Shocking Data - 45 Year Gold Cycle Ending Soon ? Weekend Investing | Alok Jain

Summary

TLDRThis video delves into the 45-year cycle of gold and equities, challenging the notion that the current gold bull run is just another short-term trend. The speaker explains the history of the gold standard, the impact of the US dollar detaching from gold in 1971, and the subsequent 54-year experiment with fiat currency. They explore key global monetary cycles, the impending need for a financial reset, and the risks of unsustainable debt. The video emphasizes the importance of gold as a long-term investment and the possibility of a major shift in the financial system by 2030.

Takeaways

- 😀 Gold has risen 10,000% in the last 54 years, while the S&P 500 has increased by 6,400% during the same period.

- 😀 The US dollar was unpegged from gold in 1971, which began a 50-year experiment where fiat currency was used without any gold backing.

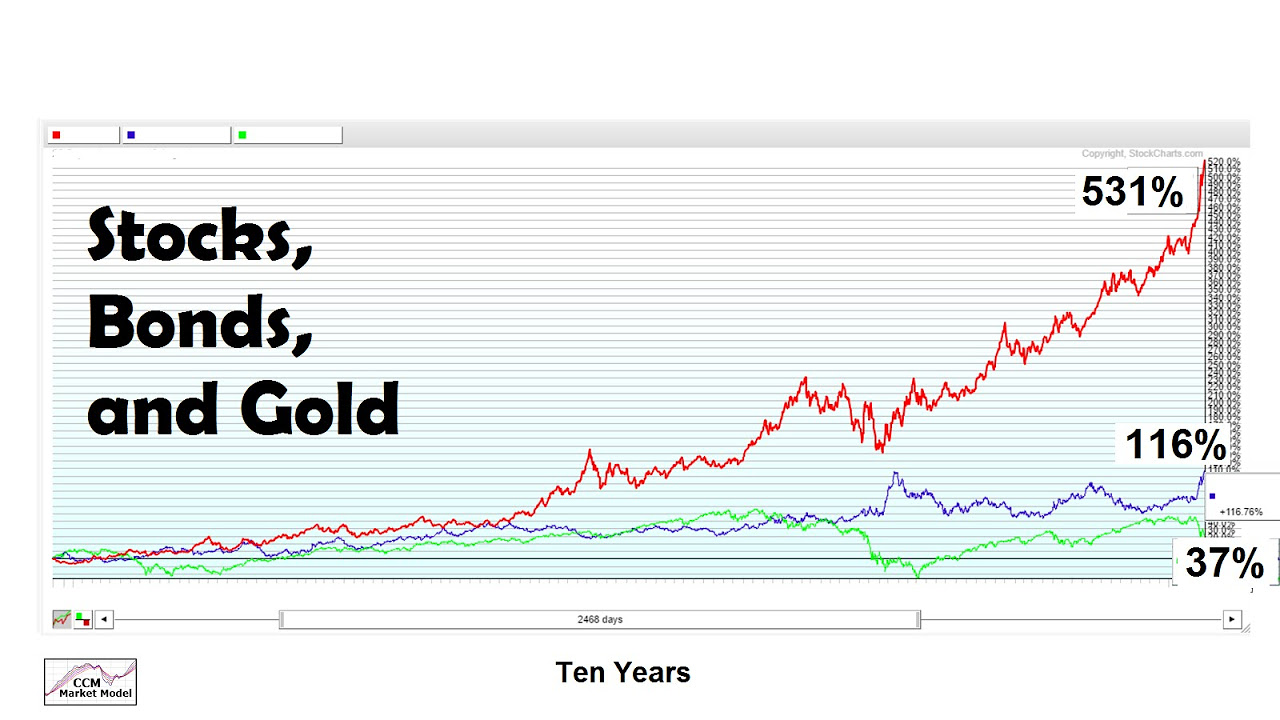

- 😀 The S&P 500 to gold ratio reveals a broader trend of monetary cycles, with gold outperforming stocks during major historical events.

- 😀 There is speculation that gold may strengthen again against equities, with a potential reset around 2030-2031 based on historical 45-year cycles.

- 😀 The current debt crisis, with global debt at 300% of GDP, is unsustainable. The US is facing a situation where it might default or restructure its debt.

- 😀 Global supply chains have collapsed, and dollarization is rapidly increasing, with countries diversifying their reserves away from the dollar and towards assets like gold.

- 😀 The Triffin Dilemma suggests that the US, as the issuer of the global reserve currency, must run deficits to supply the world with dollars, which erodes the dollar’s value over time.

