72,000 PKR Monthly Dividends #RentalIncome #ElonMusk #MonthlyDividends #SarmaayaExplain

Summary

TLDRThis video explains why renting a house can be a smarter financial choice than purchasing one. By using the example of Elon Musk, who chooses to rent instead of buying, the video illustrates how investing in assets like REITs can offer better returns. The speaker compares dividend yields from stocks (10%) with rental yields (17%) and demonstrates how partial investment in stocks can provide enough dividends to cover rental costs. The video emphasizes that investing wisely can lead to financial growth and savings, offering more flexibility and better returns than traditional property ownership.

Takeaways

- 😀 Renting a house is often a smarter financial choice than buying because it allows for more investment flexibility.

- 😀 Elon Musk is an example of someone who prefers renting over owning property to invest his money in business ventures.

- 😀 The concept of dividend yield is important when evaluating the return on an investment. It measures the percentage return on a given asset.

- 😀 Rental yield is the return on investment from renting out a property, calculated by dividing annual rental income by property value and multiplying by 100.

- 😀 Real Estate Investment Trusts (REITs) allow people to invest in real estate without directly purchasing property, offering dividend returns.

- 😀 Laman City REIT in Pakistan provides a dividend yield of 10%, which is lower than the 17% rental yield of some properties.

- 😀 To generate rental income from dividends, an investor could invest in a REIT like Laman City to match or exceed their rent obligations.

- 😀 By investing in REITs, one can receive quarterly dividends and still achieve higher returns compared to paying rent on a house.

- 😀 Over two years, investing in Laman City REIT would have provided significant returns both from dividends and appreciation in share value.

- 😀 A partial investment of ₹86 lakh in a REIT like Laman City can generate enough dividend income to cover rent, making it a more lucrative alternative to buying property.

- 😀 Instead of investing large sums in property, one can invest in dividend-paying stocks or REITs to cover rental expenses and still save money each month.

Q & A

Why is renting a house considered a smarter financial choice?

-Renting a house is considered a smarter financial choice because, instead of investing a large sum of money in real estate, you can use that money to invest in businesses or assets that grow your wealth. This strategy allows for more flexibility and higher returns in the long term.

How does Elon Musk's approach to housing illustrate the benefits of renting?

-Elon Musk, despite being one of the richest people on Earth, prefers renting homes and has a small, pre-fabricated house. He understands that investing money in real estate might not generate the highest returns, and prefers to use his wealth to grow his businesses, which could yield higher returns.

What is dividend yield, and why is it important?

-Dividend yield is the percentage return on investment from the dividend received from an asset, relative to the price of the asset. It’s important because it helps investors compare different assets or investments to assess which ones offer the best return in relation to their value.

What is rental yield, and how does it differ from dividend yield?

-Rental yield is similar to dividend yield, but instead of returns in the form of dividends, rental yield represents the returns you get from renting a property. To calculate it, divide the annual rent by the property’s total value and multiply by 100 to get the percentage yield.

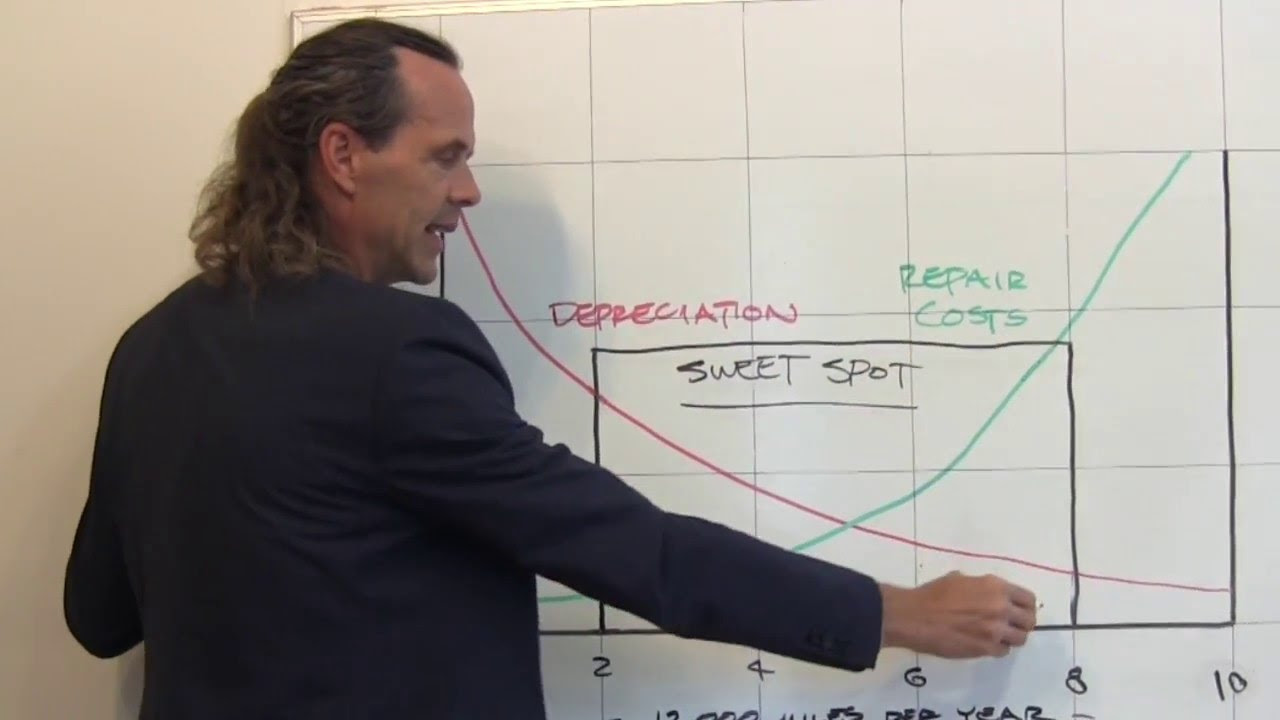

How do rental yields compare to investment returns in the stock market?

-Rental yields, like the example given for a house in I10, may offer returns of around 17%, while stock market investments, such as those in REITs, could offer a lower yield, like 10%. The key difference lies in the form of returns, but both investments can generate passive income.

What is a Real Estate Investment Trust (REIT)?

-A Real Estate Investment Trust (REIT) is a company that collects money from investors and then invests that money in real estate. It distributes the profits from these investments to shareholders in the form of dividends.

How does investing in a REIT like Laman City compare to owning property?

-Investing in a REIT such as Laman City offers a dividend yield of about 10%, while owning a property may offer a rental yield of 17%. Although the rental yield from property ownership is higher, REITs allow for more diversification and liquidity, and you don’t need the large capital required to purchase a property.

How much money would you need to invest in DCR to cover ₹72,000 in rent per month?

-To earn ₹72,000 per month from dividends with a dividend yield of 10%, you would need to invest approximately ₹86 lakhs in DCR. This would generate an annual dividend of ₹86,400, which covers the monthly rental cost.

How does the stock price appreciation factor into REIT investments?

-In addition to the dividend returns, the stock price of a REIT may also appreciate over time, adding to the overall return on investment. For example, if the stock price of a REIT increases, the value of the investment grows, providing capital gains alongside the regular dividends.

Can you live in a luxury home using dividends from stock market investments?

-Yes, it is possible to live in a luxury home by investing in stocks or REITs. By strategically investing in dividend-paying companies, you can earn enough income to cover rent in a higher-value home without having to purchase the property outright.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)