The Best Fair Value Gap FVG Trading Strategy Revealed!

Summary

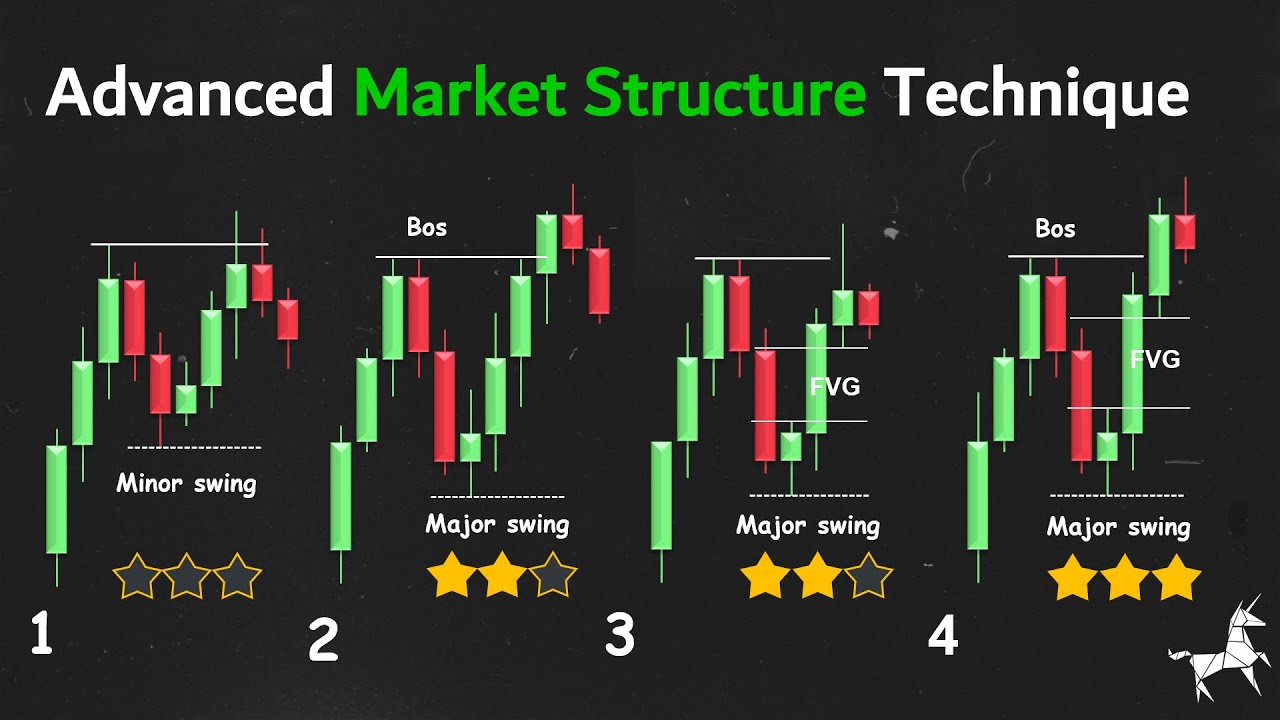

TLDRThis video dives into the Fair Value Gap (FVG) trading strategy, a powerful method based on Smart Money Concepts. It explains how to identify and trade FVG setups for better market entries, covering both higher and lower time frame analysis. The strategy focuses on market inefficiencies, showing how FVGs indicate buy or sell imbalances, and highlights key risk management practices. With real chart examples, the video emphasizes precision in trade execution, refining entries, and managing losses. The approach is versatile across various markets and time frames, making it ideal for traders looking to master advanced trading techniques.

Takeaways

- 😀 Understand the Fair Value Gap (FVG) trading strategy, which focuses on price imbalances between three consecutive candles.

- 😀 FVGs highlight areas of market inefficiency where price may return to rebalance, making them crucial for smart money traders.

