Fundamentals - Partnership | Capital account | Current Account | Part 5 | CBSE | ISC | State boards

Summary

TLDRThe video script is an educational tutorial focused on the concept of 'Capital Account' in the context of business accounting. It explains the importance of understanding capital accounts, especially for students of class 11th and 12th, and clarifies the basics of capital, liabilities, expenses, assets, and revenue. The instructor uses the analogy of a firm and its partners to illustrate how capital accounts work, including the calculation of profits and the handling of drawings. The script emphasizes the fluctuating nature of capital due to various business transactions and the need to differentiate between capital and profit for clear business analysis.

Takeaways

- 😀 The video is a tutorial focused on the concept of 'Capital Account' in the context of accounting and business.

- 📚 It emphasizes the importance of understanding the basics of Capital Account for students, especially for those in the 11th grade who are preparing for their P&L (Profit and Loss) approval.

- 🤔 The speaker clarifies that a strong grasp of the concept is necessary for students to excel in their 12th grade, where the basics become more complex.

- 🏦 The script explains that a 'Capital Account' is essential for partners in a firm, as it represents their investment and is directly linked to their profits and losses.

- 💡 The concept of 'Drawings' is introduced as an irregular activity where partners withdraw money from the business, separate from the regular profit distribution.

- 🔄 The distinction between 'Capital' and 'Drawings' is highlighted, with 'Capital' being the initial investment and 'Drawings' being the money taken out by the partners.

- 📈 The video discusses how to calculate the opening balance of a Capital Account, which is always on the credit side if it's an increase.

- 📉 It also covers the closing balance of the Capital Account and how it can differ from the opening balance due to fluctuations in the business.

- 📋 The process of creating a Capital Account involves recording various items such as interest on capital, salary, bonus, commission, and profit application.

- 👉 The video instructs viewers to review all the lectures of the week to reinforce their understanding of concepts like 'Capital Account', 'Drawings', and 'Interest on Drawings'.

- 📝 As homework, the speaker assigns a task for the viewers to revise all the lectures and concepts covered during the week to ensure a thorough understanding.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is the concept of 'Capital Account' in the context of accounting and finance, particularly focusing on the basics that are important for students of class 11th and 12th.

Why is it important to understand the Capital Account concept?

-Understanding the Capital Account concept is important because it helps in calculating profits and managing financial transactions effectively. It is a crucial part of accounting, especially for those studying commerce.

What are the components of accounts according to the script?

-The components of accounts, as mentioned in the script, are Capital, Liability, Expense, Asset, and Revenue. These components are essential for understanding the nature of financial transactions.

What is the difference between 'Capital' and 'Drawings' as per the script?

-According to the script, 'Capital' refers to the initial investment made by the partners in the business, while 'Drawings' refer to the money taken out of the business by the partners, which is usually out of profits.

What is the impact of capital withdrawals on the overall capital?

-Capital withdrawals, also known as drawings, reduce the overall capital in the business as they are deducted from the total capital amount.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

[FABM2] Lesson 037 - Statement of Changes in Equity

Basic Accounting | Accounting Cycle Step 8. Closing Entries are Journalized and Posted (Part 1)

PT Bank Larasati - Soal UKK Layanan Perbankan Paket 1 - Membuat Data Awal Perusahaan S/d Daftar Akun

Gr 11 - Accounting - Partnerships - Activity 1

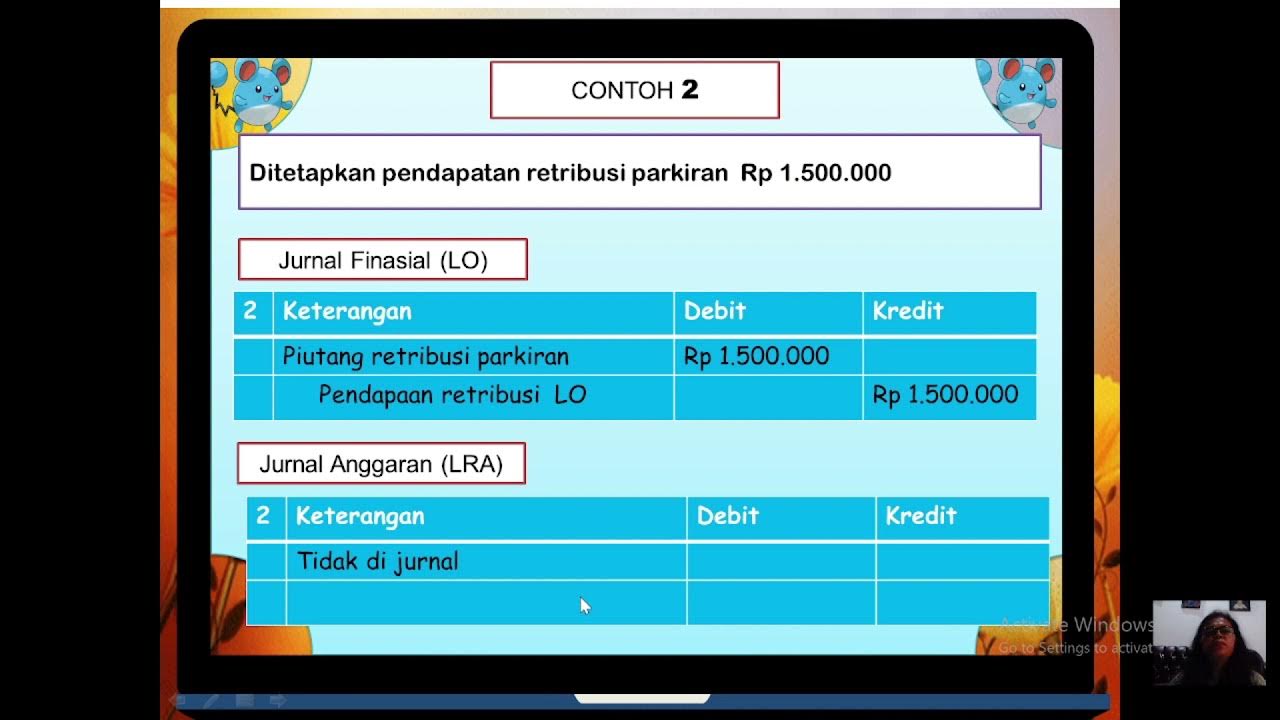

JURNAL SKPD AKUNTANSI PEMERINTAHAN

Financial Analysis in Arabic - 06 1080p

5.0 / 5 (0 votes)