First time Tax Return filing | Remember three things | Risk | Fine | Benefits | Gold | Cash | Assets

Summary

TLDRThis video discusses common mistakes and critical considerations when filing a tax return for the first time. It emphasizes the importance of accurately reporting assets like gold, cash, vehicles, and property. The script warns against inflating or omitting information, as this could lead to heavy penalties or tax demands from the Federal Board of Revenue (FBR). Viewers are advised to only report what they truly own and can prove, ensuring proper records are kept for any assets reported. The key takeaway is to file honestly and with evidence to avoid future tax complications.

Takeaways

- 😀 Always report assets truthfully in your tax return. Don't overstate or understate what you own.

- 😀 If you don't have gold, don't report it. Reporting more gold than you possess can lead to significant tax liabilities.

- 😀 If you report gold or other assets without proof of ownership, the FBR can tax you on the entire profit when you sell them later.

- 😀 Be cautious when showing cash savings. If your reported savings exceed your actual income, the FBR will inquire about the source of that cash.

- 😀 When reporting assets, such as cars or properties, ensure you can back up your claims with proper documentation.

- 😀 If you receive cash from a sale, like selling gold or property, make sure to report it accurately to avoid future complications with the FBR.

- 😀 The FBR has the authority to challenge any discrepancies in your tax return, even if the issue arises years later.

- 😀 If you report price bonds or other financial instruments, ensure that you actually own them. Selling assets without proof can lead to penalties.

- 😀 Avoid showing assets you don't own, like a file or property not legally transferred to your name, as it will complicate matters when selling or claiming benefits.

- 😀 Always report your financial assets (e.g., insurance policies) and any income from them upfront, so the FBR can trace the origin of funds when they come into your account.

- 😀 Be mindful of the advice you receive. If you’re unsure about any asset or financial item, it’s better to leave it out than risk future issues with the FBR.

Q & A

What should I include when filing my tax return for the first time?

-When filing your tax return for the first time, you should report all of your income, assets, liabilities, and any relevant financial details accurately. This includes cash, gold, vehicles, property, and any other significant assets or investments you own. Always ensure you have documentation to back up the information you report.

Can I show more gold or assets than I actually have in my tax return?

-No, you should only report the gold or assets you actually own. Reporting more than you have could lead to tax complications later, especially if the FBR asks for proof of your reported assets or sales. If you sell gold or assets that you falsely reported, you will be taxed on the full amount, and the FBR could demand supporting records.

What are the risks of over-reporting gold or assets in my tax return?

-Over-reporting gold or assets that you don't actually own can result in significant tax liabilities when you sell them. You will be taxed on the profit, and without proper documentation of the sale and purchase, you may face penalties or fines from the FBR.

How does the FBR tax the sale of gold that I reported but didn’t actually own?

