BITCOIN AND CRYPTO MARKET DOWN. DON'T PANIC. WATCH THIS & REMEMBER.

Summary

TLDRIn this pre-recorded digital asset news update, the host discusses recent political developments, including President Biden's attendance at a Bitcoin Round Table and Donald Trump's support for crypto, emphasizing the potential of Bitcoin mining in the US. Despite market fluctuations and external uncertainties, the host highlights historical patterns suggesting a bullish trend in 2025. He advises viewers on accumulation strategies and the importance of taking profits, referencing past market recoveries post-COVID-19 as a reminder of crypto's resilience.

Takeaways

- 🏠 The speaker is currently in Puerto Rico, dealing with house renovations and unstable Wi-Fi, which is why the usual live stream is pre-recorded.

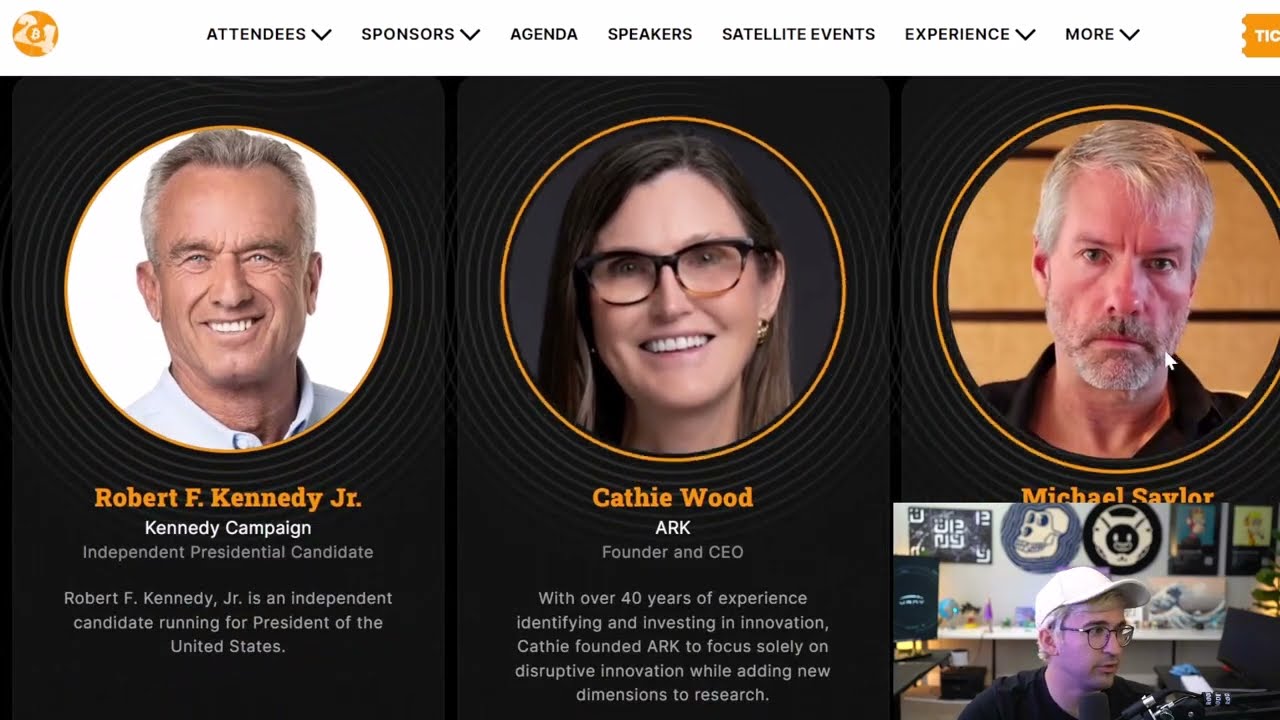

- 📧 There was a leak about President Biden's administration attending a Bitcoin and crypto Round Table in DC in July, focusing on Bitcoin mining.

