Fake Market Structure Shifts are Making You Unprofitable - Here is How to Fix it

Summary

TLDRIn this video, the speaker discusses the concept of a fake Market Structure Shift, commonly misunderstood by traders. They explain how, after a market structure shift, many traders enter expecting a retracement, only to get stopped out as price moves in the opposite direction. The speaker clarifies that this isn't a fake shift, but a real one, and delves into how market shifts can be used to identify potential trade entries. They highlight the importance of paying attention to unmitigated zones and understanding market context rather than focusing solely on patterns. Overall, the video provides insights into better identifying trading opportunities.

Takeaways

- 😀 Traders often wait for a market structure shift, but many get stopped out due to a fake market shift.

- 😀 A fake market structure shift is not always fake—sometimes it's a valid shift with a specific purpose, such as mitigating unfilled areas.

- 😀 The one-minute timeframe often shows bullish trends that shift when reaching higher timeframe zones (like 15-minute, 30-minute, or 1-hour zones).

- 😀 A genuine market structure shift happens when price breaks a protected low, confirming a valid shift from bullish to bearish.

- 😀 Traders typically look to enter after a retracement to the 50% level of a shift, but sometimes the market runs through stops before continuing higher.

- 😀 A common mistake is assuming a shift is fake just because price didn’t fully reach the higher timeframe zone. The shift might still fulfill its objective even without a full reach.

- 😀 A valid market shift can still lead to higher prices even if price moves lower temporarily to mitigate unfilled zones or areas.

- 😀 The goal of a market structure shift is often to mitigate zones that have been left unfilled by previous price moves, not to necessarily continue lower.

- 😀 A real market structure shift might appear to be 'fake' if it already achieved its goal (e.g., mitigating an area), causing confusion among traders.

- 😀 It’s crucial to assess the market's context rather than just focusing on patterns. Understanding the broader structure will help in distinguishing a genuine shift from a false one.

Q & A

What is the main reason why traders get stopped out in the market?

-The main reason traders get stopped out is due to a fake market structure shift or a fake flip. Traders often wait for a structure shift to break a protected swing high, but the price may stop them out before continuing in the expected direction.

What do most traders wait for before taking a trade?

-Most traders wait for the structure to shift, meaning they look for the protected swing to get broken before they consider entering a trade.

How can a market structure shift be real and not fake?

-A market structure shift can be real if it breaks a protected low or high, but it does not always indicate that price will continue in the direction expected. Traders need to pay attention to whether the shift is meant to mitigate an unmedicated zone or if it's a shift towards a higher time frame zone.

Why does price often stop out traders after a market structure shift?

-Price stops out traders because it often runs through their stop-loss before continuing in the expected direction. This happens because the shift might be intended to mitigate an unmedicated zone or fulfill another objective before continuing higher or lower.

What is the role of the higher time frame zone in determining price direction?

-The higher time frame zone, such as a 15-minute, 30-minute, or 1-hour zone, plays a significant role in determining whether the price will continue lower or higher. If price reaches this zone and shifts, it can lead to either a reversal or further continuation.

How can traders determine whether a market structure shift will send price lower or higher?

-Traders can determine the likely price movement by analyzing whether the shift is part of mitigating an unmedicated zone or fulfilling a higher time frame objective. They need to observe if the price has already mitigated the necessary zones or if further action is required.

What should traders look for when taking an entry after a market structure shift?

-Traders should ensure they have a lower time frame confirmation inside the new zone before taking an entry. If the zone hasn't been mitigated yet, traders can look for further confirmation before entering a trade.

Why does the price sometimes continue higher after a market structure shift instead of reversing?

-The price may continue higher after a market structure shift if the shift was not meant to reverse price but rather to mitigate an unmedicated zone. Once this mitigation is done, the price may continue toward the higher time frame target.

What happens when price taps into a higher time frame zone and still experiences a fake market structure shift?