- 😀 Bullish FVGs indicate buy-side imbalances, while bearish FVGs signal sell-side inefficiencies that traders can capitalize on.

- 😀 The FVG strategy is applicable across various timeframes and markets, including Forex and stocks.

- 😀 To improve trading precision, refine the FVG by scaling down to lower timeframes like the 4-hour or 1-hour charts.

- 😀 Always consider the 50% Fibonacci retracement level when choosing FVG zones for trades, focusing on the discount zone for bullish and premium zone for bearish setups.

- 😀 A solid FVG trading plan includes higher timeframe analysis to identify key levels, liquidity zones, and fair value gaps.

- 😀 Once an FVG is identified on the higher timeframe, zoom into a lower timeframe to seek confirmation signals and execute trades.

- 😀 Risk management is key—use stop-loss orders and secure profits at key levels while adhering to a solid trading plan.

- 😀 Losses are part of trading—stay disciplined, manage risk, and continue to follow your trading rules to improve over time.

Q & A

What is the Fair Value Gap (FVG) trading strategy?

-The FVG trading strategy is based on Smart Money Concepts, focusing on identifying price imbalances formed between three consecutive candles on a chart. It highlights areas where buying pressure exceeds selling pressure, suggesting price may revisit those zones to fill the imbalance, creating potential trading opportunities.

Why is the Fair Value Gap significant in trading?

-The Fair Value Gap signals areas where large market participants, like institutions, have influenced price action. These gaps indicate buy-side or sell-side imbalances, and the market often revisits these zones to collect unfilled orders, making them essential for predicting potential price movements.

How does the Fair Value Gap strategy apply to different time frames?

-The FVG strategy works across all time frames, from daily charts to lower time frames like 5 minutes. It’s adaptable because price action consistently forms gaps regardless of time frame, but smaller time frames offer more precise entries while larger time frames provide an overall market context.

What is the importance of refining the Fair Value Gap for day traders?

-Refining the FVG allows traders to pinpoint more precise trade entries by scaling down to a lower time frame, such as a 4-hour chart. This reduces the risk of trading in large, imprecise zones and enhances the accuracy of trade entries, especially for day traders.

How do you identify the best Fair Value Gap for trade setups?

-The best Fair Value Gaps are those located within the discount zone for bullish trades or the premium zone for bearish trades, identified using the Fibonacci retracement tool. These zones offer safer, more conservative entries and reduce the chances of being caught in a liquidity grab.

What are the key steps in applying the FVG strategy?

-The FVG strategy consists of two main steps: 1) Analyzing the market structure on a higher time frame to identify key levels, liquidity areas, and FVG zones. 2) Zooming into a lower time frame for confirmation signals like liquidity sweeps and changes in character before executing the trade.

How do liquidity zones play a role in the FVG strategy?

-Liquidity zones, such as support and resistance levels or equal highs and lows, help identify areas where large volumes of orders exist. Understanding these zones allows traders to anticipate price movements as the market gravitates toward or away from them, enhancing trade accuracy and risk management.

How do liquidity sweeps and changes in character indicate a trend reversal?

-A liquidity sweep occurs when price moves through a key level, triggering stop losses and creating momentum. A change in character happens when price breaks a significant low or high, signaling that the balance of buying and selling power has shifted. These events often suggest that a trend reversal is imminent.

What should traders do if they face a small Fair Value Gap?

-If the Fair Value Gap is small, the price is likely to fluctuate around the zone. Traders should use a wider stop loss to avoid being stopped out by normal market movements. This helps manage risk and ensures that the trade remains valid despite fluctuations.

How can traders manage risk when dealing with a large Fair Value Gap?

-For a large Fair Value Gap, placing a stop loss below the entire zone might lead to high-risk exposure. Traders should either use a smaller stop loss, just below a refined section of the gap, or enter at the midpoint of the zone to improve the risk-to-reward ratio and manage potential losses effectively.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)