ICT CISD 100% Win Rate Strategy

Summary

TLDRIn this video, the presenter delves into the concept of Change in a State of Deliveries (CISDS) in trading, explaining how it plays a crucial role in their trading model. By pairing CISDS with liquidity sweeps, higher time frame Points of Interest (POIs), and SMT (Smart Money Techniques), traders can effectively identify entry points. The video demonstrates real-life examples of using these strategies on assets like NQ, YM, and ES. The presenter also offers tips on projecting targets and maximizing risk-to-reward ratios, concluding with an invitation to join their Discord for live trades and mentorship.

Takeaways

- 😀 Change in a state of deliveries (CISD) plays a crucial role in the trading model, especially when paired with liquidity sweeps, higher time frame POIs, and other factors.

- 😀 A valid change in the state of delivery occurs when significant liquidity is swept and a closure happens above a series of downward candles, signaling a shift in price direction.

- 😀 The change in the state of delivery can also be valid without a major liquidity sweep if paired with SMT (Smart Money Tool) at significant lows or highs using correlated assets like YM or NQ.

- 😀 In trading, session liquidity (such as Asia session liquidity) should be marked and watched for potential sweeps, which can trigger a valid change in the state of delivery when followed by a closure above downward candles.

- 😀 A change in the state of delivery confirms when the market respects the lows, providing an opportunity to target higher price levels. The concept applies across various time frames, including smaller ones like the 3-minute and 5-minute charts.

- 😀 After a valid change in the state of delivery, traders can anticipate the lows to be protected, placing stop-loss orders at the lows and targeting a risk-to-reward ratio of at least 2:1.

- 😀 Using liquidity sweeps and changes in the state of deliveries can yield significant profit potential, as demonstrated by trades that could result in a risk-to-reward ratio (RRR) of 4:1 or even higher.

- 😀 By marking manipulation legs and using projections from previous videos, traders can estimate standard deviations and more accurately target price points, enhancing risk-to-reward outcomes.

- 😀 Traders should watch for rate of liquidity, closure above downward candles, and SMT pairing with correlated assets to confidently enter trades with protective stop-losses and clear price targets.

- 😀 Engaging in mentorship or joining a trading community, such as a Discord group, provides real-time support, guidance, and education for traders looking to refine their strategies and learn from others’ live trades.

Q & A

What is a Change in the State of Delivery (CISD) in trading?

-A Change in the State of Delivery (CISD) occurs when a significant liquidity sweep happens, followed by a closure above (or below) a series of downward candles, indicating a shift in market direction. It helps identify when a trend change is likely to occur.

Can a Change in the State of Delivery be effective without a liquidity sweep?

-Yes, a Change in the State of Delivery can still be valid when paired with SMT (Smart Money Technique) at the lows or highs, using a correlated asset like YM or NQ, even without a liquidity sweep.

