The Gold Revaluation Theory That Could Change Bitcoin Forever!

Summary

TLDRThe video delves into a theory suggesting that the U.S. may be orchestrating a controlled shift in global finance, starting with a revaluation of gold before transitioning to Bitcoin. With the dollar’s dominance under threat, gold’s price is surging while Bitcoin’s price remains suppressed. Analysts like Luke Roman and Josh Mandel propose that Washington could re-anchor the dollar using gold and then pivot to a Bitcoin-backed system. As global trust in the dollar weakens, Bitcoin’s role as a neutral, uncontrollable asset becomes crucial in this evolving monetary realignment.

Takeaways

- 😀 Gold is experiencing a strong bull market in 2025, while Bitcoin is underperforming, sparking speculation about a potential shift in global monetary systems.

- 😀 There is a theory that the US is revaluing gold to absorb inflation and restore confidence in the financial system, keeping Bitcoin suppressed until the timing is right.

- 😀 The US is facing a fiscal crisis with record peace-time deficits, high inflation, and decreasing foreign demand for treasuries, complicating monetary policy decisions.

- 😀 A potential solution being speculated is using gold as a collateral to stabilize the system while Bitcoin is kept on the sidelines temporarily.

- 😀 The petrodollar system, which has historically anchored the US dollar, is gradually eroding as countries like China and India are increasingly purchasing oil in other currencies, such as the yuan.

- 😀 If the petrodollar system unravels, gold is seen as the only credible asset to replace the dollar as the global settlement asset, according to macro analyst Luke Roman.

- 😀 Josh Mandel, a former Wall Street trader, argues that the US could re-anchor the dollar by revaluing its gold reserves from $42/ounce to potentially $16,000/ounce to restore confidence in its debt.

- 😀 Stablecoins, backed by the US dollar, are being seen as a bridge to keep global capital invested in dollar instruments while the transition to a new monetary system takes place.

- 😀 Bitcoin is viewed as the ultimate neutral asset that could replace the US dollar system, but it needs time and careful management to avoid premature disruption of the current system.

- 😀 The US is positioning itself to benefit from a future Bitcoin rally through large-scale Bitcoin mining operations and the acquisition of seized Bitcoin, indicating government alignment with the digital asset's future potential.

- 😀 Gold is likely performing as the ‘safe’ asset now, while Bitcoin’s price action may be artificially suppressed, preparing for a broader shift in the global financial system.

Q & A

What is the 'gold-first theory' mentioned in the script?

-The 'gold-first theory' suggests that the U.S. could use a revaluation of its official gold reserves to restore confidence in its financial system before transitioning to Bitcoin as the ultimate global asset. This involves quietly revaluing gold to absorb inflation and stabilize the system, while Bitcoin remains suppressed temporarily.

Why is Bitcoin's price action being compared to gold's surge in 2025?

-Bitcoin’s price action is being compared to gold’s surge because, while gold has been increasing in value, Bitcoin has been falling. This divergence is interpreted as a potential sign that Bitcoin’s price is being suppressed to allow gold to perform as a stabilizing asset for the U.S. financial system.

What role does the petrodollar system play in the script’s analysis?

-The petrodollar system, which has traditionally anchored the dollar’s global dominance by pricing oil in dollars, is breaking down. Nations are starting to settle oil trades outside the dollar, and the script suggests that gold could replace the petrodollar system as the new settlement asset for global trade, especially oil.

How does Luke Roman view the potential shift away from the dollar?

-Luke Roman believes that if the petrodollar system breaks down and trust in the U.S. dollar fades, gold is the only asset capable of credibly taking its place as the global settlement asset. He argues that the U.S. will either have to devalue its debt or inflate it away, with gold playing a key role in this transition.

What is Josh Mandel’s role in this theory, and what is his Bitcoin price prediction?

-Josh Mandel, a former bond analyst and Wall Street trader, has gained attention for his Bitcoin price predictions. He predicted Bitcoin would reach $84,000 by March 14, 2025, and $444,000 as a peak during the current cycle. His theory suggests a gold revaluation by the U.S. to stabilize the system before pivoting to Bitcoin as a future monetary system.

How does the U.S. government’s gold reserves factor into the theory?

-The U.S. holds around 8,100 tons of gold, officially valued at just $42 per ounce. The theory proposes that the U.S. could revalue this gold to current market prices or higher, possibly around $16,000 per ounce, to restore confidence and stabilize the U.S. monetary system before pivoting to Bitcoin.

What is the significance of stablecoins in this theory?

-Stablecoins are seen as a tool for the U.S. to finance its deficits without issuing long-term debt. By issuing short-term treasuries in the form of stablecoins, the U.S. could maintain demand for dollar instruments globally while buying time to transition to a new financial system, potentially based on Bitcoin.