- 😀 Historically, every 50-100 years there is a global monetary reset, which could happen through a world war, pandemic, or a major financial crisis.

- 😀 One potential outcome of the reset would be massive inflation, enabling the US government to pay back its debt with devalued dollars.

- 😀 The idea of a new anchor for currency is being explored, with potential shifts towards gold or digital currencies (CBDCs) to restore confidence in money.

- 😀 Leading financial institutions are advising investors to allocate at least 20% of their portfolios into gold as a hedge against long-term economic uncertainty.

Q & A

What happened on August 15, 1971, and why is it significant in the context of gold and the US dollar?

-On August 15, 1971, President Nixon announced that the US would temporarily disassociate the dollar from its gold backing. This decision marked the end of the Bretton Woods system, which allowed foreign governments to exchange US dollars for gold at a fixed rate. This event is significant because it led to the era of fiat currencies, where money is no longer backed by physical assets like gold.

How has the value of gold and the S&P 500 changed since 1971?

-Since 1971, gold has increased by 10,000% in dollar terms, while the S&P 500 has grown by 6,400%. This indicates that both asset classes have significantly appreciated, but gold has outperformed the stock market in terms of percentage increase over the last 54 years.

What is the significance of the S&P 500 to gold ratio chart discussed in the video?

-The S&P 500 to gold ratio chart helps visualize how the stock market (S&P 500) has outperformed or underperformed gold over the past 140 years. The ratio shows key turning points when gold has outperformed equities, often in times of financial crisis or global resets, such as during World War II and the 1980s.

What are some of the historical events that correspond with the lows (troughs) in the S&P to gold ratio?

-The troughs in the S&P to gold ratio correspond to significant historical events, including the Panic of 1893, World War II, and the period around 1980. These events were often followed by major resets or shifts in the global financial system.

Why does the video suggest that gold may perform better than equities in the coming years?

-The video suggests that due to ongoing global monetary cycles and financial instability, including high levels of global debt and low productivity, gold may outperform equities in the coming years. The S&P 500 to gold ratio is falling despite the stock market reaching all-time highs, indicating that gold may be positioned to perform better.

What is the current state of global debt, and why is it a concern for the US economy?

-Global debt is now 300% of global GDP, with US debt alone reaching around $38 trillion. This high level of debt is concerning because the cost of servicing it, especially with rising interest rates, is becoming unsustainable. As a result, there are fears that the US may eventually default or need to inflate the currency to manage its debt burden.

What is the Triffin Dilemma, and how does it relate to the US dollar as the global reserve currency?

-The Triffin Dilemma is an economic theory that suggests a conflict arises when a country holds the global reserve currency. The country must run large deficits to supply enough currency to the world, which leads to inflation and erosion of the currency's value. The US faces this dilemma because it has to supply the dollar to the world, which leads to the devaluation of the currency.

How does the video describe the potential for a monetary reset?

-The video suggests that a monetary reset is becoming increasingly likely due to unsustainable levels of debt, geopolitical instability, and inflation. Historically, such resets have occurred every 50-100 years and can take the form of significant shifts in the global financial system, including major wars or pandemics.

Why does the video advocate for holding gold in investment portfolios?

-The video argues that gold is a stable store of value during times of financial instability. It is especially important to hold gold as a hedge against the potential collapse of fiat currencies and to preserve wealth through periods of monetary resets. The video highlights that institutions like JP Morgan and Goldman Sachs are now recommending putting 20% of investments into gold.

What might the future look like for the US dollar, and how could this affect investments in gold?

-The future of the US dollar is uncertain, with the possibility of a collapse in its value due to high inflation, rising debt, and global shifts away from the dollar. If the dollar weakens, gold and other real assets could increase in value. The video suggests that gold may be repriced to higher levels, further solidifying its role as a safe haven for investors.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Willy Woo - They're Selling! Proof Something Huge Is About To Hit Bitcoin In The Next Few Weeks.

"ราคาทองวันนี้" 18 เม.ย. 2025 :"ดอลลาร์" เสื่อมค่า "จีน" สะสมทอง หนุนราคาพุ่งต่อ | TNNชั่วโมงทำเงิน

Gold Can Add Value To A Stock/Bond Portfolio

A VERDADE SOBRE O CICLO DE PREÇO DO BITCOIN HOJE - ANÁLISE ON-CHAIN

Gold और Silver में Invest करें या नहीं?

[FULL] Dialog - Harga Emas Naik Terus, Saatnya Jual atau Beli?

5.0 / 5 (0 votes)