- 🤝 Former President Donald Trump supports crypto and has met with Bitcoin miners, suggesting that all future Bitcoin should be mined in the U.S.

- 🤔 The speaker is skeptical about politicians fulfilling promises but acknowledges the meeting as a positive step.

- 💼 The Bitcoin mining coalition includes representatives from major companies like Riot, Marathon, Tera Wolf, and Clean Spark.

- 📊 The speaker discusses the current market situation, with a market cap of 2.5 trillion and a downward trend in prices, attributing it to more sellers than buyers.

- 📉 Bitcoin's price has dropped significantly in the last 24 hours, and the speaker notes that the long-term trend over a year still shows growth.

- 🔄 The speaker believes in the four-year cycles of Bitcoin's price, suggesting that we might see an all-time high in 2025 after a dip and reset in 2022.

- 📈 Historical data is cited to show that after reaching an all-time high, the market often experiences a period of sideways movement before a significant bullish trend.

- 📊 The speaker emphasizes the importance of taking profits, especially during bearish trends, using personal examples from past dates.

- 👍 The video concludes with a reminder to consider the speaker's advice, watch related videos for more insights, and the importance of making informed decisions in the market.

Q & A

Why is the speaker pre-recording the video instead of doing a live stream?

-The speaker is pre-recording the video because they have been moving around a lot in Puerto Rico due to house renovations and staying in Airbnbs with unstable Wi-Fi.

What significant event is mentioned regarding President Joe Biden and cryptocurrency?

-There was a leak of emails indicating that President Joe Biden's administration will be attending a Bitcoin and crypto Round Table in DC in July, focusing on Bitcoin mining.

What did Donald Trump reportedly say in a closed-door meeting with Bitcoin miners?

-Donald Trump reportedly said that Bitcoin can help win the AI arms race and that all future Bitcoin should be mined in the United States.

Which Bitcoin mining companies were represented in the meeting with Donald Trump?

-Representatives from Riot, Marathon, Tera Wolf, Clean Spark, and several other Bitcoin miners were included in the meeting.

What political figure is the speaker suggesting viewers support with a link in the description?

-The speaker is suggesting viewers support John Deon, who is running a campaign against Elizabeth Warren in Massachusetts.

What is the current market cap of the cryptocurrency market according to the speaker?

-The current market cap of the cryptocurrency market is around 2.5 trillion.

What are some of the geopolitical concerns mentioned that might be affecting the cryptocurrency market?

-The speaker mentions potential wars and the presence of the Russian Navy's nuclear submarines near Cuba as geopolitical concerns affecting the market.

What is the speaker's view on the current state of the cryptocurrency market?

-The speaker views the current state as a 'red day' and a good opportunity for accumulation, but acknowledges that it might be stressful for some.

What historical pattern does the speaker refer to when discussing the cryptocurrency market cycles?

-The speaker refers to a four-year cycle pattern in the cryptocurrency market, with all-time highs followed by dips and resets.

What advice does the speaker give regarding taking profits in the cryptocurrency market?

-The speaker advises to take profits during the bearish trend and sentiment, emphasizing the importance of not expecting the market to go up in a straight line.

What is the speaker's prediction for the cryptocurrency market in 2025?

-The speaker predicts that there will be monster bullish moves in 2025, but also acknowledges that they could be wrong.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

THIS WEEK IS HUGE FOR CRYPTO

What Trump’s Crypto Reserve Means for Everyday Investors

🚨Breakout Confirmed! Here’s Why Next 90 Days Will Be NUTS!🥜

BITCOIN: TRUMPS INSANE CRYPTO PLAN!!!! 🚨 (all holders must see this)

⚠️Dato DECISIVO de INFLACIÓN HOY en EEUU | BITCOIN Cargando el MUELLE en los $60K? | Noticias Crypto

Bloomberg Crypto 05/28/2024

5.0 / 5 (0 votes)