The Only Liquidity Video You'll Ever Need

Summary

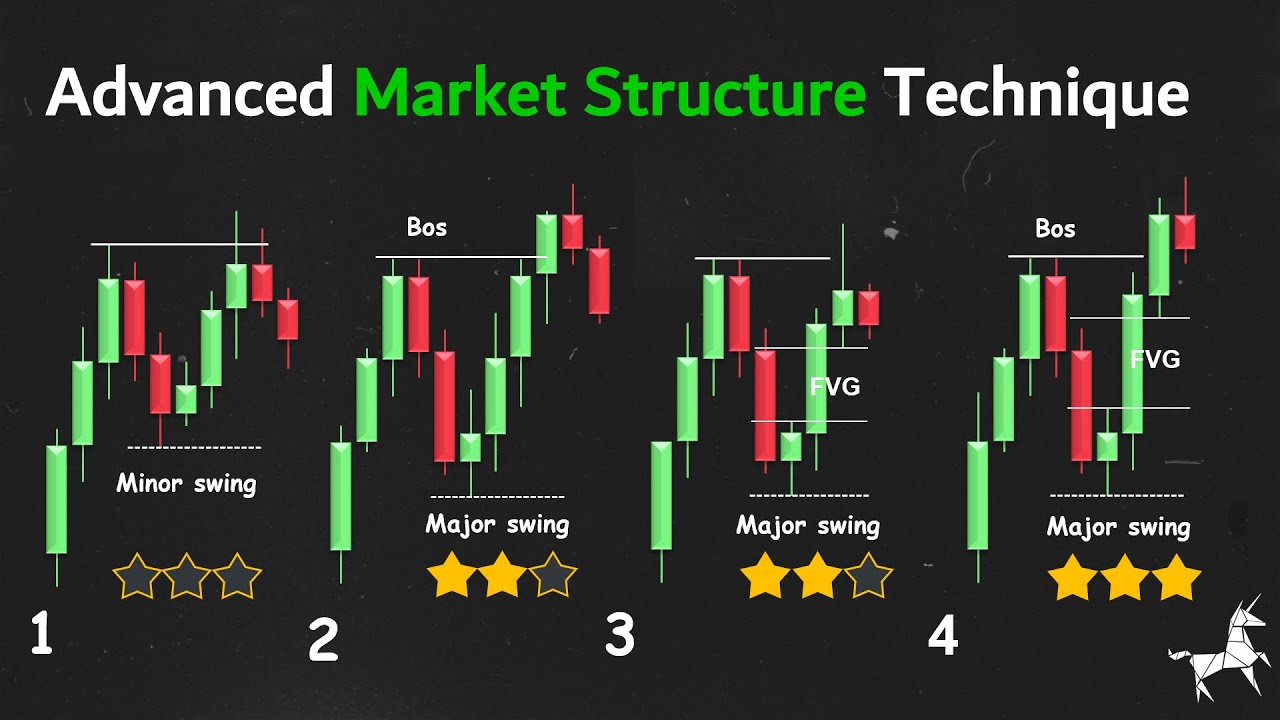

TLDRThe video dives into advanced trading strategies, focusing on liquidity hunting and trade management. The trader demonstrates how they use liquidity levels and fair value gaps to target specific price points, aiming to capture high-probability trades. They share insights on managing trades, such as exiting positions as targets approach and leaving a 'runner' for potential further gains. Emphasizing the importance of study, backtesting, and live trading, the trader stresses that consistent success in the markets requires effort, knowledge, and a well-honed edge. The video also highlights key lessons from the trader’s 14 years of experience.

Takeaways

- 😀 Liquidity hunting is a key aspect of the trading strategy, focusing on identifying where the market is likely to move based on specific price levels.

- 😀 The speaker emphasizes the importance of understanding market structure and using liquidity zones to set trading targets.

- 😀 Trade management is crucial, and the speaker typically takes off a majority of the position as the market approaches the target, leaving a runner for potential further profits.

- 😀 Aggressive price movement towards bearish fair value gaps and equal lows is a key indicator to follow in the strategy.

- 😀 The strategy involves a careful balance between aiming for a target and managing risk when the price approaches that target.

- 😀 The speaker shares personal experience of a trade, where they were up 441 ticks before closing the position, highlighting the trade’s profitability.

- 😀 Full target levels aren't always necessary to hit; the speaker advocates for taking profits as the market gets close to these levels, as it often reverses before reaching them.

- 😀 The method discussed requires extensive work including backtesting, forward testing, and live market trading to find an edge in the strategy.

- 😀 The speaker makes it clear that this strategy may not work for everyone, and traders must put in the work to refine their approach.

- 😀 Viewers are encouraged to continue learning about liquidity dynamics and apply these insights to their trading practices for long-term success.

Q & A

What is the primary focus of the speaker in the video?

-The primary focus of the speaker is on teaching how to identify liquidity zones in the market and manage trades based on liquidity principles. They share their approach to trade execution, particularly how they target liquidity and manage trades effectively.

How does the speaker handle trade management when nearing a target?

-The speaker typically closes most of the position as the market approaches the target, but they may leave a portion of the position open as a 'runner' to capture further gains if the target is eventually reached.

Why does the speaker close the majority of their position before reaching the full target?

-The speaker closes most of their position early because they have experienced situations where the market gets very close to the target but doesn't hit it. By closing early, they secure profits and avoid missing out.

What does the speaker mean by 'hunting liquidity'?

-'Hunting liquidity' refers to identifying areas in the market where liquidity is concentrated, such as specific price levels, and positioning trades around those areas. The goal is to predict where the market will move based on these liquidity needs.

What is the speaker's approach to setting trade targets?

-The speaker sets trade targets by analyzing key liquidity zones, such as equal lows or highs, and determining where the market is likely to move in order to fill these liquidity gaps. The target is based on where significant market orders are likely to be triggered.

Does the speaker guarantee that their trading method will work for everyone?

-No, the speaker does not guarantee that their trading method will work for everyone. They emphasize that it requires a lot of study, backtesting, and live market experience to find a trading edge.

What does the speaker suggest for traders who are still struggling despite knowing the liquidity concepts?

-The speaker suggests reviewing the lessons they've learned over 14 years in the markets, which are shared in a separate video. These lessons may help traders refine their strategies and improve their trading performance.

What does the speaker recommend doing when liquidity zones are approached?

-The speaker recommends taking off the majority of the position as the market approaches liquidity zones, while potentially leaving a small portion to capture any further movement towards the target.

What is the main takeaway from the speaker’s trading philosophy on liquidity?

-The main takeaway is that understanding and identifying liquidity zones is crucial for successful trading. By targeting areas with high liquidity, traders can improve the accuracy of their trades and better manage risk.

What does the speaker mean by 'equal lows' and why are they significant?

-'Equal lows' refer to price levels where the market has previously touched or tested multiple times. These are significant because they can indicate areas of liquidity where the market may eventually move towards, allowing traders to target those levels for potential profit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

3 High Probability Scalping Strategies Using Smart Money Concepts

What I Learnt From The ICT's Longest X Space (over 5 hours)

2022 ICT Mentorship Episode 9

The 4 Reasons Markets ACTUALLY Move (Draw on Liquidity Explained)

I Discovered Best Market Structure Analysis (Premium Video)

ICT Concepts - Immediate Rebalance (Strongest Signature) 🤫

5.0 / 5 (0 votes)