[Strategic Cost Management] General Subject Orientation

Summary

TLDRThis video introduces a course on Strategic Cost Management, emphasizing its importance in using accounting as a tool for decision-making. Lecturer Kevin Troyemcua outlines the course objectives, which include understanding strategic cost management, financial statement analysis, and applying various management accounting techniques like cost-volume-profit analysis and budgeting. The course aims to develop creative decision-making skills in students, helping them manage costs and operations efficiently. Key topics include cost behavior, pricing decisions, performance evaluation, and responsibility accounting. Students are encouraged to take a holistic approach to problem-solving and decision-making in management accounting.

Takeaways

- 😀 Strategic Cost Management focuses on using accounting as a tool for managerial decision-making in organizations.

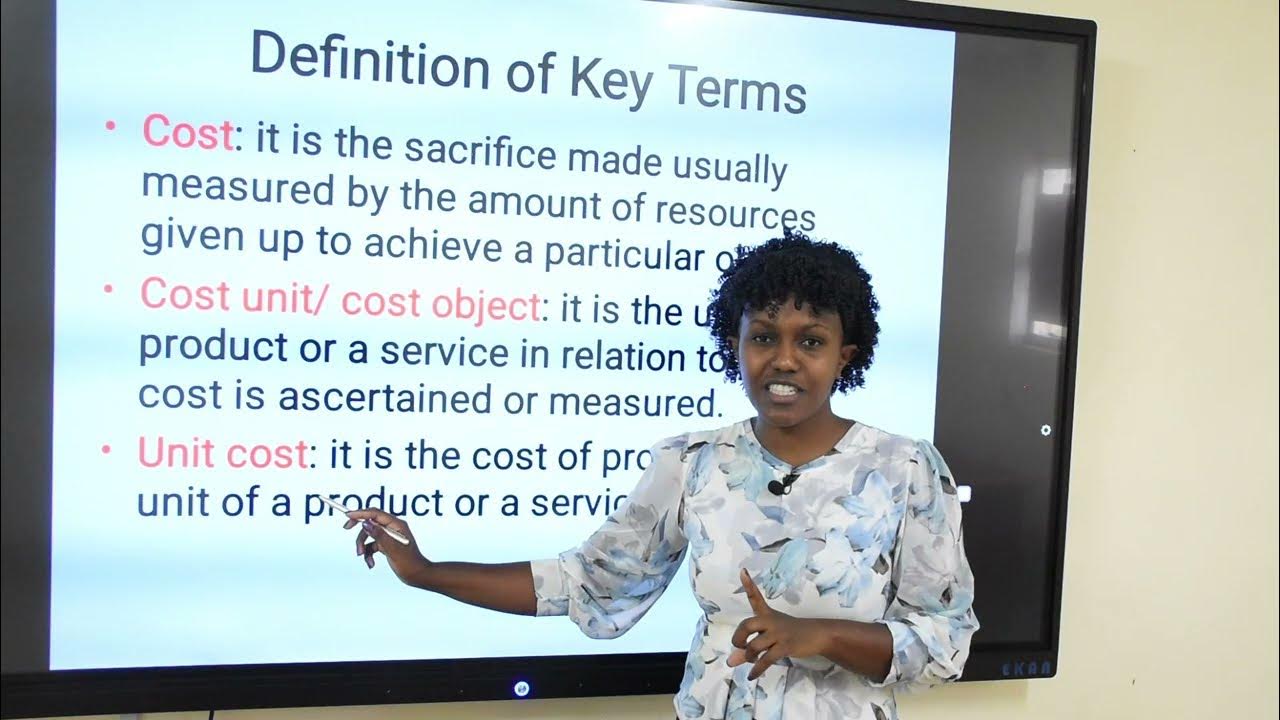

- 😀 The course covers topics such as cost concepts, classifications, cost behavior, and how to manage costs strategically.

- 😀 Key focus areas include the role of management accounting in decision-making, planning, and controlling costs in businesses.

- 😀 Students will learn to analyze and interpret financial statements to derive insights for future decision-making.

- 😀 The course emphasizes applying management accounting techniques to various scenarios, such as short-term and long-term decision-making.

- 😀 It includes lessons on Cost Volume Profit (CVP) analysis, segment reporting, profitability analysis, and pricing decisions.

- 😀 Students will explore non-financial indicators like productivity and employee performance as part of decision-making.

- 😀 The course aims to prepare students to become creative managers, capable of making holistic, flexible decisions.

- 😀 Topics like standard costing, variance analysis, budgeting, and differential cost analysis will be applied in managerial contexts.

- 😀 Strategic Cost Management is about managing costs in line with strategic objectives, balancing between operational effectiveness and profitability.

- 😀 Students will also learn how to evaluate performance using both financial and non-financial metrics, such as balance scorecards.

Q & A

What is the main objective of the Strategic Cost Management course?

-The main objective of the course is to teach students how to use accounting as a tool for decision-making, focusing on cost management and operational control within business organizations.

How is Strategic Cost Management different from financial accounting?

-Strategic Cost Management focuses on using accounting for decision-making and operational control, whereas financial accounting is more about preparing financial statements in line with standards. Management accounting, which is covered in this course, is more flexible and applied for internal business analysis.

What are the key expectations from students after completing this course?

-Students are expected to describe the importance of strategic cost management, understand financial statements and use them for decision-making, and develop a holistic approach to problem-solving in management accounting.

What is the role of management accounting in this course?

-Management accounting plays a key role in helping students analyze, interpret, and forecast business operations. It is used as a tool for strategic decision-making, with an emphasis on cost management and operational efficiency.

What are some of the key topics covered in Strategic Cost Management?

-Some key topics include cost concepts and classifications, product costing (e.g., absorption and variable costing), cost-volume-profit (CVP) analysis, activity-based costing (ABC), standard costing, budgeting, differential cost analysis, responsibility accounting, transfer pricing, and performance measures.

How does CVP (Cost-Volume-Profit) analysis help in decision-making?

-CVP analysis helps determine the break-even point, target net income, and how changes in cost and volume affect a company's profits. It is a vital tool for managers in making decisions about pricing, product lines, and cost control.

What is the difference between absorption costing and variable costing?

-Absorption costing allocates both fixed and variable manufacturing costs to products, while variable costing only assigns variable manufacturing costs to products. The key difference lies in how fixed costs are treated: absorbed into product costs in absorption costing, but treated as period costs in variable costing.

What is the significance of standard costing in cost control?

-Standard costing helps set cost benchmarks for materials, labor, and overhead, and then compares actual costs to these standards. The analysis of variances between the actual and standard costs allows managers to control and optimize costs, making it a crucial tool for performance management.

How does differential cost analysis support decision-making?

-Differential cost analysis helps managers determine which costs are relevant to specific decisions, such as accepting a special order or discontinuing a product line. It identifies the costs that will change as a result of the decision, which is essential for making informed choices.

What are the key components of responsibility accounting?

-Responsibility accounting involves assigning responsibility for financial outcomes to different managers or departments. It includes performance measures, goal congruence, and evaluating results based on responsibility centers like revenue, cost, profit, and investment centers.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Introduction to Cost Accounting | Cost Accounting | CPA Exam BAR | CMA Exam

Management Accounting vs. Cost Accounting: What's the difference?

Cost Accounting, Costing, Why cost accounting is necessary?

Introduction to Cost and Management Accounting

AKUNTANSI SEBAGAI SISTEM INFORMASI

MA1 - Intro to Management Accounting

5.0 / 5 (0 votes)