-Even after tapping into a higher time frame zone, price can still experience a fake market structure shift if there are still unmedicated zones inside that area. The price may continue to mitigate these zones before the expected move happens.

How can traders avoid falling for fake market structure shifts?

-Traders can avoid falling for fake market structure shifts by zooming out to assess the broader context of the market structure, identifying whether the shift is intended to mitigate unmedicated zones or whether it signals a true market reversal.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

1721991465949096

Market Structure Shift is BS (ST Model) - Ep 23

Averages 1 | CAT | ( Arithmetic, Quantitative Aptitude)

Market Structure Shift and Change of Character (MSS/CHOCH) | ICT | SMC

How to Properly Use Market Structure (12 Minute Guide)

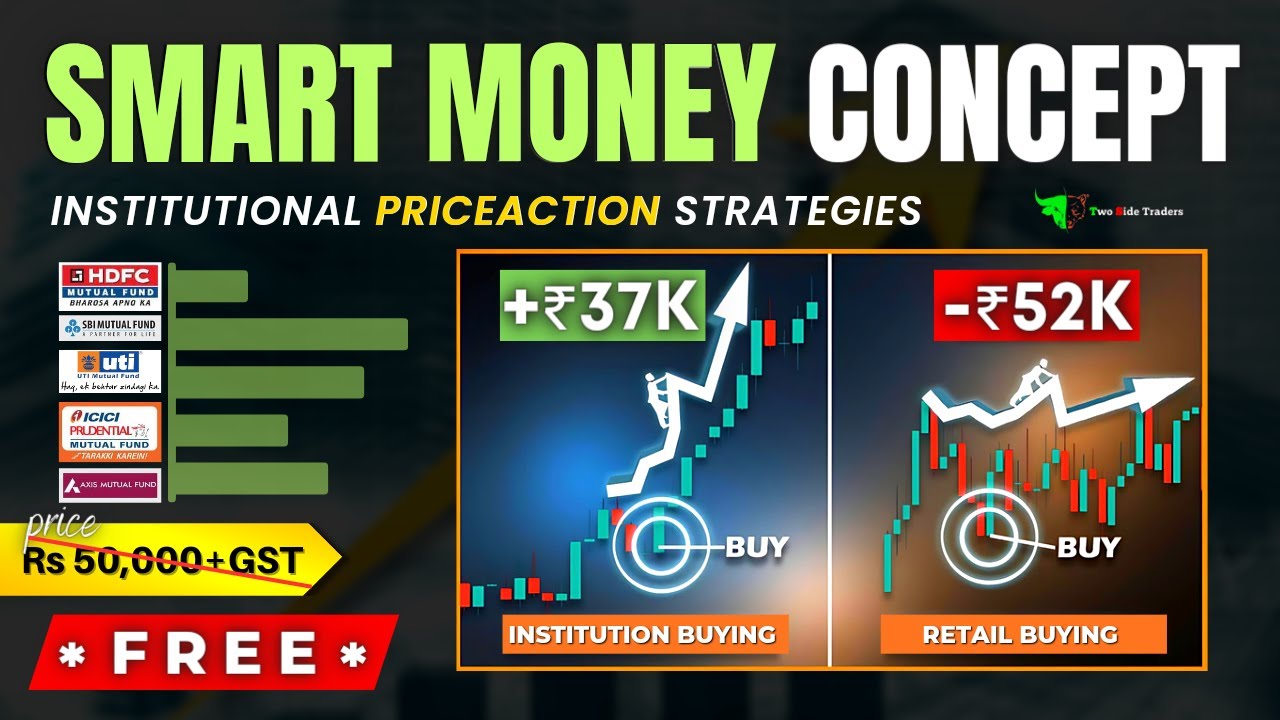

How Operator TRAPS New Traders | *FREE Advance Price Action Trading | Smart Money Concepts In Hindi

5.0 / 5 (0 votes)