Crowding Out Effect and Loanable Fund Market | Kelas Terbuka Ekonitas OSN Ekonomi

Summary

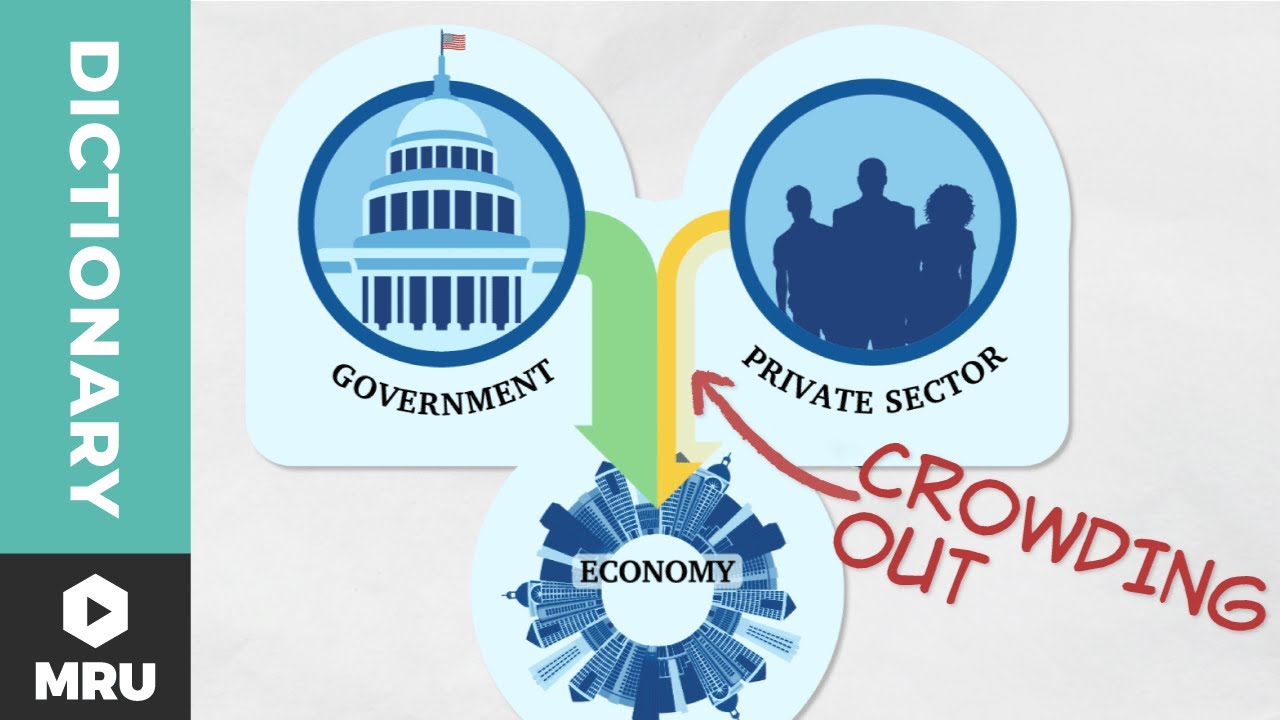

TLDRThis video discusses the concept of 'crowding out' in fiscal policy, where increased government spending can unintentionally reduce private investment. The script explains how government spending affects the loanable funds market, with a focus on how changes in supply and demand influence interest rates and investment. It outlines two scenarios: one where the government has a budget surplus and another where it runs a deficit. In both cases, the outcome is a decrease in private investment, illustrating the crowding-out effect, where government spending leads to less private investment, even though consumption may increase.

Takeaways

- 😀 Crowding-out effect occurs when increased government spending leads to decreased private investment.

- 😀 Government spending increases consumption, which boosts household income and spending power, but also impacts investment negatively.

- 😀 The loanable funds market consists of supply (from savings) and demand (from investors), affecting interest rates and available funds.

- 😀 National savings come from private savings (household and business savings) and public savings (government savings).

- 😀 Public saving is the difference between government revenues (taxes) and government spending.

- 😀 If the government runs a deficit, it must borrow money, affecting the loanable funds market and the interest rate.

- 😀 If government spending rises while the government has a surplus, the supply of loanable funds decreases, which leads to higher interest rates and reduced investment.

- 😀 In the case of a government budget deficit, increased spending leads to higher demand for loanable funds and shifts the demand curve to the right.

- 😀 Despite an increase in overall loanable funds, the supply for private investment decreases, as government borrowing takes up a significant portion of the funds.

- 😀 The increase in interest rates from government borrowing crowds out private investment, reducing the amount of funds available for private projects.

- 😀 The correct interpretation of the crowding-out effect is that increased government spending results in a decrease in private investment, even with a higher total amount of loanable funds.

Q & A

What is the crowding-out effect in fiscal policy?

-The crowding-out effect refers to the situation where an increase in government spending leads to a decrease in private investment. This occurs because government spending raises interest rates, which in turn reduces the amount of loanable funds available for private investment.

How does an increase in government spending affect consumption?

-When the government increases its spending, it raises the income of individuals, which boosts their consumption. This is because government spending acts as income for the public, allowing them to purchase more goods and services.

What is the relationship between government spending and investment?

-Government spending affects investment by altering the market for loanable funds. An increase in government spending can reduce the funds available for private investors, leading to a reduction in private investment.

What is the market for loanable funds, and how does it relate to the crowding-out effect?

-The market for loanable funds is where savings (both private and public) meet demand for loans by investors. In the context of the crowding-out effect, an increase in government spending leads to reduced national savings, shifting the supply curve for loanable funds to the left. This increases interest rates and reduces private investment.

What is the difference between private saving and public saving?

-Private saving refers to the money saved by households and businesses, while public saving refers to the savings of the government, which is the difference between government revenue (mainly from taxes) and government spending.

What happens to the supply of loanable funds when the government increases spending and has a budget surplus?

-When the government increases spending but starts with a budget surplus, public saving decreases, leading to a decrease in national savings. As a result, the supply of loanable funds decreases, causing interest rates to rise and reducing private investment.

What happens to the loanable funds market when the government runs a budget deficit?

-When the government has a budget deficit, it does not have any public saving to draw from. Instead, the government borrows money, increasing the demand for loanable funds. This shifts the demand curve for loanable funds to the right, raising interest rates and reducing the amount of funds available for private investment.

How does an increase in government spending affect interest rates?

-An increase in government spending can raise interest rates. This occurs because government borrowing or reduced public saving increases the demand for loanable funds, which drives interest rates up.

What is the impact of government borrowing on private investment?

-Government borrowing increases the demand for loanable funds, which raises interest rates. Higher interest rates make borrowing more expensive for private investors, leading to a reduction in private investment.

What is the key takeaway from the crowding-out effect in relation to government spending?

-The key takeaway is that when the government increases its spending, it may inadvertently reduce private investment, especially if the government borrows money or if public saving decreases. This is because the higher interest rates resulting from increased demand for loanable funds make it harder for private investors to obtain financing.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)