Kontrak Derivatif dalam Perdagangan Berjangka Komoditi

Summary

TLDRThe transcript covers various types of financial contracts, including forward contracts, futures contracts, options contracts, and swap contracts. It explains how these contracts are agreements between buyers and sellers for the delivery of commodities or assets at a specific date in the future. The forward contract's value depends on the commodity, and its terms are not negotiable except for price. The options contract offers the right, not the obligation, to buy or sell an asset at a predetermined price. The swap contract involves simultaneous buying and selling of the same commodity or asset.

Takeaways

- 😀 A Fatim contract's value and price depend on the subject commodity and contract type.

- 😀 There are four main types of contracts: forward contracts, futures contracts, options contracts, and swap contracts.

- 😀 These contracts involve transactions between a buyer and a seller agreeing to deliver commodities or assets at a predetermined time and specific quantity and quality.

- 😀 Forward contracts are standard agreements to buy or sell commodities at a set future date, with non-negotiable terms other than price.

- 😀 Futures contracts are similar to forward contracts but are traded on an exchange and often have standardized terms.

- 😀 Options contracts provide the buyer with the right, but not the obligation, to buy or sell commodities at a specific price within a certain time frame.

- 😀 A swap contract involves agreements to buy and sell commodities or assets simultaneously, for the same commodity or asset.

- 😀 These contracts play a key role in hedging risks associated with price fluctuations in commodities and assets.

- 😀 The key terms of these contracts, like price and delivery date, are essential to their function and are usually agreed upon at the outset.

- 😀 These types of contracts are commonly used in financial markets for risk management, speculation, and investment purposes.

Q & A

What is the nature of the contract mentioned in the script?

-The contract described in the script is a type of agreement in which the value and price depend on the commodity or asset being exchanged. These contracts are generally not transferable and are agreed upon by the buyer and seller to deliver specific commodities or assets at a predetermined time in the future.

How many types of contracts are mentioned in the script, and what are they?

-The script mentions four types of contracts: Forward contracts, Futures contracts, Options contracts, and Swap contracts.

What distinguishes a forward contract from other contract types?

-A forward contract is a standardized agreement between a buyer and seller to exchange a commodity or asset at a set price on a future date. The terms of the contract are not negotiable except for the price.

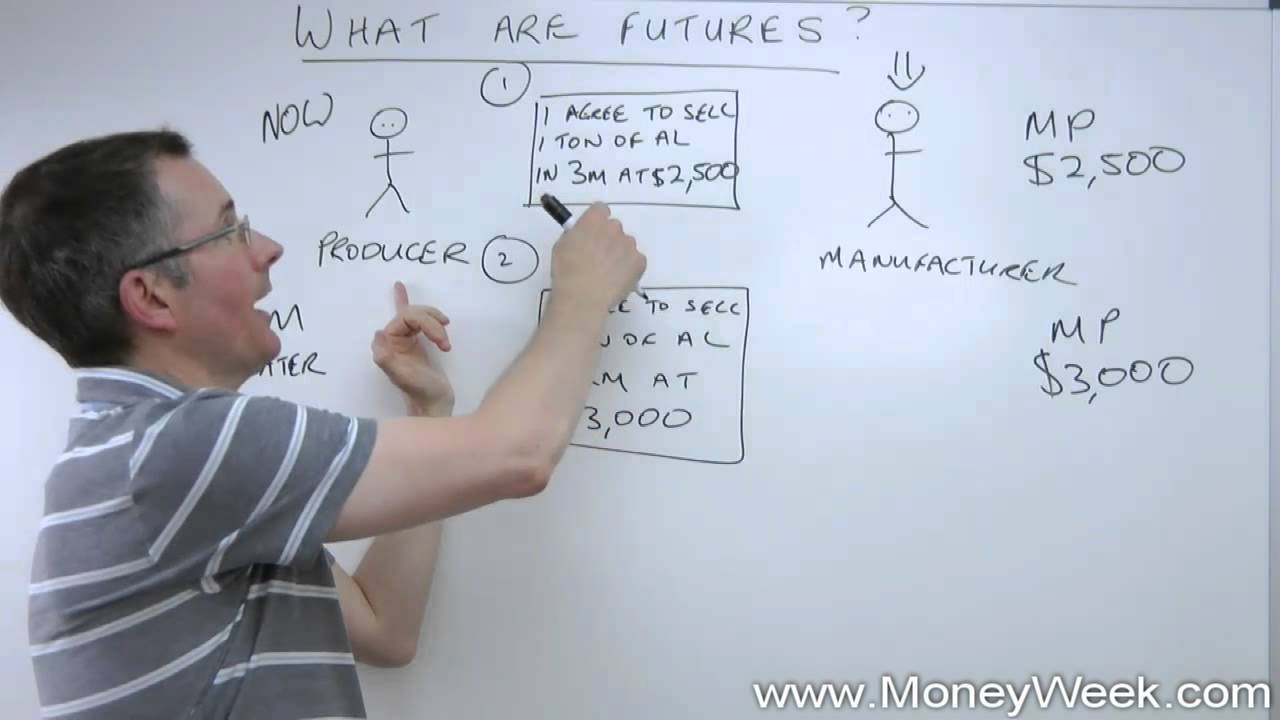

What is a futures contract?

-A futures contract is similar to a forward contract, but it is typically traded on an exchange, and the terms of the contract are standardized, including the delivery date and contract size.

What is the primary characteristic of an options contract?

-An options contract grants the holder the right, but not the obligation, to buy or sell a commodity or asset at a specified price within a set period of time.

What is the key feature of a swap contract?

-A swap contract involves an agreement to buy and sell the same commodity or asset simultaneously. This type of contract is commonly used for hedging or risk management.

Are the terms of the contracts negotiable?

-In forward contracts, the terms are generally fixed, except for the price. For options contracts, the price is negotiated, but the contract terms are non-negotiable. Futures contracts have standardized terms set by the exchange. Swap contracts are customized to the needs of the involved parties.

What is the purpose of a forward contract?

-A forward contract is used for agreeing on the price and delivery date of a commodity or asset, allowing parties to hedge against price fluctuations in the market.

What is the role of the buyer and seller in these contracts?

-The buyer and seller in these contracts agree to deliver or receive a commodity or asset in the future. The buyer typically agrees to purchase the commodity, and the seller agrees to provide it at the specified price and time.

Can the assets or commodities in these contracts be transferred to other parties?

-No, the assets or commodities in these contracts generally cannot be transferred to other parties. The contracts are binding between the agreed buyer and seller.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Differences Between Futures and Forward Contracts

What are financial instruments? | History of History of Financial Markets

What are futures? - MoneyWeek Investment Tutorials

#ليتفقهوا | تعرف على أنواع المعاملات المالية وتقسيماتها الفقهية مع د. زيد بن عبدالعزيز الشثري

Akad-akad dalam Bank Syariah • Perbankan Syariah #5

➡️ CONTRATOS LABORALES: ¿Qué TIPOS Hay? Con EJEMPLOS en 7 minutos .

5.0 / 5 (0 votes)