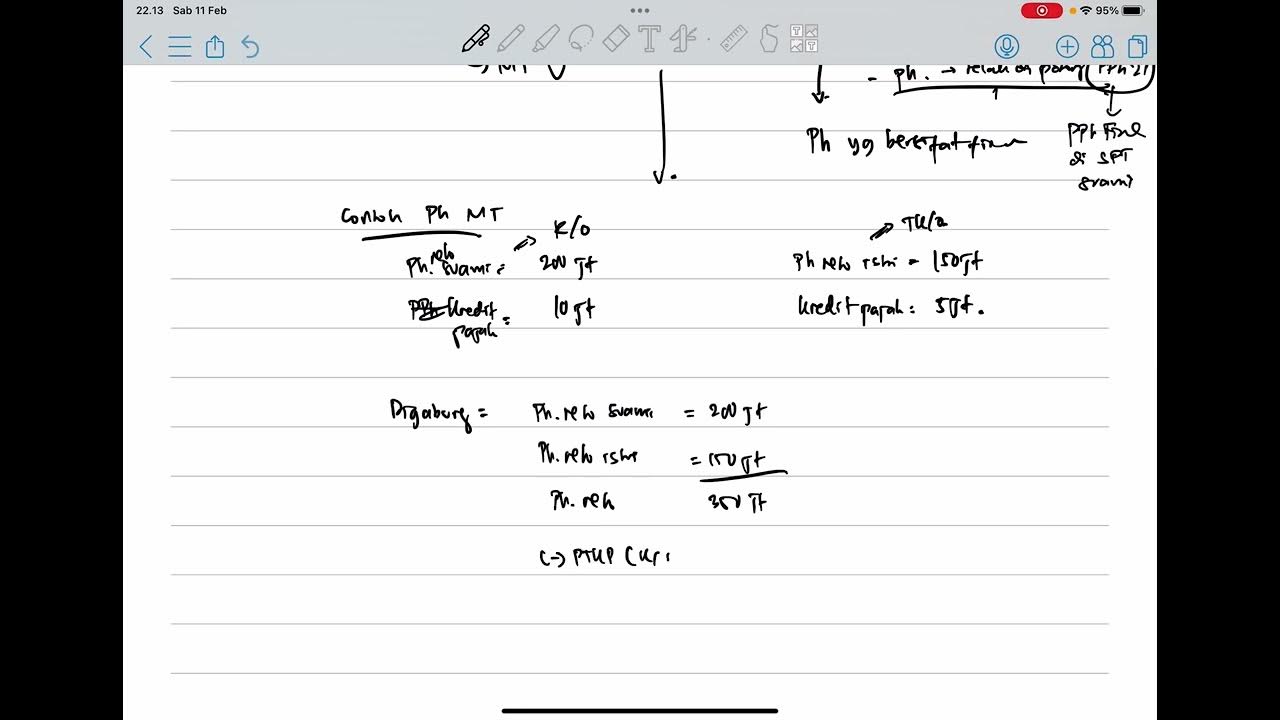

-If you report gold in your tax return and later sell it, the FBR will tax the profit you make from the sale. For example, if you report having 10 tolas of gold, and later sell it for a significant amount, you'll be taxed on the profit, which can be as high as 45%, depending on your income bracket.

What should I do if I don’t have the gold or assets I reported?

-If you don’t actually have the gold or assets you reported in your tax return, you should correct the mistake immediately. Failing to do so can result in future complications, including FBR investigations and penalties. Only report assets that you can substantiate with evidence.

Is it okay to show large amounts of cash in my tax return if I think I might need it later?

-No, you should not show cash that you do not have. If you show a large amount of cash, such as ₹50 lakh, when your income doesn't support it, the FBR will ask where the money came from. If you cannot provide proof, you could face difficulties and potential penalties.

What will happen if I show excessive cash in my tax return?

-Showing excessive cash that exceeds your income or available assets will raise questions from the FBR. You will need to provide a clear explanation of where the cash came from, such as inheritance or savings from previous years, along with supporting records. If you can’t explain the source, you might be subject to taxes on unreported income.

Why should I be careful about showing price bonds in my tax return?

-If you don’t actually own the price bonds you’re reporting in your tax return, you could face complications later when you try to sell them. It’s important to only report the price bonds you truly own and have records for. Otherwise, you could be questioned about their existence during an FBR audit.

How can I prove the legitimacy of assets I report in my tax return?

-To prove the legitimacy of assets you report in your tax return, ensure you have supporting documentation such as receipts, ownership records, and transaction slips. If you sell any reported assets, you should retain proof of the sale and any profits made to substantiate your tax filings.

What are the consequences of not reporting certain assets in my tax return?

-If you fail to report certain assets, such as vehicles, properties, or insurance policies, the FBR could question the source of income when you receive money from these assets later. Not reporting these assets properly could result in fines or the demand for back taxes if you can't prove the source of the funds.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Common Mistakes while Filing ITR | CA Anoop Bhatia

What is GSTR 9 Annual Return | What is Gstr-9 in Hindi

GSTR3B FILING में आया बड़ा UPDATE

NRI Tax Filing Last Date 31.07.2024 . Should You File Tax Returns Or Not ? CA Sanketh Nayak

PPh Orang Pribadi (Update 2023) - 9. Penghasilan Istri

【マジで注意】今年の年末調整絶対ミスるな

5.0 / 5 (0 votes)