What does the theory say about Bitcoin's role in the future?

-Bitcoin is viewed as the ultimate neutral asset for global trade, beyond the control of any single nation. While gold may act as a bridge in the transition, Bitcoin is seen as the end-state solution that can provide a decentralized and secure global monetary system, immune to manipulation by governments or central banks.

Why is there speculation that Bitcoin is being suppressed?

-The theory suggests that Bitcoin is being suppressed to prevent it from front-running the shift toward gold revaluation. If Bitcoin were to rise too quickly, it could undermine the controlled narrative of restoring confidence through gold. By keeping Bitcoin steady, the U.S. can manage the transition more smoothly.

How does the Bitcoin market react to these theories, and what does this mean for the future of Bitcoin?

-The Bitcoin market’s reactions, such as the largest crypto liquidation in history and the suppression of Bitcoin’s price, suggest that large players might be managing the market to avoid disrupting the gold-focused transition. The theory posits that once the system is reset, Bitcoin’s true potential will be unleashed as a global asset.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Is Time Real? - Philosophy Tube

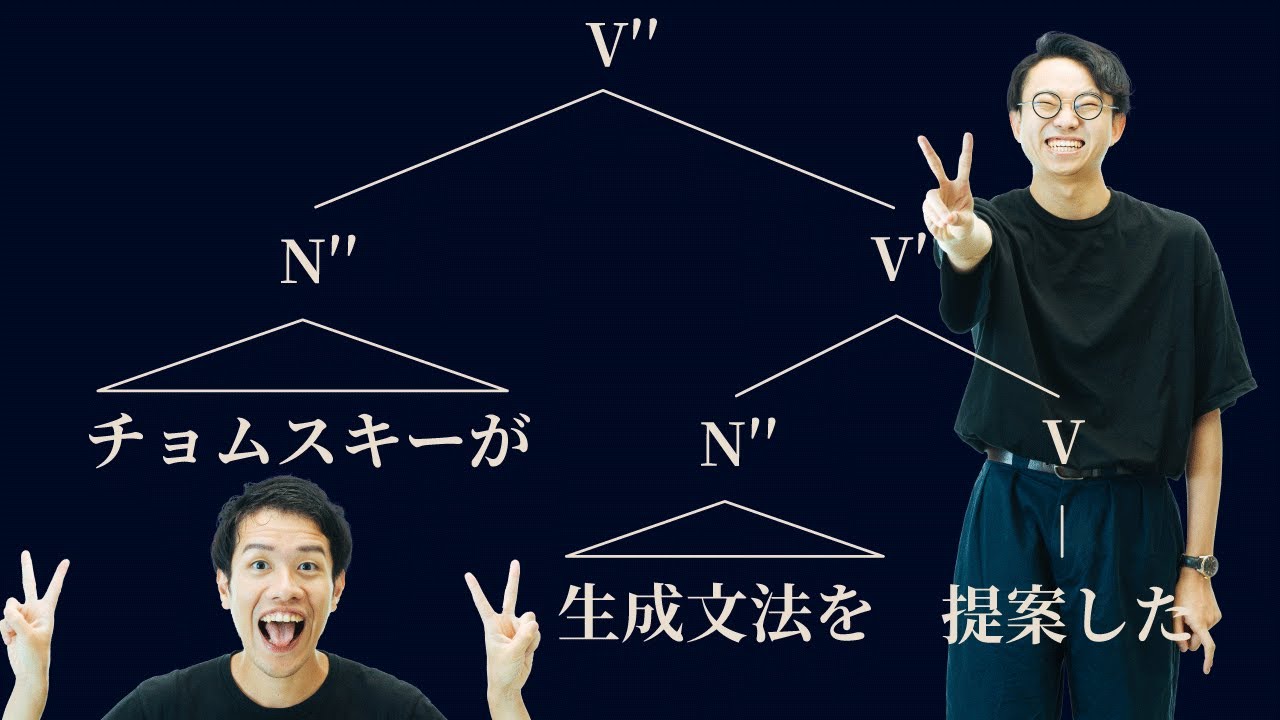

チョムスキーが提唱した「ふたまたニョキニョキ理論」【生成文法3】#169

𝗠𝗘𝗚𝗔 Theory: Joy Boy's 1,000 Year Plan! (Roger, Shanks, Luffy...)

Expanding Earth and Pangaea Theory

Unit 2 - Broadbent's Filter Theory

Roger Penrose: "Time Has No Beginning And Big Bang Wrong"

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

5.0 / 5 (0 votes)