5-Minute Stock Analysis for Beginners | How to Analyze Any Stock

Summary

TLDRThis video provides a concise, step-by-step guide to analyzing stocks quickly and effectively, focusing on both individual company performance and overall portfolio management. Using Tesla and its competitors as examples, it demonstrates how to evaluate sales growth, operating margins, and valuation ratios to identify strong investments. The video also explains the importance of diversification across sectors and asset classes to manage risk and enhance returns. Whether you’re picking individual stocks or reviewing your entire portfolio, the strategies presented enable investors to make informed decisions in as little as five minutes, balancing growth potential with safety and long-term performance.

Takeaways

- 📈 Momentum investing alone is no longer sufficient; investors need to analyze individual stocks based on fundamentals.

- 🏢 Bottom-up investing focuses on understanding individual companies and picking the best in an industry, unlike top-down investing which starts with macro trends.

- 💡 Key metrics for stock analysis are valuation (is the stock fairly priced?) and competition (is it the best company in its sector?).

- 🚗 When comparing stocks, select competitors of similar market cap and in the same industry for meaningful insights.

- 📊 Sales growth indicates revenue expansion and potential competitive advantage, while operating margin shows efficiency in converting sales into profits.

- 🔍 Quick ways to find metrics include Yahoo Finance or brokerage platforms, but checking financial statements gives a more accurate view.

- 💵 Valuation metrics like the price-to-sales ratio help determine if a stock is overpriced or undervalued relative to peers.

- ⚖️ Strong growth and profitability must be weighed against higher valuations and potential risks when deciding on an investment.

- 🧩 Portfolio analysis is critical: even the best stocks can hurt returns if portfolio concentration is too high in one asset or sector.

- 🌐 Diversification across asset classes and sectors reduces risk; aim for exposure to at least 4–5 sectors and multiple asset types.

- 🛠️ Tools like SectorSpider.com and Yahoo Finance help track sector exposure and maintain balanced portfolio allocation.

- 📌 Regularly reviewing sales growth, operating margin, valuation, and sector distribution allows investors to make informed, low-risk decisions.

Q & A

What is the main difference between momentum investing and the stock analysis approach discussed in the video?

-Momentum investing relies on buying trending stocks, hoping their prices continue to rise, whereas the stock analysis approach in the video focuses on evaluating a company's fundamentals, such as sales growth, operating margin, and valuation, to make informed investment decisions.

What are the two main approaches to investing mentioned in the video?

-The two approaches are top-down investing, which starts with big trends and sectors before selecting stocks, and bottom-up investing, which starts with individual companies and analyzes their fundamentals and competitive positioning.

How does the video suggest finding competitors for a stock like Tesla?

-The video suggests looking at the company's sector and industry in platforms like Yahoo Finance, then selecting competitors with similar market capitalization for a fair comparison. For Tesla, competitors include Toyota, Ford, GM, and Nio.

Why is sales growth an important metric for stock analysis?

-Sales growth indicates how quickly a company is expanding its revenue, which can lead to faster profit growth and higher stock prices. It also highlights a company's competitive advantage within its industry.

What is operating margin, and why is it significant?

-Operating margin is calculated by dividing operating income by revenue. It shows how efficiently a company converts sales into profits and provides insight into management's effectiveness in controlling expenses.

How can an investor quickly calculate the price-to-sales ratio?

-The price-to-sales ratio can be calculated by dividing the company's market capitalization by its total revenue. Many investing platforms, like Yahoo Finance, also provide this ratio directly for convenience.

What does a high price-to-sales ratio indicate, and how should it be interpreted?

-A high price-to-sales ratio indicates that investors are paying more per dollar of revenue, reflecting higher expectations for growth or profitability. Investors should weigh it against sales growth and operating margin to determine if the stock is fairly valued.

Why is portfolio diversification important according to the video?

-Diversification reduces risk by spreading investments across multiple asset classes and sectors. It helps protect against losses in any single stock or sector, ensuring more stable overall returns.

What two key questions should investors ask when analyzing their portfolio?

-Investors should ask: 1) How much of the portfolio is allocated to each asset class (stocks, bonds, real estate, crypto, commodities), and 2) How much is invested in each sector of the economy to ensure proper diversification.

