JORNADA DE TRABALHO, SALÁRIO POR DIA, POR HORA E PROPORCIONAL | Conferência da Folha de Pagamento

Summary

TLDRIn this informative class, Vanessa Silva, a specialist in Human Resources and Labor Law, explains the importance of payroll verification and the calculations behind daily and hourly salaries. She discusses key concepts such as working hours, the legal framework, salary types, and proportional pay. Vanessa demonstrates how to use a spreadsheet to simplify and automate payroll checks, ensuring accuracy and efficiency in HR practices. This class is part of a series aiming to enhance HR professionals' skills, with practical tips and tools to help optimize payroll management and avoid common errors.

Takeaways

- 😀 The class focuses on understanding salary calculations, working hours, and the verification of payroll using spreadsheets.

- 😀 Verification of payroll is essential to ensure accuracy, identifying errors and confirming correct calculations.

- 😀 The legal basis for calculations in the HR department is crucial, with all payroll calculations supported by labor laws.

- 😀 Daily working hours are typically 8 hours, as set by article 58 of the CLT, with exceptions for specific roles like telemarketing operators.

- 😀 The federal constitution guarantees a 44-hour workweek, which is the standard for most employees in Brazil, with variations depending on the contract or collective agreements.

- 😀 Monthly working hours are calculated by multiplying the daily hours by the number of working days in a month, usually 220 hours per month for a full-time employee.

- 😀 Salary calculations can be influenced by collective agreements or state minimum wages that exceed the national minimum wage.

- 😀 Proportional salary calculations are necessary for employees who work part of the month due to late hires or early terminations.

- 😀 The spreadsheet shared in the video helps automate and simplify the payroll verification process, eliminating the need to memorize complex formulas.

- 😀 The spreadsheet can calculate various payroll aspects, including hourly wages, overtime, absences, commissions, and social security contributions like INSS and FGTS.

- 😀 It's crucial to always verify the payroll, even if it's system-generated, to ensure the accuracy of payments and deductions.

Q & A

What is the focus of today's class?

-Today's class focuses on understanding salary calculations, including proportional salary, monthly and weekly working hours, and how to verify these calculations effectively using a spreadsheet.

Why is verification important in the payroll process?

-Verification is crucial because it helps identify errors in payroll calculations, such as incorrect parameters, missed calculations, or discrepancies. It ensures the accuracy and legality of the payroll before processing payments.

What does Article 58 of the CLT tell us about daily working hours?

-Article 58 of the CLT states that the normal daily working hours for employees in any private activity should not exceed 8 hours, unless a specific regulation sets a shorter limit. For example, telemarketing operators have a 6-hour workday.

What is the significance of the Federal Constitution's Article 7 for weekly working hours?

-Article 7 of the Federal Constitution guarantees that the normal workweek should not exceed 44 hours, with 8 hours per day. It also allows for adjustments like hour compensation or workday reductions via agreements or collective bargaining.

How is the weekly work schedule of 44 hours calculated?

-The weekly work schedule of 44 hours is calculated by having 8 hours of work from Monday to Friday (40 hours) and 4 hours on Saturday, summing up to a total of 44 hours per week.

What role does the minimum wage play in salary calculations?

-The minimum wage sets the baseline salary for employees, ensuring that they receive at least the national minimum wage for a standard 44-hour workweek. However, more beneficial salary instruments, like collective agreements or state-specific minimum wages, can apply if they are higher.

What is a proportional salary, and when is it calculated?

-A proportional salary is calculated when an employee works for only a part of the month, such as when they are hired mid-month or leave the company before month-end. It is also calculated in cases of absences or contract terminations.

How is a daily salary used in payroll calculations?

-A daily salary is used for calculating absences or DSR (Rest Day) discounts. For example, if an employee has an unjustified absence, their daily salary is deducted based on the number of days absent.

