2022 ICT Mentorship Episode 17

Summary

TLDRThis lesson delves into applying a specific trading model to the Forex market, focusing on the Euro-Dollar pair. The instructor explains key concepts like relative highs and lows, buy and sell-side liquidity, fair value gaps, and order blocks, illustrating how these influence market moves. The video emphasizes using daily, hourly, and minute-level charts to anticipate price behavior, highlighting critical time frames like the New York open for optimal trading setups. Practical guidance is offered on entries, stops, and exits, incorporating realistic spreads and risk management. The content bridges theory with actionable Forex strategies, making complex market mechanics accessible for traders.

Takeaways

- 😀 Use daily charts to identify market bias by spotting relative equal highs and lows and understanding where buy/sell stops may rest.

- 😀 Highlight key levels such as big figure numbers, Fibonacci extensions, and previous swing highs/lows to anticipate price targets.

- 😀 Annotate charts while learning to recognize liquidity pools, fair value gaps, and order blocks; gradually reduce annotations as skill improves.

- 😀 Apply the smart money concept: accumulation, manipulation (Judas swings), and distribution to understand market moves.

- 😀 Focus on session-specific 'kill zones' for timing trades: FX (7:00–10:00 AM NY) and Index (8:30–11:00 AM), with extensions for high-impact news.

- 😀 Look for protractions and imbalances to identify intermediate swing highs/lows and potential reversal points.

- 😀 Enter trades near liquidity or imbalance zones, using fair value gaps and opening price thresholds as guides.

- 😀 Place stops above recent swing highs/lows and use a pip buffer (3–10 pips) to account for spread and broker variability.

- 😀 Set targets based on converging levels (big figures, Fibonacci, relative lows) and apply slight buffers for safer exits.

- 😀 Recognize that high-impact news events can extend volatility and influence session behavior; adapt stops and expectations accordingly.

- 😀 Calculate risk/reward ratios for every trade to ensure trades have favorable potential outcomes (example given: >8:1).

- 😀 FX and index strategies share similar principles but require adjustments for market-specific session times and behavior.

Q & A

What is the 'kill zone' in trading and how is it defined?

-The 'kill zone' refers to a specific time window in the market when price movement is expected to be most active and predictable. For Forex, this is between 7:00 AM and 10:00 AM (New York Time), and for index futures, it is between 8:30 AM and 11:00 AM (New York Time). Trading during this time is believed to offer the best opportunities for entering high-probability trades.

Why is it not advisable to take new trades after 10:00 AM in Forex trading?

-After 10:00 AM, market conditions typically become less volatile, and price movements tend to slow down. This makes it more difficult to predict short-term trends. Therefore, it's generally safer to avoid opening new positions unless there is a significant news driver.

What role do liquidity pools play in the context of price manipulation?

-Liquidity pools are areas where large volumes of stop-loss orders (buy stops or sell stops) are clustered, typically just above or below significant price levels. Institutions or market makers can target these pools to trigger a cascade of stop-loss orders, causing a sharp price move. Understanding where liquidity is located can help traders anticipate potential price manipulation.

What is the significance of a 'fair value gap' in trading?

-A fair value gap is a price imbalance that occurs when price moves too quickly from one level to another without enough time to properly fill the gap. These gaps are often considered high-probability areas where price may retrace or consolidate before continuing its trend. Identifying these gaps can help traders predict potential entry or exit points.

What is an order block and how does it help in making trading decisions?

-An order block is a price area where institutional traders have placed significant buy or sell orders, often resulting in a strong market reaction when price reaches that level. Order blocks are used by traders to identify key support or resistance zones, as price is likely to react when it revisits these levels.

How does the timing of news releases, such as the PMI or ISM numbers, affect trading?

-High-impact news releases, like the PMI or ISM data, can trigger significant volatility in the market. These events often result in rapid price movements as traders adjust their positions based on new information. Traders need to be aware of when these news releases occur, as they can provide opportunities for trading or present risks due to increased market uncertainty.

Why might some traders avoid trading around high-impact news releases?

-Some traders avoid high-impact news releases because they can create unpredictable price movements and increased volatility. Without understanding how the market will react to the news, it can be risky to take trades in such conditions. However, experienced traders may use this volatility to their advantage by anticipating the direction the market might move after the news release.

How can the concept of price protraction be used in trading?

