own understanding and improve trading strategies.

- 🚀 The speaker concludes by summarizing their approach to stock commentary and the importance of providing educational value to their audience.

Q & A

What is the main purpose of Chart-reader CUP's video content?

-The main purpose of Chart-reader CUP's video content is to share experiences and provide educational insights on stock trading, rather than giving specific investment advice.

Why doesn't Chart-reader CUP provide buy/sell points in his stock reviews?

-Chart-reader CUP does not provide buy/sell points because he aims to create an authentic, witnessed record of his trades to ensure the accuracy of his discussed trades and performance, rather than offering a paid service with specific trading prompts.

What is the significance of the portfolio equity curve in Chart-reader CUP's approach?

-The portfolio equity curve is significant because it serves as a visual representation of the trader's performance and strategy effectiveness, which cannot be replaced by just a screenshot from a brokerage account.

What is the issue with buy now/sell now alert services according to Chart-reader CUP?

-The issue with buy now/sell now alert services is that they often lead to a herd mentality, causing self-fulfilling market movements that can result in failure for those following the service without understanding the underlying strategies.

Why did Chart-reader CUP stop using the MPA service after a few months?

-Chart-reader CUP stopped using the MPA service after a few months because he realized that simply following buy/sell alerts without understanding the methods and strategies behind them was not a path to success in trading.

What is Chart-reader CUP's view on the importance of learning and applying trading methods?

-Chart-reader CUP believes that learning and applying trading methods is crucial for success in trading. It involves understanding the methods, practicing them, and adapting them to one's own personality and situation to make informed decisions.

How does Chart-reader CUP approach teaching and learning in the context of trading?

-Chart-reader CUP views teaching as a form of active learning, where by presenting information and discussing it with others, he can clarify his own understanding and improve his own trading skills.

What is the role of active learning in Chart-reader CUP's educational philosophy?

-Active learning plays a central role in Chart-reader CUP's educational philosophy as it allows for deeper understanding and retention of knowledge by engaging in discussions, creating trading plans, and teaching others.

How does Chart-reader CUP explain the concept of 'why not both' in relation to his approach to trading and teaching?

-'Why not both' reflects Chart-reader CUP's belief in a win-win approach where he can teach others, helping them to learn and potentially earn more, while also gaining new insights and income for himself.

What is the significance of the learning pyramid in Chart-reader CUP's educational strategy?

-The learning pyramid signifies the different levels of learning effectiveness, with Chart-reader CUP advocating for more interactive and practical methods such as teaching others and creating trading plans, which lead to better knowledge retention.

How does Chart-reader CUP view the role of internet resources in modern learning compared to traditional books?

-Chart-reader CUP acknowledges the power of the internet for learning, stating that it can provide immediate access to a vast amount of information, making it a more efficient tool for targeted learning than traditional books.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

We Need To Talk About Rocket Lab Stock After This Massive Run!

Apa Yang Harus Trader Crypto Lakukan Di 2025

The " ONE CANDLE " Scalping Strategy I Will Use For Life

8 साल Share Market में रहकर ये सीखा कि...👆| Ishmohit Arora | @SOICfinance Josh Talks Stock Market

How To Stop Checking Stocks EVERYDAY! 3 Strategies I Used & The Benefits From Checking Less Often

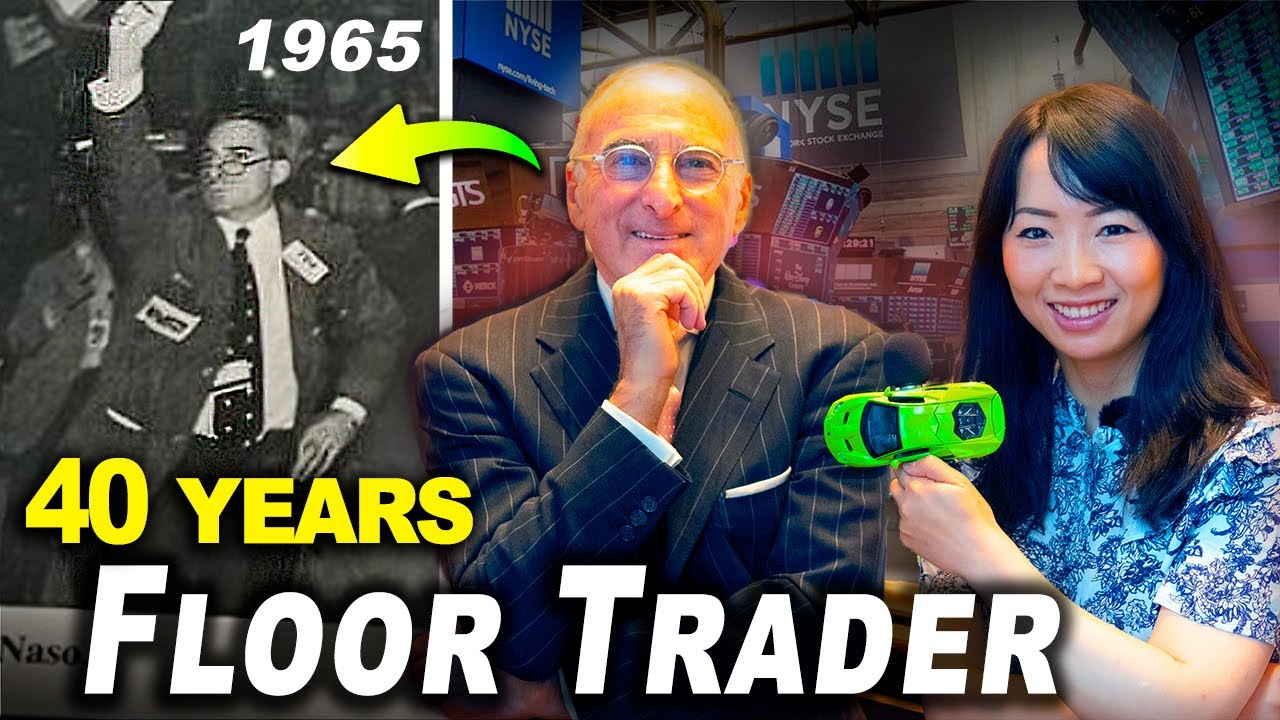

Veteran Wall Street Trader Reveals Strategies Used At Stock Exchanges

5.0 / 5 (0 votes)