La Spa e le azioni

Summary

TLDRThe S.p.A. (società per azioni) is a corporate structure commonly used for large-scale business activities in Italy. It is a capital-based company with legal personality, where ownership is represented by shares. Its advantages include limited liability and the ability to raise capital easily, while the disadvantages involve high setup costs and organizational complexity. S.p.A.s can raise funds through shares, bonds, or other debt instruments, with distinct rights for shareholders (such as dividends and voting) versus bondholders (who receive fixed interest). Differences between shares and bonds are also outlined, with shares offering a stake in the company and bonds being debt instruments.

Takeaways

- 😀 The most common corporate form for large-scale economic activities in Italy is the **Società per Azioni (S.p.A.)**, a corporation with legal autonomy and capital structure divided into shares.

- 😀 **S.p.A.s** offer **limited liability**, meaning shareholders are only responsible for company debts up to the amount of their investment.

- 😀 A significant **advantage of the S.p.A.** is its ability to easily raise capital through the issuance of shares, bonds, and other debt instruments.

- 😀 One downside of the **S.p.A.** is its **high establishment cost**, with a minimum required capital of €50,000.

- 😀 **Internal organization and operations** in an S.p.A. are often complex, making it harder to manage compared to simpler corporate structures.

- 😀 **S.p.A.s** may seek capital through two main methods: issuing shares and bonds either in the **public market** or **private placement**.

- 😀 Shares represent ownership and confer **voting rights**, **dividends**, and a **share in liquidation proceeds** to shareholders.

- 😀 Shares can be transferred between holders, but some restrictions may exist, such as **pre-emption rights** or **approval clauses** by the company’s board or shareholders.

- 😀 The **S.p.A.** can issue **bonds** (obbligazioni), which are **debt instruments**, representing a loan the company must repay with interest.

- 😀 Unlike shares, **bonds** make the holder a **creditor** with **fixed interest** payments, whereas **shares** provide **ownership rights** and dividends based on company performance.

Q & A

What is the most common corporate form used for large-scale economic activities?

-The most common corporate form for large-scale economic activities is the joint-stock company, or 'Società per Azioni' (SPA) in Italy.

What type of company is a 'Società per Azioni' (SPA)?

-A 'Società per Azioni' (SPA) is a capital company with full asset autonomy and legal personality. Its shares represent capital and are publicly traded or can be placed through authorized intermediaries.

What are the key advantages of an SPA?

-The advantages of an SPA include limited liability for corporate debts and the ability to raise capital easily to achieve entrepreneurial goals.

What are the main disadvantages of an SPA?

-The main disadvantages of an SPA include the high costs associated with its establishment and the complexity of its internal organization and operations.

What is the minimum capital requirement for an SPA?

-The minimum capital requirement for an SPA is 50,000 euros.

How do SPAs typically raise funds?

-SPAs often raise funds through the issuance of shares, bonds, or other debt securities to investors. They can also use the capital market to issue equity or debt.

What is the difference between SPAs that utilize the capital market and those that do not?

-SPAs that use the capital market offer shares or securities to investors, while those that do not may place shares through banks or authorized financial intermediaries.

What rights do shareholders have in an SPA?

-Shareholders in an SPA have economic rights such as receiving dividends and participating in liquidation. They also have participatory rights, including the ability to attend and vote at the shareholders' meeting.

What are some limitations on the circulation of shares in an SPA?

-The circulation of shares in an SPA can be restricted by clauses in the company’s bylaws, such as pre-emption rights, where shareholders must offer shares to other existing shareholders before third parties, or approval rights, where the board must approve the transfer of shares.

What are bonds in an SPA and how do they differ from shares?

-Bonds are debt securities issued by the SPA. Unlike shares, which represent ownership in the company, bonds represent a loan to the company, and bondholders are creditors, not shareholders.

What are the main differences between shares and bonds in an SPA?

-Shares represent a portion of the company’s equity, giving the holder voting rights and dividends based on the company’s performance. Bonds, on the other hand, represent a debt to the company, giving the holder a fixed interest return and repayment of the principal amount at maturity.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Samsung PRO Plus Vs Sandisk Extreme Pro. Don't buy the bad one.

