Time & Price Algorithmic Trading: Environment Selection

Summary

TLDRIn this lecture on environment selection for trading, the focus is on understanding when to engage in the market to maximize success. The video discusses the importance of selecting the right market environments—low resistance liquidity runs vs. high resistance liquidity runs—and explains how to identify them. Key tools for environment selection include the economic calendar, specific trading sessions, and intermarket relationships. The goal is to avoid messy, high resistance conditions and engage only when conditions are conducive to smooth, predictable price action. The lecture ends with a homework assignment to help students identify examples of both types of liquidity runs.

Takeaways

- 📘 Environment selection is the first and foundational step in the 2025 trading protocol, determining when to engage in trading based on favorable market conditions.

- 🧭 The goal of environment selection is to trade during low-resistance liquidity runs and avoid high-resistance liquidity runs to increase trade success probability.

- 📈 A low-resistance liquidity run features smooth, clean price movements where discount arrays act as perfect supports and premium arrays act as perfect resistance.

- 📉 A high-resistance liquidity run involves choppy, indecisive price action where price fails to respect support and resistance levels, creating messy market behavior.

- 💡 Low-resistance liquidity runs are characterized by consistent expansions and retracements in the direction of the anticipated draw liquidity.

- ⚠️ High-resistance liquidity runs result in unpredictable reversals and consolidations, often leading to stop-loss hits even when the trade direction is correct.

- 🎯 Environment selection helps traders identify when market conditions align with the protocol’s logic, ensuring cleaner delivery and higher trade efficiency.

- 🧮 Three main tools are used for environment selection: the economic calendar, sessions of interest, and intermarket relationships.

- 🕒 The economic calendar helps identify days and sessions with expected volatility injections, improving the likelihood of low-resistance liquidity runs.

- 🌍 Intermarket relationship analysis ensures that correlated or inversely correlated markets are moving in sync—misalignment often signals high-resistance, choppy environments.

- 📝 Homework: collect 15 examples each of low- and high-resistance liquidity runs to develop pattern recognition and understanding of market delivery types.

- 🔍 The next lecture will focus on using the economic calendar to identify high-probability trading days and sessions for low-resistance liquidity runs.

Q & A

What is environment selection in trading?

-Environment selection is the process of choosing specific market conditions to trade in, based on the likelihood of achieving low resistance liquidity runs. It helps traders identify favorable conditions that align with their trading protocol to increase the probability of success.

Why is environment selection crucial in trading?

-Environment selection is crucial because it helps traders avoid high resistance liquidity runs, which are messy and prone to causing unnecessary losses. By selecting low resistance environments, traders can increase the likelihood that their strategy will play out successfully.

What are low resistance liquidity runs and how do they differ from high resistance liquidity runs?

-Low resistance liquidity runs are characterized by clean price movements where price expands and retraces in a predictable manner, utilizing discount arrays as support and premium arrays as resistance. High resistance liquidity runs are chaotic and choppy, where price fails to respect these levels and fluctuates between buy and sell programs, leading to unpredictable price action.

What role do discount and premium arrays play in low resistance liquidity runs?

-In low resistance liquidity runs, discount arrays act as support and premium arrays as resistance. When price retraces into these levels, it tends to find support or resistance, allowing for more predictable price movements toward the draw liquidity.

Can you provide an example of a low resistance liquidity run?

-A low resistance liquidity run occurs when price expands higher, retraces into a discount array, utilizes that array as support, and continues higher. This clean pattern repeats as price progresses towards its draw liquidity, without significant deviation or retracement.

What is an example of a high resistance liquidity run?

-A high resistance liquidity run involves choppy price action, where price repeatedly fails to respect discount or premium arrays as support or resistance. Price moves unpredictably, oscillating between buy and sell programs, leading to messy and inefficient delivery.

Why is it important to avoid trading in a high resistance liquidity run?

-Trading in a high resistance liquidity run is risky because, despite having a solid analysis and setup, the market delivers erratically. This increases the likelihood of hitting stop-losses due to the messy price action, even if the broader direction aligns with your draw liquidity.

How does the economic calendar help in environment selection?