-Price protraction refers to the extended movement or manipulation of price beyond typical support or resistance levels. Institutions may deliberately push the price past certain levels to trigger stop-loss orders, only to reverse the move later. Traders who recognize price protraction can use it to identify entry points for counter-trend trades once the manipulation has completed.

What is the role of the 1.09 big figure in Euro Dollar (EUR/USD) trades?

-The 1.09 big figure is considered a significant price level for EUR/USD traders, as it represents a key psychological level where large volumes of liquidity can exist. If price approaches this level, it may act as a support or resistance point, and traders may anticipate price reactions based on historical behavior at this level.

What risk management strategies should traders use when trading Forex and index futures?

-Traders should focus on identifying high-probability setups and avoid entering trades outside of the 'kill zone' times, as price action may be less predictable afterward. Risk management strategies include using appropriate stop-loss levels, sizing positions based on risk tolerance, and only trading when there is enough market movement to justify an entry.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

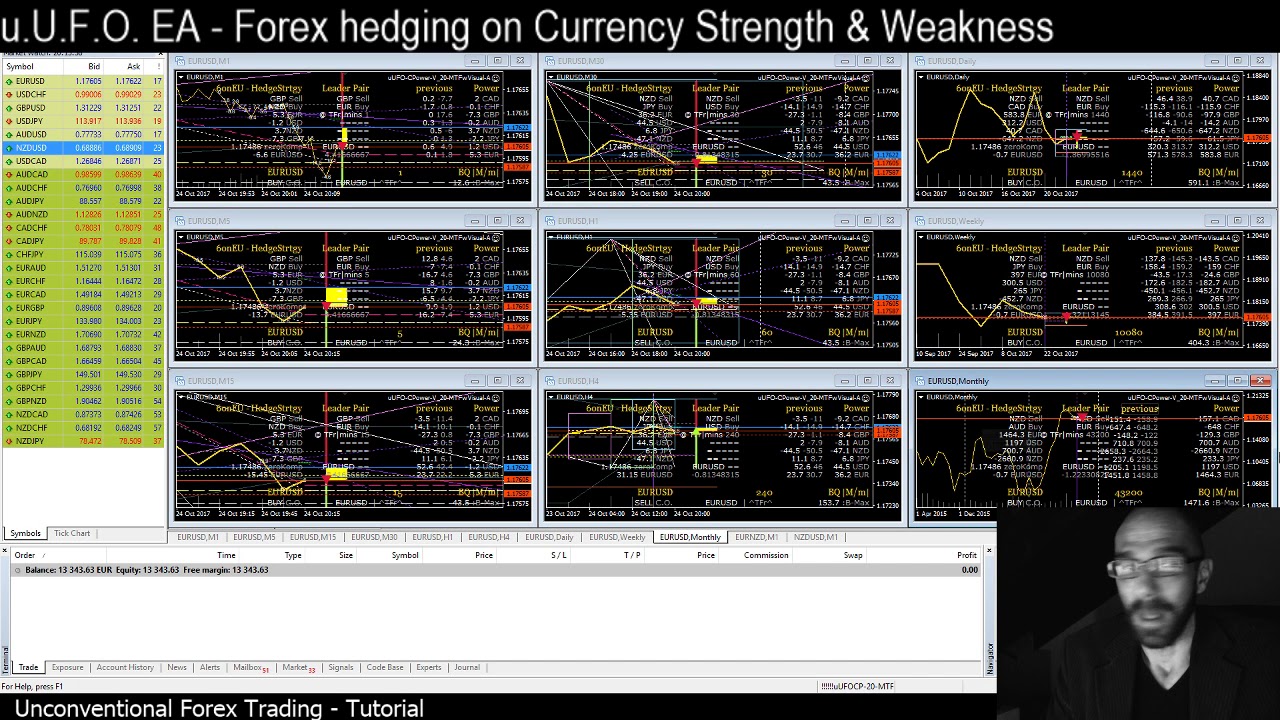

Forex math based formula application - MT4 - uUFO-EA: foreign currency hedging strategy explained.

What Moves Forex Prices?

ICT Forex & Futures Market Review October 4, 2025

Revealing My Favorite ICT Strategy With Checklist (Asian Liquidity Sweep)

My Incredibly Easy 20 Pips a Day Trading Strategy

💰Make Money with Forex WITHOUT TRADING? ($300 TODAY with this EASY Strategy)

5.0 / 5 (0 votes)