Dihantam Moody’s, IHSG Tergelincir: Masih Ada Harapan Balik Arah? | TICKER TALK

Summary

TLDRIn the latest edition of Tikert (February 9, 2026), Yulistio Pratomo and expert Ko Michael Yo discussed the recent downturn in Indonesia's stock market, with the IDX (IHSG) experiencing a sharp drop of 2.08%. Despite the decline, foreign investors showed notable net buying activity. The conversation also addressed Moody's outlook downgrade on Indonesia, explaining that it only affects the outlook, not the rating. The analysts suggested the market could see a rebound, with a potential support level of 7,550, while advising investors to focus on strong dividend-paying stocks amid the volatility.

Takeaways

- 📉 The Indonesian Stock Index (IHSG) fell sharply by 2.08% to 7,935.26 on Friday, marking a 4.73% decline over the past week.

- 📊 The market saw significant declines across most sectors, with energy, finance, technology, and infrastructure sectors losing ground, while the transportation sector showed modest gains (+0.53%).

- 💼 Despite the market decline, foreign investors recorded a notable net buy of IDR 994.41 billion, highlighting continued interest from abroad.

- 📉 Market capitalization contracted by 4.69%, dropping to IDR 14.341 trillion, indicating a contraction in overall market value.

- 📅 Moody's downgraded Indonesia’s outlook from stable to negative, but the country’s investment-grade rating (BA2) remained intact.

- 🛑 The downgrade of Indonesia’s outlook by Moody's was seen as an anticipatory move, not a direct downgrade of the country's rating.

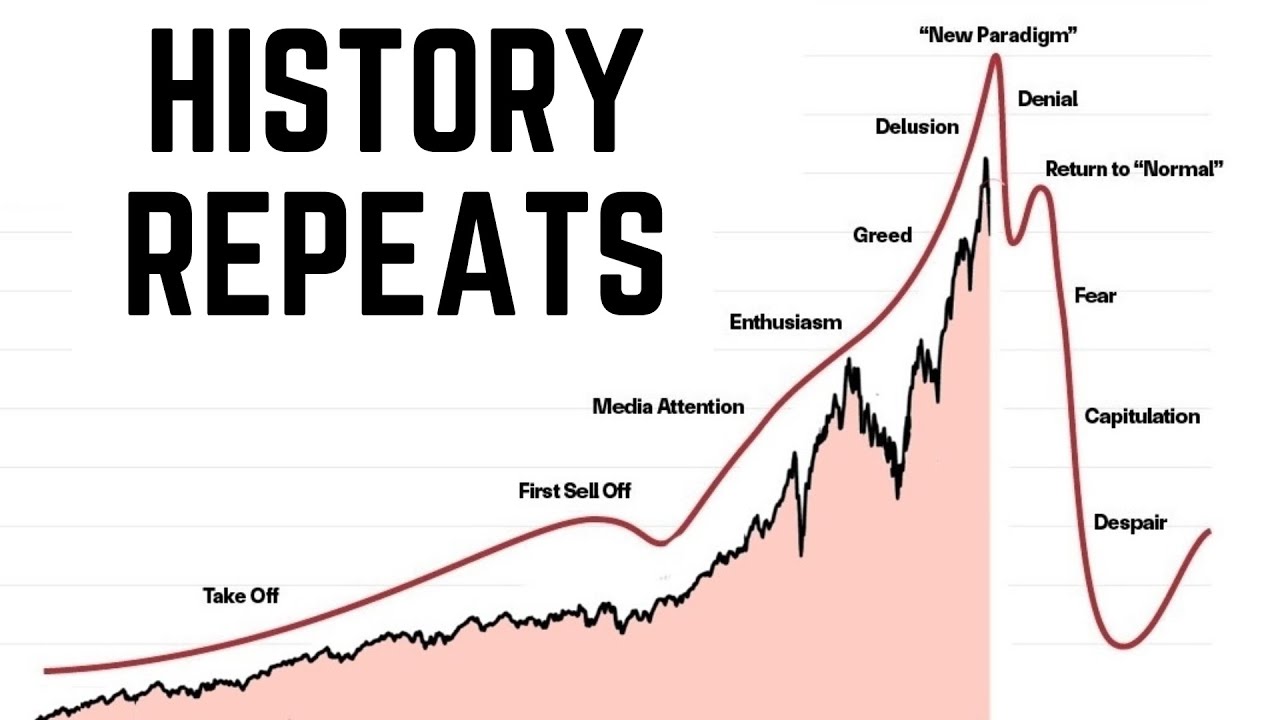

- 📉 IHSG has been in an overbought condition throughout 2025, and the recent correction has been particularly sharp, with technical support at 7,550 points.