3 Reasons To Invest In The S&P500! (Don't Miss Out!)

7 Worst Game Mechanics That Everyone Hated

Logitech MX Keys vs MX Keys S Keyboard - 5 Differences

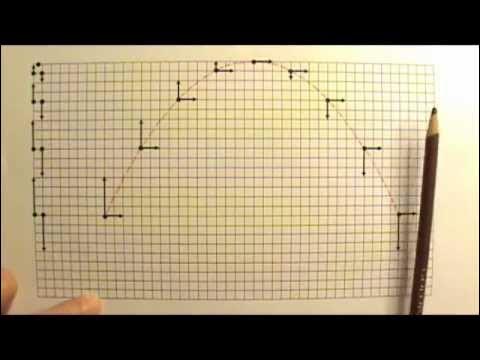

AP Physics 1: Kinematics 17: Projectile Part 2: Shot at an Angle (Symmetric)

Micologia, Virologia e Microbiologia Clínica 03/02

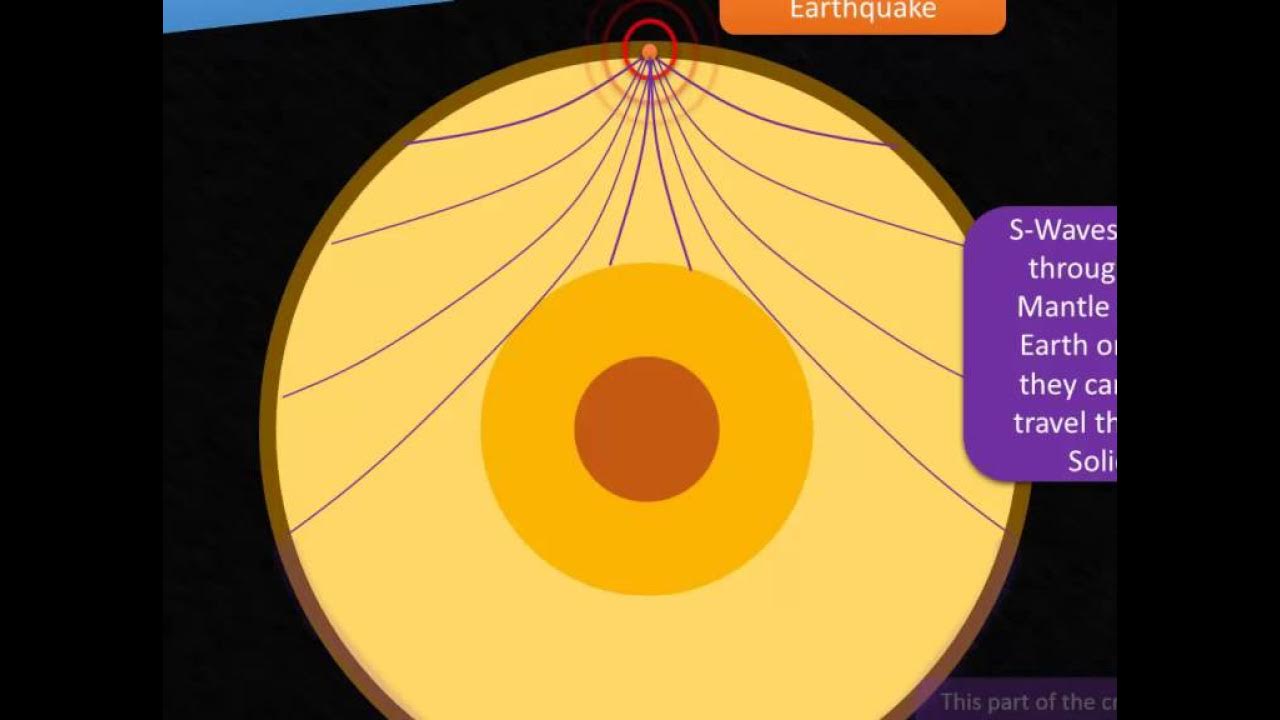

P1- Earthquake Shadow Zones

5.0 / 5 (0 votes)