-The economic calendar allows traders to anticipate days and sessions with high volatility injections, which are more likely to produce low resistance liquidity runs. By examining scheduled events, traders can plan their trades around high-probability sessions.

What is the importance of trading within specific sessions of the day?

-Certain sessions within each day have a higher probability of producing low resistance liquidity runs. By narrowing the trading window to these periods, traders increase their chances of engaging in favorable market conditions.

How does intermarket relationship factor into environment selection?

-Intermarket relationships help identify synchronized movements between correlated or inversely correlated markets. When these markets move in sync, it suggests a low resistance liquidity run. If they move out of sync, it indicates potential high resistance liquidity runs, which traders should avoid.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Time & Price Algorithmic Trading: Execution Protocol

Timing Expansions | Index Futures Outlook & Trade Breakdown

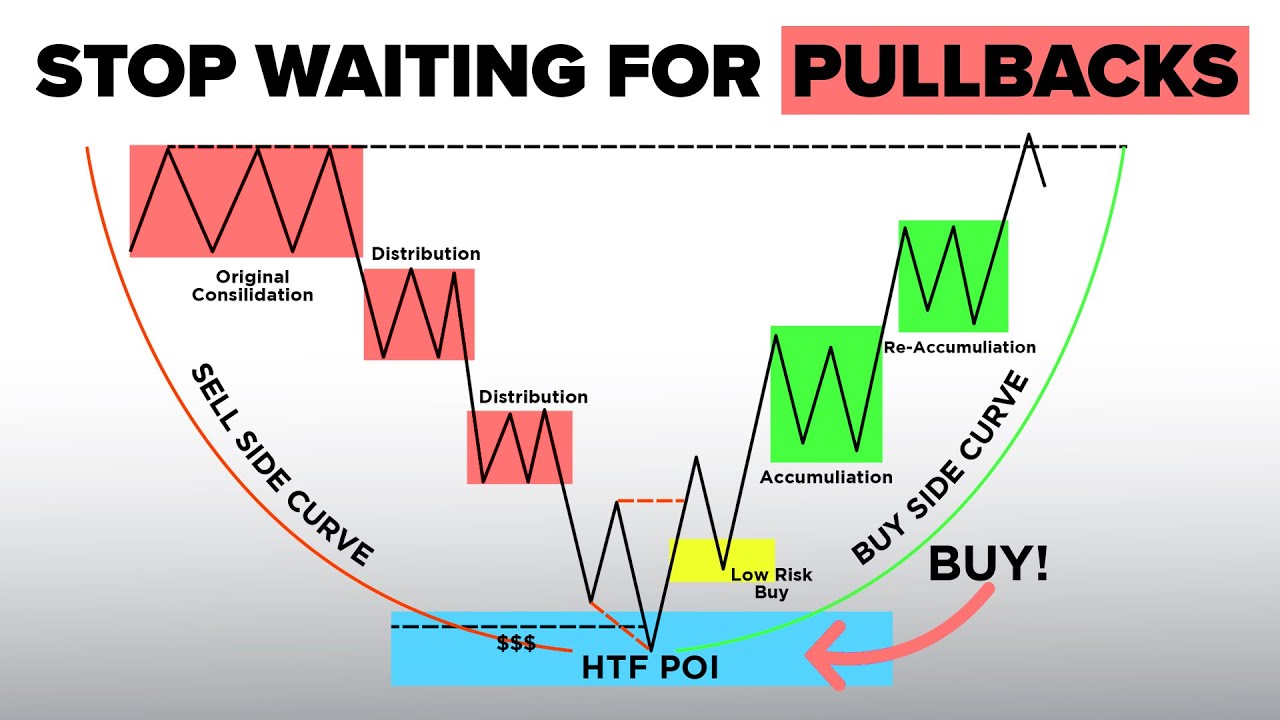

Stop Waiting for Pullbacks, Use Market Maker Models Instead (ICT Concepts)

A Mistake That 99% of ICT Traders Make...

Cara Trading Crypto Harian untuk Pemula

Time & Price Algorithmic Trading: Introduction

5.0 / 5 (0 votes)