Is a bubble forming as AI investments drive economic growth?

Summary

TLDRTech companies are investing hundreds of billions into AI, fueling rapid innovation and potentially contributing significantly to GDP growth. AI is being hailed as a transformative force, likened to an electricity-like revolution, enhancing data analysis, business processes, and creativity. However, experts warn of a potential AI bubble, overinvestment, and market volatility, reminiscent of early auto and internet booms. While AI promises immense benefits, including breakthroughs in medical diagnostics, it also poses risks of widespread job displacement, particularly for white-collar workers, and unforeseen societal challenges. The future remains uncertain, balancing utopian possibilities with disruptive consequences.

Takeaways

- 💻 Tech companies are investing hundreds of billions of dollars into AI infrastructure, driving rapid technological expansion.

- 📈 AI spending may be contributing to nearly half of this year's projected GDP growth, highlighting its economic impact.

- ⚡ AI is being compared to the electricity revolution, as it accelerates innovation and improves business processes.

- 🤖 Companies are adding intelligence to data and operations, making analytics and workflows smarter across industries.

- 💡 AI is expected to automate routine tasks while enhancing human creativity and innovation.

- 💰 Big tech has massively increased spending on AI architecture and foundational models since the release of ChatGPT in 2022.

- 🫧 Some experts warn of an AI bubble, comparing it to historical overinvestments in cars, PCs, and social media.

- 🏭 There is a possibility of market consolidation, with only a few foundational AI models and companies surviving long-term.

- 📉 AI-driven market growth poses risks; a downturn could affect stock markets and investors' portfolios despite a modest effect on the real economy.

- 👔 AI is expected to displace a significant portion of white-collar jobs, though new opportunities may also emerge.

- 🩺 AI has transformative potential in fields like medical diagnostics, potentially reducing costs and improving healthcare outcomes.

- ⚠️ Despite its benefits, AI introduces risks such as job losses, security challenges, deepfakes, and unpredictable societal impacts.

Q & A

How much are tech companies investing in AI infrastructure according to the transcript?

-Tech companies are investing hundreds of billions of dollars into AI infrastructure, including data centers and computational resources.

What comparison is made between AI and past technological revolutions?

-AI is compared to the electricity revolution, with claims that it could make processes faster and smarter, similar to how electricity enabled modern appliances and productivity.

Why do some experts warn about an AI bubble?

-Experts warn that the rapid investment in multiple foundation AI models may be excessive, similar to past over-investments during the internet and PC booms, and that consolidation will likely leave only a few dominant players.

What is a foundation model in the context of AI?

-A foundation model is a large AI system trained on vast amounts of data that can be adapted for various applications, and many companies are investing tens of billions of dollars in developing them.

How is AI affecting the stock market?