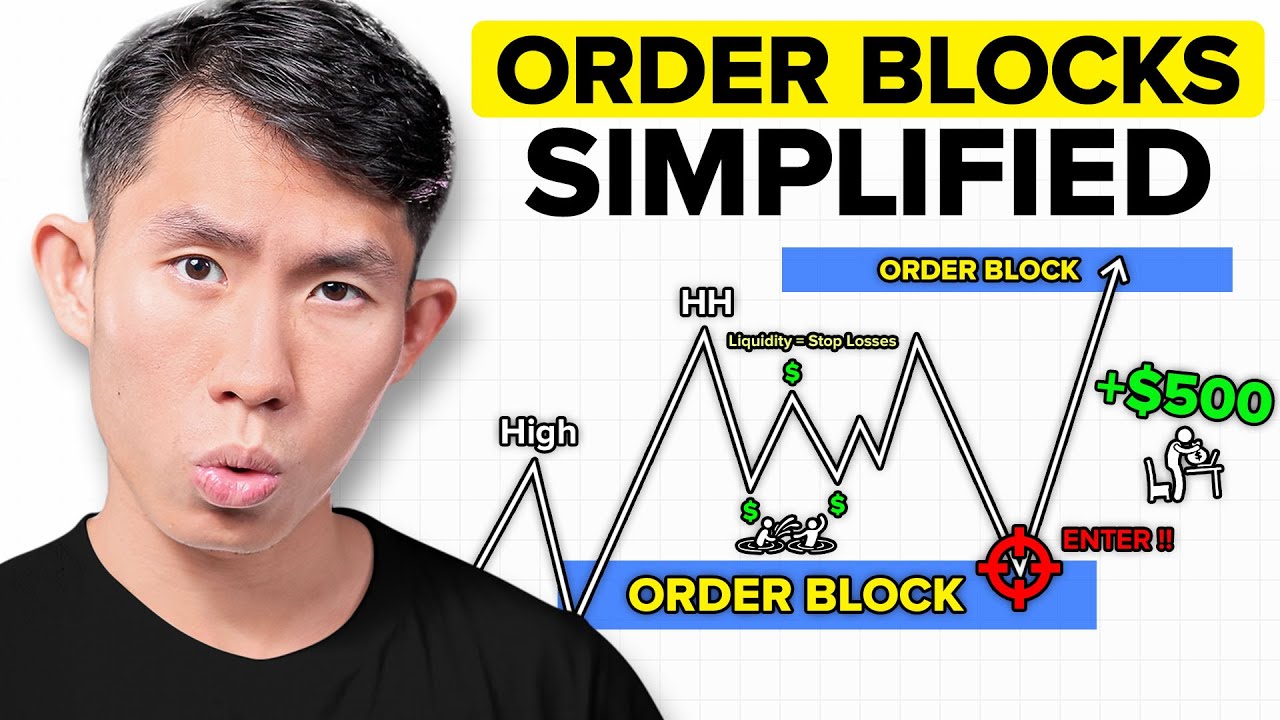

How do liquidity sweeps and a Change in the State of Delivery work together?

-Liquidity sweeps identify areas of significant liquidity, and a Change in the State of Delivery occurs when price closes above or below the relevant candle series, marking a trend shift. Combined, they create strong trade setups that anticipate market direction.

Why is a closure above a series of downward candles important for CISD?

-A closure above a series of downward candles validates the Change in the State of Delivery, confirming that the previous bearish movement has ended and a potential upward shift in price may follow.

What role does SMT (Smart Money Technique) play in validating CISD?

-SMT helps validate CISD by identifying divergence between correlated assets. If one asset sweeps liquidity and another doesn’t, it suggests a potential market reversal, confirming the CISD when paired with price action at key levels.

What is the significance of targeting a 2 RR (Risk-to-Reward ratio) in the trades?

-A 2 RR is a common risk-to-reward target in the script as it offers a balanced approach to capturing profits while limiting risk. It ensures that traders are aiming for a reasonable return in relation to the risk taken on the trade.

How can traders use the Asia session liquidity for trade setups?

-Traders can use Asia session liquidity to identify potential sweep points where price may target these levels before reversing. This can help confirm a Change in the State of Delivery, setting up potential trades based on the session’s liquidity raid.

What is the importance of time frames in identifying a Change in the State of Delivery?

-Time frames are crucial as they help identify precise entry points for trades. Smaller time frames, like the 3-minute or 5-minute charts, are often used to spot more immediate reversals after liquidity sweeps and CISD confirmation.

How do liquidity sweeps and change in the state of delivery impact risk management?

-Liquidity sweeps and CISD are used to manage risk by identifying high-probability entry points. Traders can place stop losses at logical levels, such as the previous low, while targeting higher risk-to-reward ratios, ensuring better risk management.

What is the benefit of using projections and standard deviations in trading?

-Using projections and standard deviations helps traders estimate price targets based on past price behavior. This provides clearer insight into where price might reach, helping traders make informed decisions on profit-taking and stop placement.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Change In The State Of Delivery (CISD) - Reversal Confirmation

How to Use ICT's 1st Presented FVG (Powerfull)

Finding Bias with Breakaway Gap

Master Order Blocks to Trade like Banks (no bs guide)

Perfecting LTF Orderblock Entries With CRT - Candle Range Theory - ICT Concepts

Liquidity Concepts Simplified

5.0 / 5 (0 votes)