Order Block Trading Strategy | Smart Money Concept | Core Concept

Summary

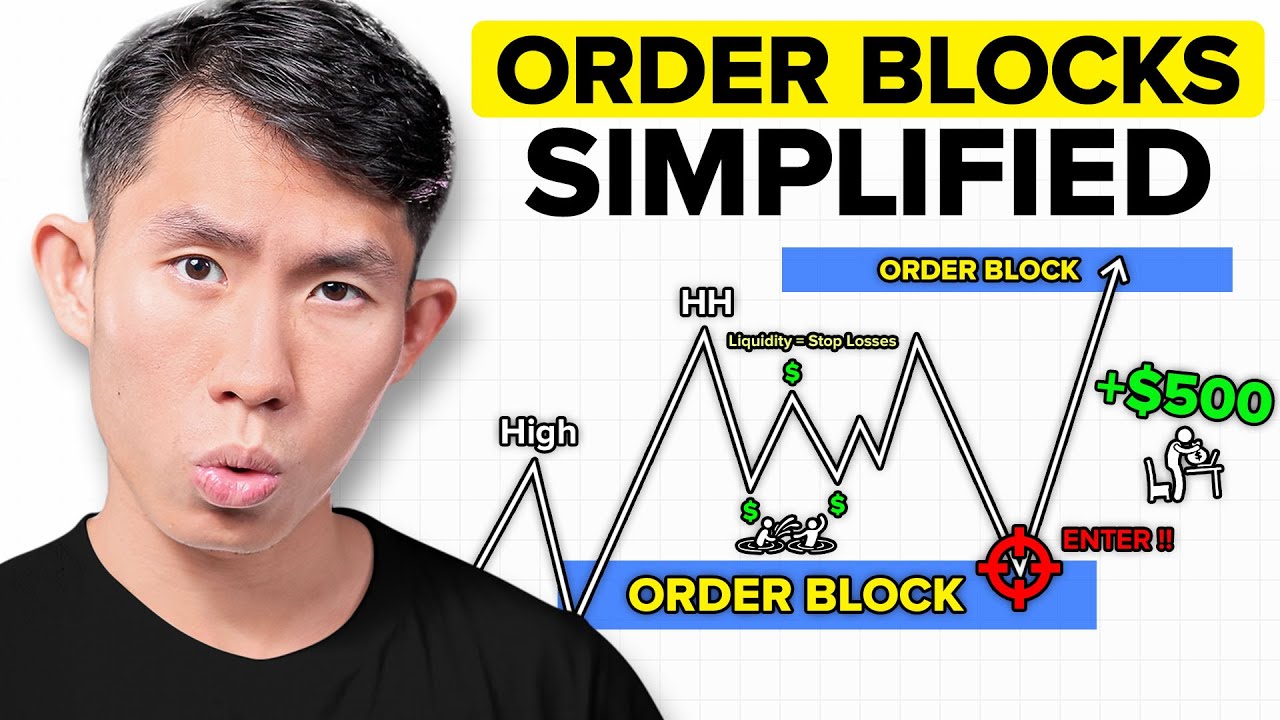

TLDRThis video delves into the concept of order blocks, explaining their formation and the psychology behind them. The presenter compares how retail traders and institutions place orders, emphasizing that institutions execute large trades in stages, leading to the creation of order blocks. The key concept revolves around unfulfilled orders, which are often revisited to balance the institution's positions and maintain their average price. The video highlights how identifying these zones can guide successful intraday trading strategies by tracking institutional activity, ultimately teaching traders to follow institutional footprints for more accurate market predictions.

Takeaways

- 😀 Order blocks are important to understand the psychology of trading, particularly for institutional traders.

- 😀 Retail traders typically place smaller orders, while institutions need larger quantities and must stagger their orders.

- 😀 Institutions execute large trades within a defined range to fulfill their requirements, creating what is known as an 'order block.'

- 😀 Retail traders usually buy at a specific price, while institutions place orders across a range of prices to ensure fulfillment.

- 😀 Price movements often return to the 'order block' range to fulfill unfulfilled institutional orders, creating a potential buy opportunity.

- 😀 An order block can be identified by observing consecutive bullish or bearish candles, which indicate a zone of institutional activity.

- 😀 A solid order block forms when, after a bullish candle sequence, a price gap (fair value gap) occurs, confirming the incomplete fulfillment of orders.

- 😀 Understanding the relationship between supply and demand is key to predicting how price will behave around order blocks.

- 😀 When price revisits the order block, it can trigger a strong move, indicating that unfulfilled orders from institutions are being executed.

- 😀 Following the footprints of institutional traders by identifying order blocks can lead to more successful trades than following retail trader behavior.

Q & A

What is an Order Block in trading?

-An Order Block is a price zone where large institutions place their buy or sell orders over time. These zones are formed because institutions cannot execute large orders all at once, and therefore, they stagger their orders within a certain price range.

Why can't institutions execute large orders immediately?

-Institutions often deal with much larger orders than retail traders. For example, while retail traders may place small orders (e.g., 2 lakh lots), institutions might need to execute orders for 5 lakh lots or more. These large orders cannot be fulfilled instantly and must be placed within a range of prices over time.

How does liquidity play a role in Order Block formation?

-Liquidity is essential for fulfilling large institutional orders. Retail traders provide liquidity by executing their smaller orders, allowing institutions to complete their larger orders within the Order Block. When there is sufficient liquidity, institutions can buy or sell at different price points within the Order Block.

What is the significance of a Fair Value Gap in an Order Block?

-A Fair Value Gap occurs when there is a gap between the low of a red candle and the high of the following green candle, indicating that not all institutional orders have been filled. This signals the potential for the price to return to the Order Block to complete the unfulfilled orders.

How can identifying Order Blocks help traders?

-By identifying Order Blocks, traders can anticipate potential price movements, particularly when the price returns to an Order Block to complete unfulfilled institutional orders. This allows traders to align themselves with the market's larger institutional trends, improving their chances of successful trades.

What happens when all the orders in an Order Block are fulfilled?

-Once all the orders in an Order Block are fulfilled, the price moves away from the zone, and the Order Block no longer exists. At this point, the price continues in the direction dictated by the completion of the institutional orders.

How do retail traders and institutions differ in executing orders?

-Retail traders typically place smaller orders that are executed quickly, while institutions place much larger orders that require more time to execute. Institutions stagger their orders within a range of prices to fulfill them gradually, whereas retail traders execute their orders at a single price point.

What role does supply and demand play in Order Block formation?

-Order Blocks are largely driven by supply and demand dynamics. When institutions need to fulfill large orders, they create a demand zone (the Order Block), where orders are fulfilled over time. The supply of retail traders helps institutions complete their larger trades by providing the necessary liquidity.

How can a trader predict price movement using Order Blocks?

-Traders can predict price movements by watching how the price reacts when it returns to an Order Block. If there is a significant gap indicating unfulfilled institutional orders, the price may return to the Order Block to complete these orders, leading to a potential up or down move.

Why should traders focus on institutions rather than retail traders?

-Traders should focus on institutions because institutions have more influence on the market due to their large order sizes. Following retail traders often leads to being 'trapped' in the wrong direction, while following institutional order flow allows traders to align with the dominant market movement.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)