Psychology of Money in Just 10 Minutes

Summary

TLDRIn this video, the speaker explores key financial insights from 'The Psychology of Money' by Morgan Housel. They highlight how luck and risk shape success, the difference between getting wealthy and staying wealthy, and the importance of saving for freedom, not just material things. The speaker emphasizes that true wealth is often invisible and focuses on the emotional side of money, stressing that a reasonable financial plan is more important than a rational one. Through relatable examples, the video encourages viewers to understand money beyond just numbers and take actionable steps toward long-term financial peace.

Takeaways

- 🎯 Success is never fully under your control because luck and risk play a major role alongside hard work and skill.

- 🍀 Many success stories overlook invisible advantages like timing, location, and access to opportunities.

- ⚖️ Failure is not always due to stupidity, just as success is not always due to brilliance—circumstances matter.

- 💸 Getting wealthy and staying wealthy require completely different mindsets and skill sets.

- 🔥 Building wealth often requires taking risks, optimism, and bold moves that others avoid.

- 🛡️ Preserving wealth requires humility, patience, and avoiding unnecessary or reckless risks.

- 🕰️ Saving money is less about buying things later and more about buying freedom, flexibility, and options.

- 🚪 Having savings gives you the power to walk away from toxic jobs, bad relationships, and unfair situations.

- 👀 True wealth is invisible—it’s the money you don’t spend, not the things you show off.

- 🏎️ Looking rich and being rich are two very different games, and confusing them leads to financial stress.

- 🧠 Emotions heavily influence financial decisions, making reasonable strategies more effective than perfectly rational ones.

- 📉 The biggest enemy of investors is emotional panic during downturns, not lack of knowledge.

- 😌 The best financial plan is one you can stick with and that lets you sleep well at night.

- ⏳ Long-term survival in the financial game matters more than chasing the highest possible returns.

Q & A

Why did Mike Tyson, despite earning $400 million, end up bankrupt?

-Mike Tyson's bankruptcy stemmed from reckless spending on luxury items like mansions, exotic tigers, luxury cars, and an extravagant $2 million bathtub. By 2003, he was $23 million in debt, highlighting how poor financial decisions can undo even the highest earnings.

What is the main reason why some people retire richer despite earning less?

-The key reason is the difference in how people manage their money. Wealth is not just about earning a high income but about controlling spending, saving wisely, and making sound financial choices, which allows some individuals to retire early despite lower earnings.

What role do luck and risk play in financial success?

-Luck and risk are significant factors in financial success, but they are often overlooked. Success is not purely the result of skill; it’s influenced by factors like timing, connections, and even unexpected events, as seen in the stories of Bill Gates and Jesse Livermore.

What’s the difference between getting wealthy and staying wealthy?

-Getting wealthy often involves taking risks, such as starting a business or making bold investments. In contrast, staying wealthy requires avoiding risks, being patient, and practicing humility, which ensures wealth isn’t lost through reckless behavior.

Why do many lottery winners go bankrupt?

-Many lottery winners go bankrupt because they fail to manage their newfound wealth responsibly. They make impulsive decisions, over-invest in risky ventures, and often fail to adjust their mindset to focus on long-term wealth preservation.

What is the concept of the 'FU fund'?

-The 'FU fund' refers to a financial reserve that gives someone the freedom to walk away from toxic situations, such as bad jobs or relationships, without worrying about immediate financial survival. It’s about having enough savings to make choices based on freedom, not financial necessity.

How can saving money buy freedom instead of just material goods?

-Saving money can buy freedom by providing options and control over your time. Instead of spending money on expensive items, saving allows you to leave toxic situations and make decisions based on your values rather than being trapped by financial constraints.

What does the story of Ronald Reed teach us about wealth?

-Ronald Reed’s story demonstrates that wealth is often invisible. While he lived a modest life, he quietly accumulated wealth through smart savings and investments. His $8 million inheritance showed that true wealth often lies in what you don't see—savings, investments, and financial security.