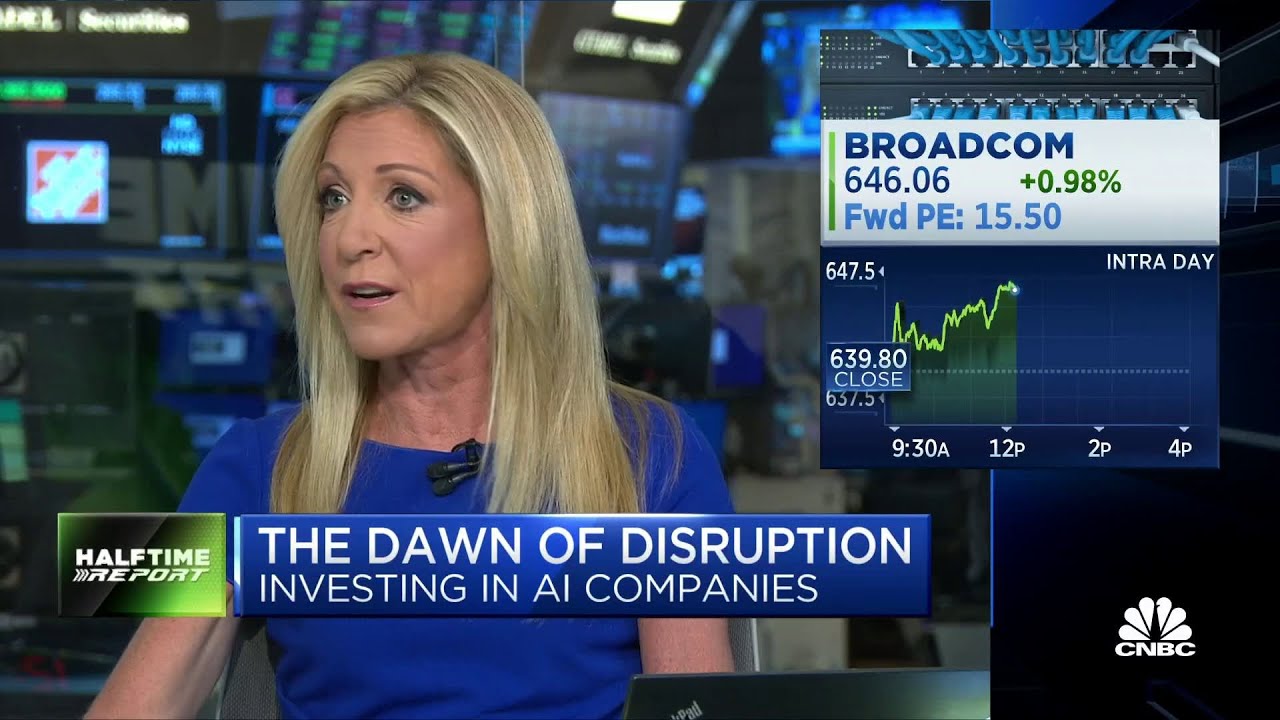

-AI has driven the stock market, particularly tech stocks, with the S&P 500 up 10% this year largely due to AI-related investments. However, declines in AI-driven stocks could have significant ripple effects.

What are the potential impacts of AI on employment?

-AI could replace a large portion of white-collar jobs, displacing workers even in profitable companies, while also creating new opportunities in fields like medical diagnostics and automation.

What industries are highlighted as being transformed by AI?

-Industries highlighted include technology, finance, and healthcare, with AI enabling smarter business processes, automation, and potential revolution in medical diagnostics.

What does the transcript suggest about the long-term survivability of AI companies?

-The transcript suggests that many AI startups may not survive, and the market is likely to consolidate to a few dominant companies that control the primary foundation models.

What dual nature of AI is discussed in the transcript?

-AI is portrayed as having a dual nature: it can drive progress, efficiency, and innovation (utopian outcomes) but also displace jobs, create economic risks, and pose security challenges (dystopian outcomes).

How do tech leaders justify the massive spending on AI?

-Tech leaders argue that AI is transformative, akin to electricity or the internet, and that investing in AI infrastructure now will enable smarter systems, creativity, and long-term economic growth.

What are some of the risks if the AI bubble bursts?

-If the AI bubble bursts, it could cause a market downturn, loss of stock market value, and economic pain for investors, though the real economy would be less affected due to its larger scale.

How does the transcript describe AI’s impact on education and graduates?

-Graduates, including those with advanced computer science degrees, are facing difficulties finding jobs due to AI-driven automation and changes in hiring practices, even at profitable companies.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

A.I. arms race heats up: Tech giants compete for leadership

인력? 응, 이제 버려…판교가 무너진다(이수호 기자)

Cathie Wood on How AI Can Double GDP, Bull Case for Bitcoin $1M, Elon’s Trillion-Dollar Pay Package

New quantum computers - Potential and pitfalls | DW Documentary

Elon Musk sues ChatGPT-maker OpenAI | BBC News

AI Hype Vs Reality: Why 95% Companies Are Losing Money (MIT Report)

5.0 / 5 (0 votes)