The ONLY Liquidity Rule You’ll Ever NEED To Become Profitable

Summary

TLDRIn this video, the trader walks viewers through their daily trading routine, focusing on key liquidity levels and price action analysis to identify profitable setups. Using real-time examples of QQQ, SPY, and Netflix, they demonstrate how to mark important price levels, observe market reactions, and execute trades based on these insights. The strategy centers around understanding market liquidity, taking partial profits, and adjusting positions as price movements evolve. Viewers gain valuable insights into making informed decisions with a clear, methodical approach to trading.

Takeaways

- 😀 Pre-market prep is essential for understanding key levels and liquidity areas before market open, helping to identify potential trade setups.

- 😀 Marking previous day highs and lows, as well as other significant price levels, is a core strategy for determining support and resistance zones.

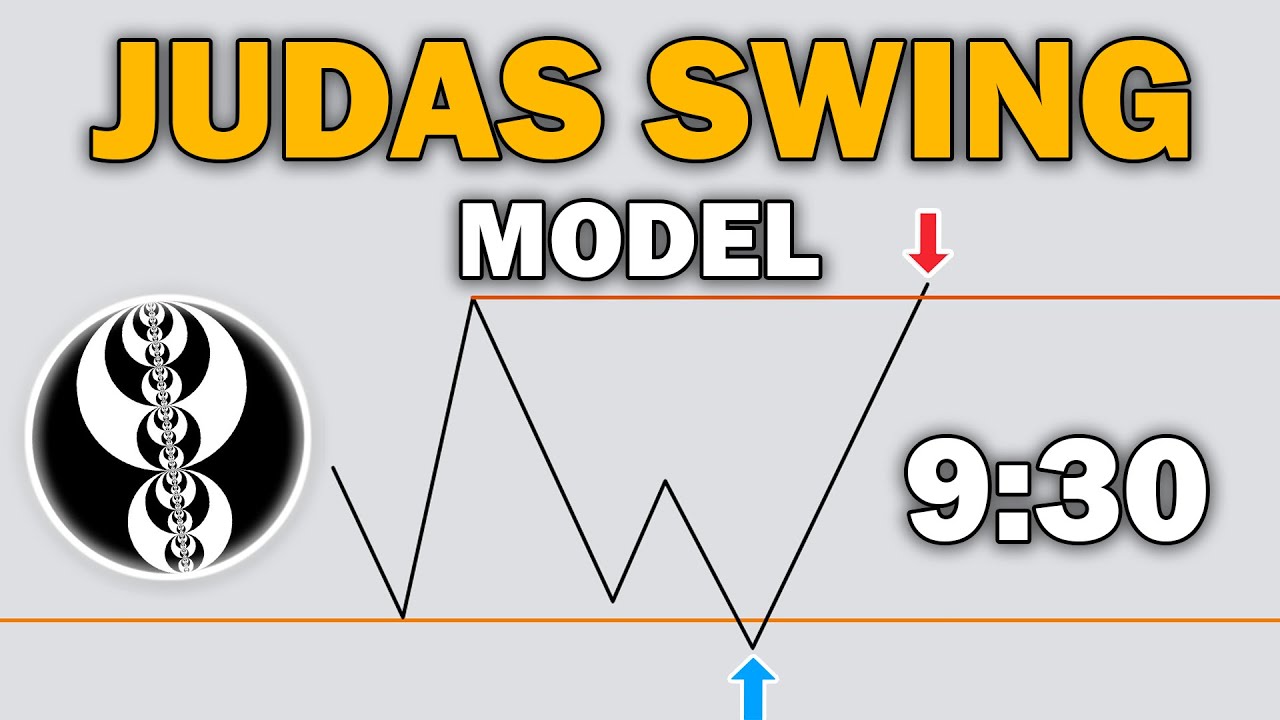

- 😀 Liquidity sweeps and liquidity runs are important concepts for predicting price movement; a sweep suggests a reversal, while a run suggests continuation.

- 😀 Key liquidity levels, like old highs and lows, serve as targets where price is likely to react, creating opportunities for profitable trades.

- 😀 The trader prefers to wait for the first 15 minutes of market open to observe price action before making decisions on entry or exit.

- 😀 Understanding higher timeframes and overall market trends is critical for setting a bias on whether to look for long or short trades.

- 😀 The trader uses lower timeframes for refining entries and exits, ensuring better risk management and more precise trade placements.

- 😀 A trade's stop should be set just below the break of key levels to minimize risk while allowing the trade room to move.

- 😀 Taking partial profits at key liquidity levels helps lock in gains while letting the trade run for larger targets.

- 😀 The trader emphasizes the importance of reacting to market conditions in real-time, using price action as confirmation for entries and exits.

- 😀 Managing risk effectively by scaling positions and keeping stops tight allows for flexibility in executing trades while protecting capital.

Q & A

What is the main focus of the trader’s pre-market preparation?

-The trader's pre-market preparation focuses on identifying key liquidity levels, such as previous day highs/lows and significant price levels, to establish a framework for potential trades based on expected market movements.

What role do liquidity levels play in the trader's strategy?

-Liquidity levels act as key areas where price tends to react. These levels are based on previous highs, lows, and significant market levels. Traders watch for price reactions at these points to decide whether to enter or exit trades.

How does the trader use the first 15 minutes of market action?

-The first 15 minutes help the trader gauge market direction. They observe price behavior at key levels to assess whether the market is showing strength or weakness, which helps in forming the decision to either enter a trade or wait for a better opportunity.

Why does the trader prefer focusing on price action rather than solely relying on indicators?

-The trader prefers focusing on price action because it provides real-time, actionable information about market sentiment. Price action around key liquidity levels offers clearer insights into whether the market will continue in the same direction or reverse.

What does the trader mean by a 'liquidity sweep'?

-A 'liquidity sweep' refers to the market quickly moving through a key level, causing a rapid influx of orders. This often signals a reversal or continuation of price movement, depending on the direction and the strength of the move.

How does the trader manage risk during trades?

-The trader manages risk by setting stop losses just beyond key liquidity levels and scaling out of positions when the price reaches certain targets. This approach helps to limit losses while maximizing potential gains.

What strategy does the trader use when trading stocks like Netflix and SPY?

-The trader uses a combination of identifying key support and resistance levels, watching for reactions off these levels, and entering trades based on price action. They focus on areas with significant liquidity, such as all-time highs or lows, and aim for a gradual move towards these targets.

What is the significance of the 438 level on QQQ in the trader's analysis?

-The 438 level on QQQ is a key support level. The trader observes whether the price stays below this level or reacts off of it. A break below 438 may signal further downside, while a failure to break suggests a potential reversal or consolidation.

How does the trader use the concept of 'old highs and old lows' in their analysis?

-'Old highs and old lows' are seen as levels where liquidity rests. These are areas where the market participants have previously entered or exited, and the trader expects price to gravitate towards these levels due to the concentration of liquidity.

What is the trader's approach to taking profits during a trade?

-The trader takes profits by scaling out of positions as the price reaches key targets. For instance, they take partial profits at intermediate levels, such as previous highs or lows, and keep a portion of the position open for further movement towards larger targets.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)