3 Kesalahan FATAL trading yang harus anda hindari

Summary

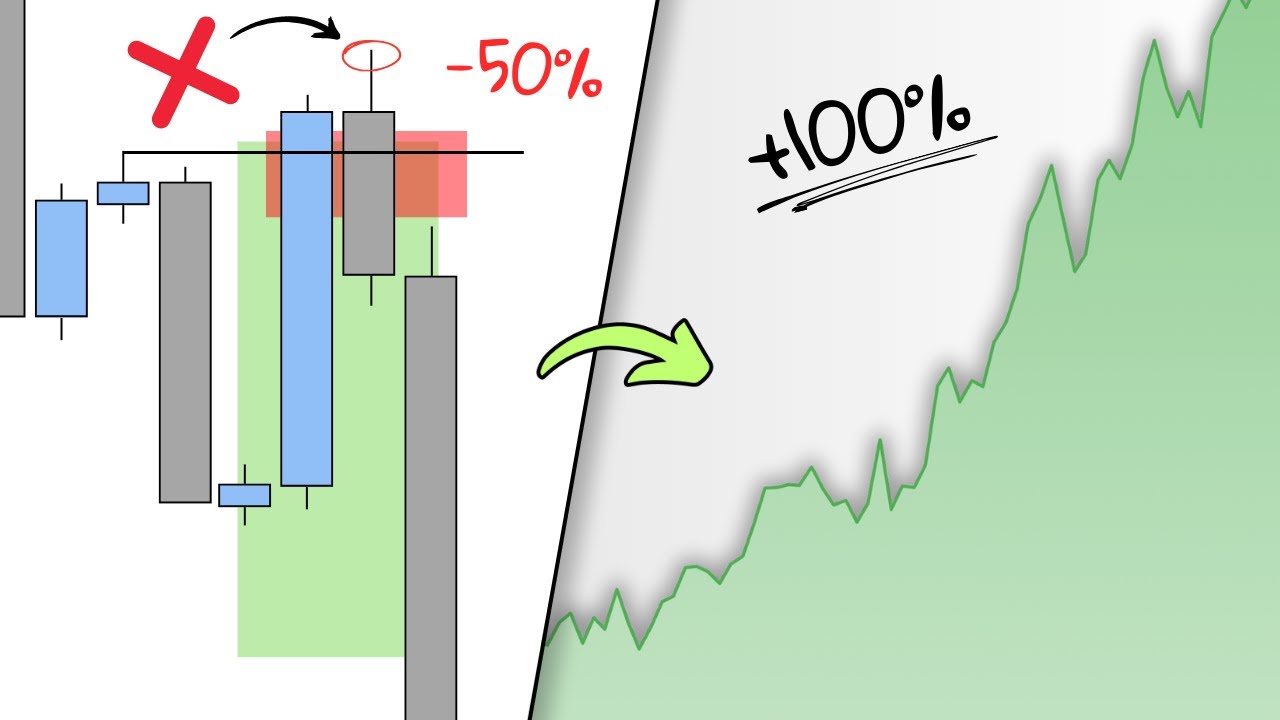

TLDRThis video highlights three common trading mistakes to avoid: not following the trend, taking excessive risks, and treating trading like a game. It emphasizes the importance of recognizing the market's trend—whether bullish, bearish, or consolidating—before making trades. The video also stresses risk management, recommending a maximum of 1-2% risk per trade to protect your capital. Lastly, it warns against reckless trading and suggests practicing on a demo account first before moving to real trades with a small risk. Patience and strategic planning are key to long-term success in trading.

Takeaways

- 😀 Recognize and trade with the overall market trend (bullish or bearish) to minimize risk.

- 😀 Avoid selling in a bullish market or buying in a bearish market, as this increases the chance of losses.

- 😀 Ensure to check multiple timeframes (e.g., daily and H4) to fully understand the trend and market structure.

- 😀 Wait for the price to break out of consolidation and retest before entering a trade to ensure a better entry point.

- 😀 Always prioritize risk management and avoid risking too much capital on a single trade. 1-2% risk per trade is ideal.

- 😀 Use appropriate lot sizes relative to your account balance to ensure you're not over-leveraging your position.

- 😀 Trading is a long-term journey—focus on protecting your capital rather than chasing quick profits.

- 😀 Understand the market structure—minor corrections in smaller timeframes may be part of a larger trend in higher timeframes.

- 😀 Treat trading seriously and professionally, not as a game or quick way to make money.

- 😀 Start with a demo account to practice and gain experience before trading with real money.

- 😀 Consistency and discipline are key to successful trading, so don’t rush or expect instant results.

Q & A

What is the first mistake people make when trading?

-The first mistake is not trading in alignment with the overall market trend. Traders often fail to recognize the trend, such as a bullish or bearish market, and make trades that go against it, which increases risk.

How can traders determine the market trend?

-Traders can determine the trend by analyzing the price movement, such as identifying if the market is going up (bullish) or down (bearish). They can also use tools like trend lines and moving averages to confirm the trend.

Why is it important to understand both big and small timeframes in trading?

-Understanding both big and small timeframes helps traders identify the larger market direction (like a bullish trend) and the shorter-term corrections. This allows them to make more informed decisions when trading on smaller timeframes.

What is the mistake that traders make when they don't see the bigger trend?

-The mistake is that traders often sell when the market is bullish, or they take short positions when the overall market is trending upwards. This leads to smaller potential profits and higher risks compared to following the trend.

What is the recommended risk percentage per trade?

-The recommended risk per trade is between 1% to 2% of the trading capital. This ensures that traders manage their risk effectively and protect their capital from significant losses.

How does risk management relate to trading capital?

-Risk management is critical as it determines how much of your capital you're willing to lose on each trade. For instance, with a capital of 1,000, the maximum loss should be limited to 1% or 2%, ensuring that losses are contained and manageable.

What role does money management play in successful trading?

-Money management helps traders avoid significant losses by setting limits on risk, such as using stop-loss orders and calculating the appropriate position sizes based on their capital. It ensures that traders do not risk too much on any single trade.

What is the third mistake traders make according to the script?

-The third mistake is treating trading like a toy or game rather than a serious business. This leads to emotional decisions where traders act impulsively, buying and selling based on excitement or fear rather than strategy and planning.

How does treating trading as a business impact a trader's performance?

-Treating trading as a business encourages disciplined decision-making, planning, and risk management. It prevents emotional decisions that could lead to impulsive actions and losses, focusing instead on long-term success.

Why does the speaker recommend starting with a demo account before going live?

-The speaker recommends starting with a demo account to practice and familiarize oneself with the market without risking real money. This helps build confidence and experience before transitioning to real trades with actual capital.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Metode Trading Johnpaul77 (Sesi 1)

MAKE $100 PER DAY ON BYBIT !!! (secret method)

This ICT Model Prints Money — 70% Win Rate Explained!

Ultimate Order Block Trading Strategy: Make $10,000+ Per Month (Forex Trading)

The Trading Geek (Brad Goh) is a Fraud and I have Proof

10 Trading Mistakes YOU NEED TO FIX NOW!

5.0 / 5 (0 votes)