wtf actually are Hedge Funds???

Summary

TLDRThis video provides an in-depth look at hedge funds, exploring how they operate, their strategies, and the risks they take. Hedge funds manage vast amounts of money and use techniques like short selling, leverage, and derivatives to maximize returns in any market condition. The video covers famous hedge fund managers such as Ken Griffin, Ray Dalio, and George Soros, highlighting their strategies and notable successes. It also delves into the dark side of hedge funds, such as the infamous collapse of Long-Term Capital Management. Finally, the video explains the path to joining a hedge fund and the skills needed to succeed in this high-stakes industry.

Takeaways

- 😀 Hedge funds are powerful financial institutions that manage trillions of dollars and influence global markets.

- 😀 They are designed to make money in any market condition, whether the market is rising or falling.

- 😀 Hedge funds are only accessible to accredited investors with a high net worth or income.

- 😀 They are lightly regulated compared to traditional funds and can use aggressive strategies like short selling, leverage, and derivatives.

- 😀 The typical hedge fund fee structure is known as '2 and 20' – 2% management fee and 20% of profits.

- 😀 Hedge fund strategies include betting on winning stocks while shorting losers, using global macroeconomic trends, and utilizing AI algorithms for quick trades.

- 😀 Notable hedge fund managers like Jim Simons, Ray Dalio, and George Soros have made billions by utilizing unique trading strategies.

- 😀 Hedge fund trading can involve event-driven strategies, such as betting on corporate events like mergers or earnings reports.

- 😀 The path to joining a hedge fund often involves working at top investment banks and gaining experience before networking into a hedge fund.

- 😀 Hedge fund interviews are rigorous and focus on assessing the ability to make high-stakes decisions and evaluate risks quickly, with a focus on generating profits.

- 😀 While hedge funds can lead to massive success, they also carry the risk of failure, as seen with the collapse of Long-Term Capital Management (LTCM) in the '90s.

Q & A

What are hedge funds, and how do they work?

-Hedge funds are investment funds that manage money from wealthy individuals and institutions. They invest in a wide range of assets and are expected to make money in any market condition by using aggressive and high-risk strategies, such as short selling, leverage, and derivatives.

Who can invest in hedge funds?

-Hedge funds are typically only open to accredited investors, meaning individuals with a net worth of at least $1 million or an income of $200,000 a year. They are not available to the general public.

What is the primary fee structure of a hedge fund?

-The common fee structure for hedge funds is known as '2 and 20', meaning they charge a 2% management fee on the total capital they manage and take 20% of the profits they generate.

What is short selling, and how do hedge funds use it?

-Short selling is a strategy where an investor borrows a stock, sells it at the current price, and hopes to buy it back at a lower price in the future. Hedge funds use this strategy to profit when they expect stock prices to fall.

What is leverage, and how do hedge funds use it?

-Leverage involves using borrowed money to increase the size of an investment. Hedge funds use leverage to amplify their returns, but it also increases the risk of significant losses if the trade goes wrong.

What role do derivatives play in hedge fund strategies?

-Derivatives are financial products whose value depends on an underlying asset, such as stocks or commodities. Hedge funds use derivatives to hedge risk, speculate, and increase potential profits.

What is the 'Global Macro' strategy used by some hedge funds?

-The Global Macro strategy involves making trades based on large-scale economic trends, such as inflation, interest rates, and geopolitical events. Hedge funds use this strategy to profit from shifts in global markets.

How did George Soros make $1 billion in 1992?

-George Soros made $1 billion by betting against the British pound during Black Wednesday. He borrowed pounds, sold them for Deutsche Marks, and profited when the pound’s value plummeted after the UK was forced to break its agreement to keep the pound at a fixed exchange rate.

How do quant hedge funds differ from traditional hedge funds?

-Quant hedge funds use AI, algorithms, and machine learning to make millions of trades per day, looking for tiny market inefficiencies. Traditional hedge funds rely more on fundamental analysis and macroeconomic trends.

What qualifications do you need to join a hedge fund?

-To join a hedge fund, it typically requires a degree from a prestigious university and relevant work experience in investment banking, sales, or trading. Strong financial modeling and valuation skills, or advanced mathematical and programming skills, are often essential, especially for quant roles.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Catheter associated Urinary Tract Infection | CAUTI Care Bundle | CAUTI BUNDLE

What are Hedge Funds? 📈 Intro for Aspiring Quants

What REALLY is Private Equity? What do Private Equity Firms ACTUALLY do?

REVIEW SKIN KILUA HUNTER X HUNTER KEREN BANGET

02 MOSFET - Exercícios de chaveamento de mosfet

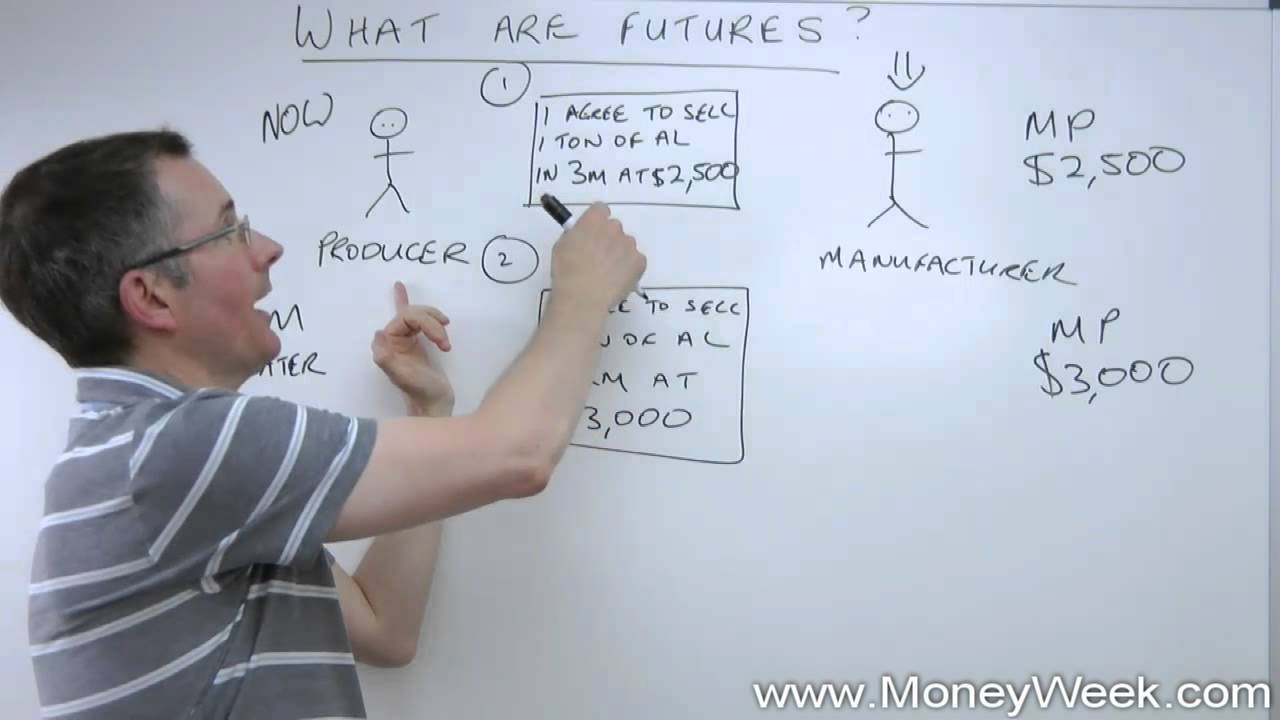

What are futures? - MoneyWeek Investment Tutorials

5.0 / 5 (0 votes)