What is the difference between looking rich and being rich?

-Looking rich involves spending money on visible luxuries like cars or clothes, which can be financed and don’t necessarily indicate true financial security. Being rich, on the other hand, is about what you don’t see—investing, saving, and prioritizing financial independence and freedom over external appearances.

Why do emotions play such a big role in financial decision-making?

-Emotions heavily influence financial decisions because people are not purely rational beings. During financial downturns, for example, panic can lead investors to make irrational decisions, like selling off investments during a market crash, which often leads to locking in losses.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Psychology of Trading

Cara Baru Memahami Uang - The Psychology of Money

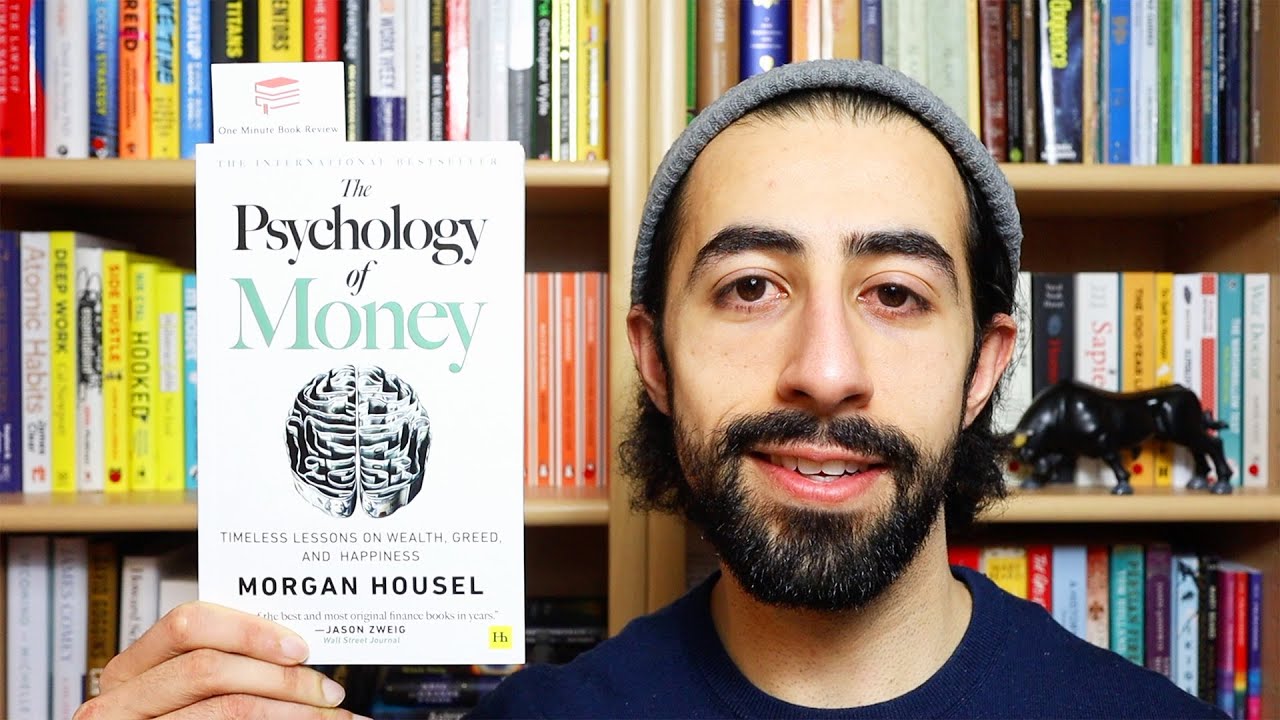

'The Psychology of Money' | One Minute Book Review

The Psychology of Money (Book) my KEY takeaways

पैसा बनाने के 8 नियम | 8 Rules to Make Money From | Psychology of Money Hindi Summary

Cuma Orang Privileged yang Bisa Kaya?! Maudy Ayunda's Booklist

5.0 / 5 (0 votes)