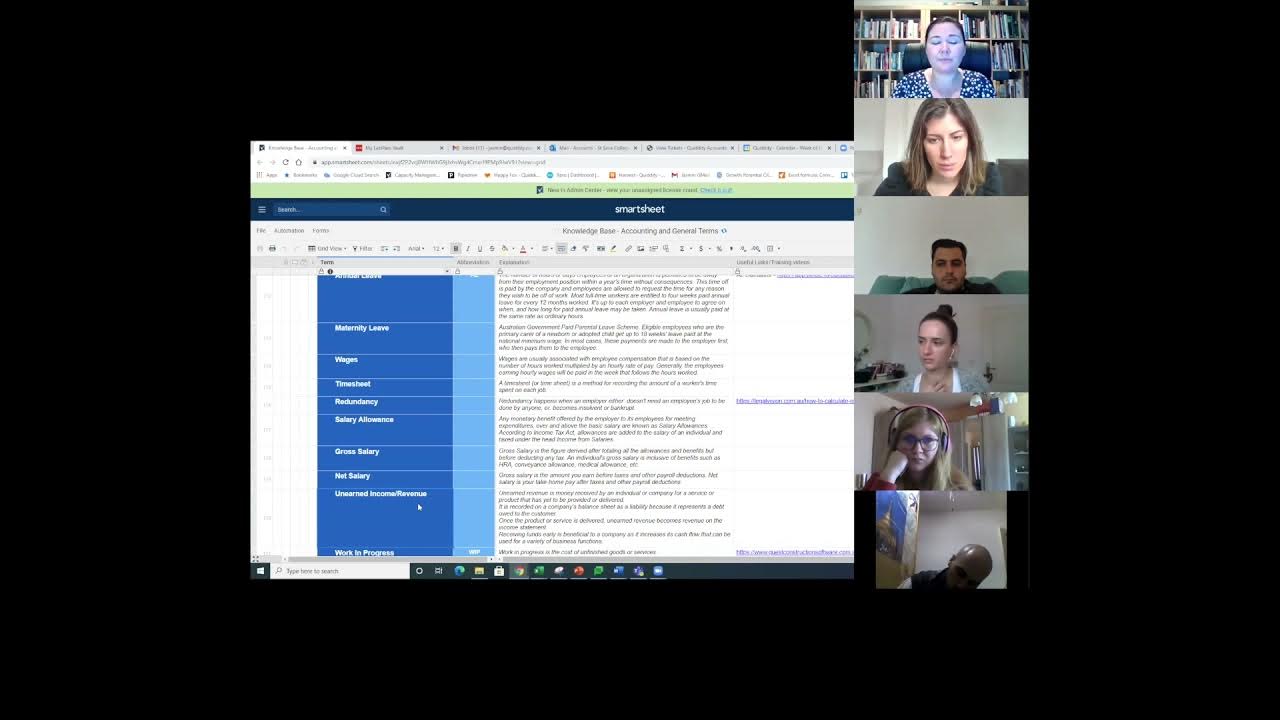

What is the importance of using a spreadsheet for payroll verification?

-A spreadsheet simplifies payroll verification by automating calculations like daily and hourly wages, overtime, absences, and proportional salaries. It helps HR professionals quickly and accurately verify payroll without needing to memorize complex formulas.

Can you explain how the spreadsheet helps with payroll calculations?

-The spreadsheet allows users to input data such as working hours, daily wage, and days worked to generate accurate payroll calculations. It includes various tabs for different calculations like overtime, daily wages, absences, and even INSS or income tax deductions, ensuring efficiency in payroll verification.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

EXECUÇÃO TRABALHISTA - INTRODUÇÃO

Konsep Penggajian dan Tunjangan Pegawai (Prosedur Penggajian Karyawan)

3. Leis Ponderais: Lei de Proust - Aula 3/5 [Química Geral]

Kirchhoff's Voltage Law (KVL) - How to Solve Complicated Circuits | Basic Circuits | Electronics

#3: CALCULANDO O SALDO DEVEDOR

Session 3 - 04 Taxes, Salaries, Wages and Leaves

5.0 / 5 (0 votes)