ICT BEST SETUP... SIMPLE STUPID SETUP

Summary

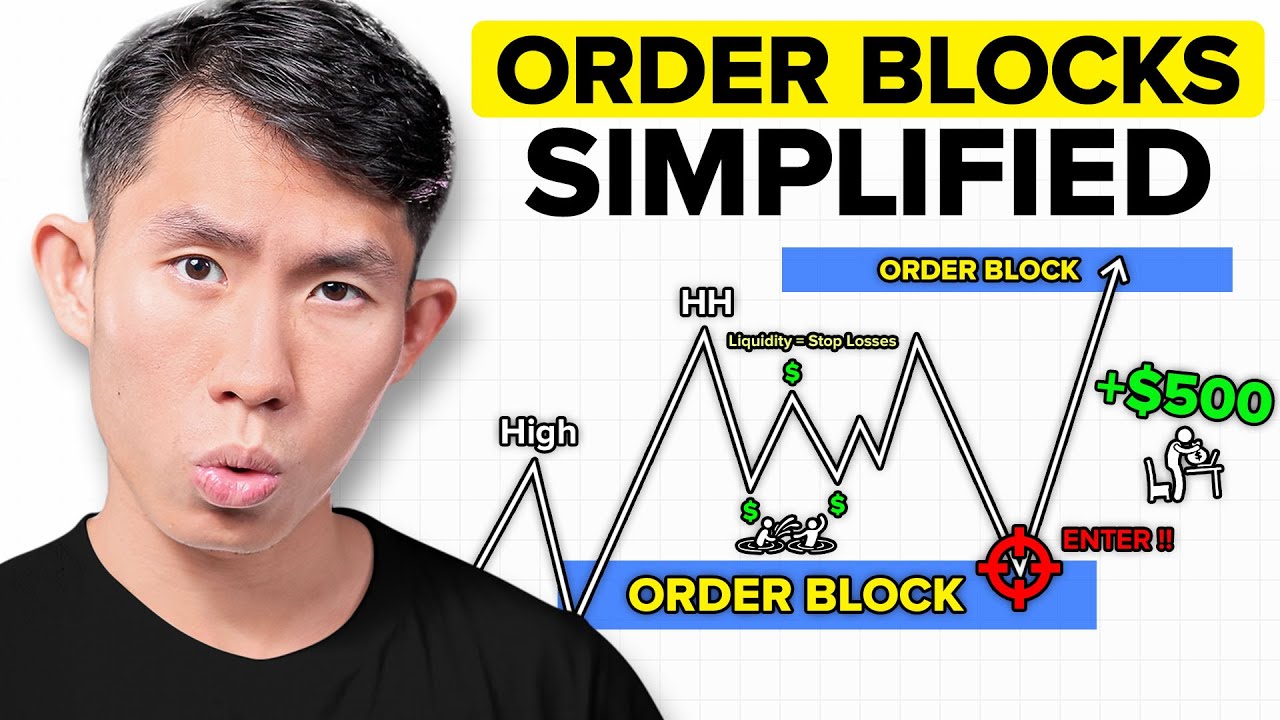

TLDRIn this video, the presenter discusses a recent US 100 trade and shares key insights into their trading strategy. They explain how they use market structure, confirmation from correlated pairs, and tools like Fibonacci and Fair Value Gaps to make informed decisions. The video emphasizes the importance of patience and waiting for confirmation before executing trades. Additionally, the presenter shares their experience with a funded account and highlights the importance of staying engaged in trading, even during vacations. They also plan to upload regular content, including live trades, to help viewers learn and improve their skills.

Takeaways

- 😀 The speaker is returning from a long break after a vacation and plans to upload content regularly, including a lecture series and live trading sessions.

- 😀 The US 100 chart is showing higher highs, with important levels at 23,500, 23,550, and 23,600. These levels are key to watch for potential reactions in the market.

- 😀 The Fibonacci tool can be used for setting targets based on the high time frame, alongside using price levels to predict market moves.

- 😀 The speaker uses a strategy with fair value gaps (FVG) and correlation pairs like US 500 to confirm price movement before entering trades.

- 😀 For a recent trade, the speaker executed a short position on US 100 after a price correction, using a correlation pair to confirm the market direction.

- 😀 The speaker emphasizes waiting for confirmation before entering any trade, such as a Juda swing, turtle soup, or fake move.

- 😀 In a high-impact news environment (e.g., job openings), the speaker exited the trade early to manage risk, showing the importance of adjusting strategy based on news.

- 😀 Gold is in a range, and the speaker is anticipating a breakout, planning to enter only with confirmation from a smaller time frame.

- 😀 The speaker advises traders to never quit trading entirely, even when on vacation, but to reduce trade size as needed and not abandon their strategy.

- 😀 Using correlation pairs (e.g., US 500 with US 100, silver with gold, EUR/USD with GBP/USD) helps confirm market behavior and improves trading accuracy.

Q & A

What is the main reason the presenter was unable to upload videos for a while?

-The presenter was on vacation, which did not allow for proper video recording setup.

What is the presenter’s trading plan for future video uploads?

-The presenter plans to upload videos daily from now on and will continue the lecture series posted last month.

What key levels did the presenter highlight on the US 100 chart?

-The presenter highlighted price levels of 23,500, 23,550, and 23,600 as crucial for identifying market reactions.

How did the presenter plan to trade based on the US 100 chart?

-The presenter expected the market to move down toward their fair value gap areas and considered buying from there, but the price went up first before reversing.

What confirmation method did the presenter use before entering a trade on US 100?

-The presenter used a correlation pair (US 500) to confirm the market’s movement, as US 500 was not moving above its previous high, suggesting a reversal.

What is the significance of waiting for confirmation before entering a trade?

-Waiting for confirmation ensures that the trade setup is more reliable, reducing the risk of entering a trade based on false signals.

How did the presenter manage risk in the trade they executed?

-The presenter used a tight stop-loss of 20 pips and aimed for a 1:3 risk-to-reward ratio, ensuring that the potential reward outweighed the risk.

What advice did the presenter give regarding trading consistency?

-The presenter emphasized not quitting trading completely, even when taking a break, suggesting traders should scale down their trades rather than stop altogether.

What was the presenter’s approach to trading gold?

-The presenter expected gold to break above a trendline and wanted to wait for confirmation on a smaller timeframe before making a trade. They also mentioned keeping a tight stop-loss.

What correlation pairs does the presenter recommend using for different assets?

-For US 100, the presenter recommends using US 500 as a correlation pair, for gold, they recommend silver, and for GBP/USD, they suggest using EUR/USD.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Keys To Weekly Bias | $NQ Trade Breakdown

Master Order Blocks to Trade like Banks (no bs guide)

I Simplified ICT's Turtle Soup Strategy

ETHEREUM ERREICHT $3500 PREISZIEL ! NIEMAND IST VORBEREITET AUF DIESEN BREAKOUT ! ETH Chartanalyse

Trading Strategy had 100% Win Rate in 2024 - What’s the Secret?

Trading Modal $10 Jadi $100 | Challenge PART 2 | Strategi Trading Modal Kecil Untuk Pemula

5.0 / 5 (0 votes)