How can tools like SectorSpider help with portfolio analysis?

-SectorSpider provides a visual overview of sector allocation and performance, helping investors understand which sectors their stocks belong to, how diversified their portfolio is, and which sectors may need rebalancing.

What is the practical time frame for performing the stock analysis process described in the video?

-The stock analysis process described can be completed in approximately five minutes, using a few key metrics like sales growth, operating margin, and valuation.

What is the advantage of combining both stock picking and portfolio analysis?

-Combining stock picking and portfolio analysis ensures that you select high-quality stocks while also managing overall risk. This approach helps maximize returns and maintain a balanced, diversified portfolio that can withstand market fluctuations.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How To Find Profitable Stocks To Trade - My Secrets REVEALED

How to Cover JEE Backlogs Fast: Step-by-Step Guide for JEE Aspirants | Diksha Ma'am

How I’d Build a Long Term Stock Portfolio From Scratch in 2026

How to Buy Stocks for Beginners - Step by Step Process

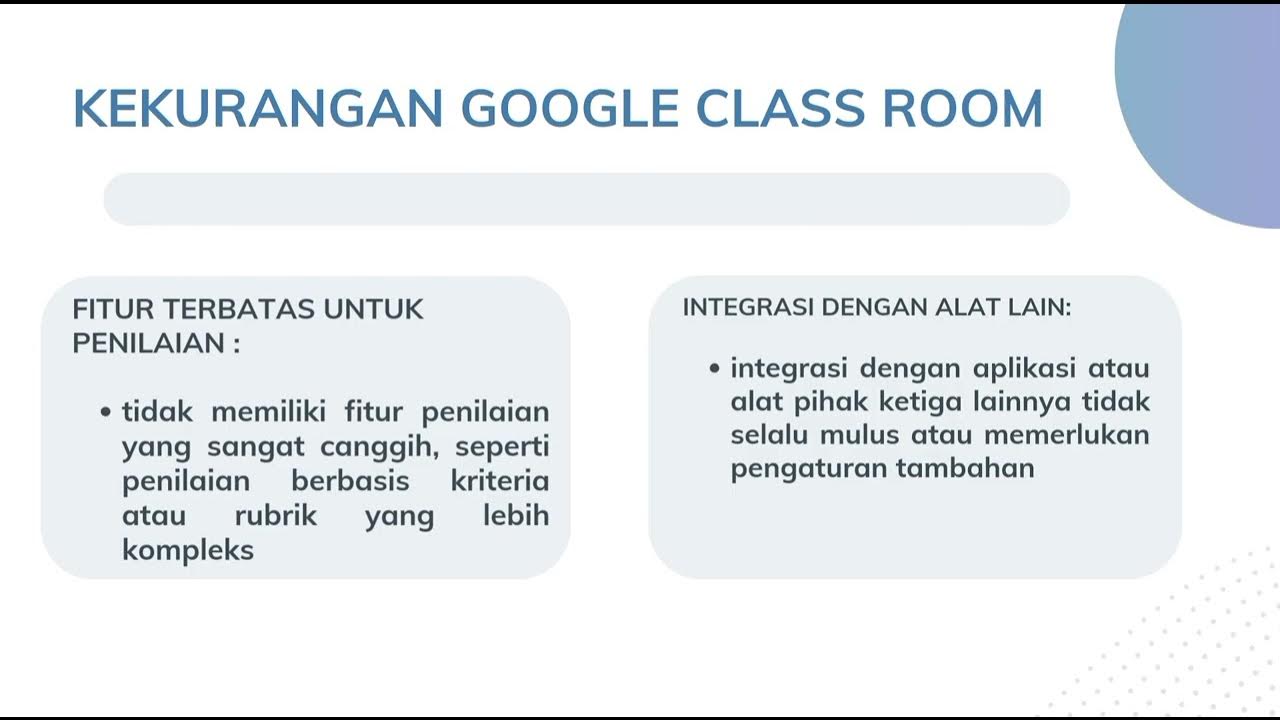

PPKn_Kelompok 3_Google Classroom Sebagai Media Pembelajaran Jarak Jauh

How I Pick Stocks: Investing for Beginners (Financial Advisor Explains)

5.0 / 5 (0 votes)