- 📈 There's potential for IHSG to recover and test 8,100 points, driven by global market rallies and investor sentiment.

- 💸 With Ramadan and Idul Fitri approaching, sectors such as banking could see increased interest due to attractive dividend yields, despite some profit-taking tendencies during holiday periods.

- 🏦 Analysts recommend focusing on stocks with solid fundamentals and strong dividend payouts, such as Bank Mandiri, Telkom, Bumi, and Antam, as these are seen as resilient growth opportunities.

- 💡 Despite the market's challenges, the structural issues facing Indonesia’s economy are not likely to lead to a full downgrade to frontier status, offering long-term investment potential.

Q & A

What caused the significant drop in the IHSG on February 6, 2026?

-The IHSG experienced a sharp drop of 2.08% due to market pressure, with most sectors, including energy, financials, and technology, experiencing declines. This drop came after a strong correction in the previous week, reflecting investor concerns about both external factors like the MSCI downgrade and internal market conditions.

What is the significance of the MSCI downgrade for Indonesia?

-The MSCI downgraded Indonesia’s outlook from stable to less stable, which caused concerns among investors. However, it is important to note that only the outlook was downgraded, not the actual rating. Indonesia’s current rating remains at investment grade (BA2), which indicates a relatively stable investment environment despite the outlook change.

How did foreign investors react to the market conditions?

-Despite the market downturn, foreign investors were still active and recorded a significant net buy of IDR 994.41 billion. This shows that foreign investors were not entirely discouraged by the market's challenges, and they continued to invest in certain sectors.

What does the technical analysis suggest for IHSG’s performance?

-From a technical perspective, IHSG had been in an overbought condition throughout 2025 and into early 2026. The support level for the index is around 7,550, and it is expected to test this level again. If this support holds, there is potential for a market rebound, with projections indicating the index could rise to 8,100.

Which sectors are expected to perform well as we approach Ramadan?

-As Ramadan approaches, there is typically some profit-taking by investors due to the holiday season. However, sectors with strong fundamentals, such as banking, may present buying opportunities. For example, Bank Mandiri, which is expected to offer a high dividend yield, is one of the stocks that could perform well.

What advice does Ko Michael Yo give to investors during market volatility?

-Ko Michael Yo advises investors to focus on stocks with strong fundamentals and good dividend payouts as defensive plays. These stocks provide a cushion against market volatility and offer potential for long-term growth, especially during periods of market uncertainty.

Which stocks are currently recommended for investors to watch?

-Ko Michael Yo recommends keeping an eye on stocks like Bank Mandiri, Telkom, Bumi, and Antam. These stocks are seen as resilient due to their strong earnings potential and upcoming earnings reports, making them attractive choices for investors.

What impact did the drop in market capitalization have?

-The market capitalization of the Indonesian stock market contracted by 4.69%, dropping to IDR 14,341 trillion. This decline indicates a reduction in the overall value of the market, reflecting investor caution and the broader sell-off in various sectors.

How does the outlook downgrade by Moody’s affect investor behavior?

-The outlook downgrade by Moody's triggered investor panic, leading to a sharp decline in the market. However, Ko Michael Yo clarifies that an outlook downgrade does not necessarily mean a rating downgrade, and the market may stabilize once the immediate shock subsides. The outlook change was more of a precautionary measure by Moody's.

Is there still investment potential in Indonesia despite the market challenges?

-Yes, despite the recent challenges, Indonesia remains an attractive destination for foreign investment. The country’s investment-grade rating, along with resilient stocks in certain sectors, means there are still opportunities for growth, particularly for investors who focus on companies with solid fundamentals.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

IHSG Anjlok, Perdagangan Saham Disetop! - [Prioritas Indonesia]

Epochaler CRASH bei dieser Aktie war absehbar!

IHSG & Nilai Tukar Rupiah ke Dollar Makin Ambruk - [Metro Hari Ini]

MARA Marathon Digital Holdings Stock Analysis, Sell Mode?!

We are at the Precipice of a Major Turning Point for US Stocks…

La caída BRUTAL de MongoDB

5.0 / 5 (0 votes)