Pearson Edexcel GCSE Business: Ways to approach the 9 mark questions

Summary

TLDRThis video provides a detailed breakdown of a business case study discussing the best approach for raising 1.2 million for an app development project. The presenter explores the advantages and drawbacks of using retained profits, such as saving on interest payments and keeping costs low, but also acknowledges the potential limitation of insufficient retained profits. A balanced conclusion is drawn, emphasizing the competitive nature of the app market and how keeping costs down through retained profits is the most effective option, though it depends on the available profits.

Takeaways

- 😀 Retained profits can be used to avoid borrowing money from external sources, helping to keep costs down.

- 😀 Avoiding external loans means there are no loan repayments or interest to pay, which helps maintain high profit margins on new projects.

- 😀 A drawback of using retained profits is the possibility that there might not be enough profit available to meet the required capital for a project.

- 😀 The business context (e.g., fluctuations in profits) plays a crucial role in deciding whether retained profits are a viable option.

- 😀 The competitive nature of the game and app market requires businesses to keep their costs as low as possible, which makes retained profits a strong option if available.

- 😀 A sophisticated conclusion involves not just repeating the initial argument, but adding context such as the competitive market and the necessity of keeping costs low.

- 😀 When making a decision, it's important to consider both the advantages and drawbacks, providing a balanced evaluation.

- 😀 To maximize marks in an exam, it's important to structure the response with an introduction of the chosen option, development of both advantages and drawbacks, and a conclusion that places value on the decision.

- 😀 A well-developed argument should include at least five link strands of development to demonstrate a clear analysis of the situation.

- 😀 The final decision in the conclusion should acknowledge that it depends on specific business conditions (e.g., retained profit levels), making the argument more nuanced and contextualized.

Q & A

What is the main focus of the transcript?

-The main focus of the transcript is on evaluating a business decision regarding raising capital for a new app, specifically by using retained profits versus borrowing money or issuing shares.

How does using retained profits benefit the company?

-Using retained profits benefits the company by allowing them to avoid borrowing money from external sources. This helps keep costs down since there are no loan repayments or interest, which in turn maintains higher profit margins for the new app.

What is the potential drawback of using retained profits?

-The drawback of using retained profits is that the company may not have enough retained earnings to meet the required $1.2 million, which could make it difficult to fund the app development.

How is the argument for using retained profits supported in the transcript?

-The argument for using retained profits is supported through multiple link strands, explaining how avoiding loans and interest payments can reduce costs and increase profit margins. This reasoning is also contextualized by the competitive nature of the gaming market.

What is the 'it depends on' rule mentioned in the transcript?

-The 'it depends on' rule refers to the uncertainty of whether the company will have enough retained profit to meet the $1.2 million requirement. If not, alternative methods, like issuing shares, may be considered.

What role does the competitive nature of the gaming market play in the decision-making process?

-The competitive nature of the gaming market is crucial because it emphasizes the need to keep costs low. By using retained profits, the company can avoid extra costs from borrowing or issuing shares, thus improving the chances of success in a highly competitive market.

How does the conclusion justify the use of retained profits?

-The conclusion justifies using retained profits by highlighting that in a competitive market, keeping costs low is essential. It argues that avoiding loans or external funding helps maintain lower costs and higher profit margins, making retained profits the best option, provided there are enough funds available.

What other option does the transcript suggest if retained profits are insufficient?

-If retained profits are insufficient, the transcript suggests that issuing shares could be a better way to raise the required $1.2 million for the app.

How many link strands of development are used in the argument for retained profits?

-The argument for using retained profits includes six link strands of development, which provides a thorough analysis of the advantages of this option.

What is the significance of structuring the answer into paragraphs with distinct advantages and drawbacks?

-Structuring the answer into paragraphs with distinct advantages and drawbacks allows for a balanced analysis. It presents both sides of the argument clearly, providing a fair evaluation before reaching a well-reasoned conclusion.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

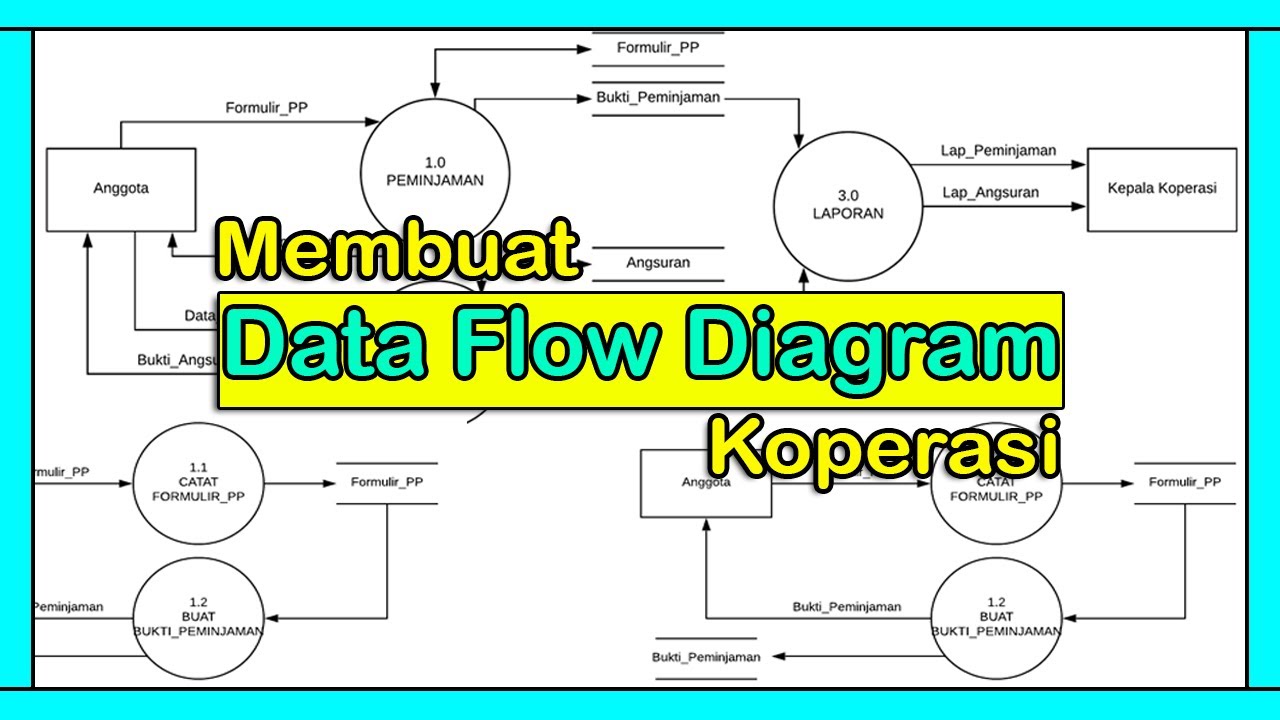

Tutorial Membuat DFD (Data Flow Diagram) | Studi Kasus Koperasi

Four Factors Necessary to Prove Nursing Negligence | Legal Issues in Nursing Pt.3

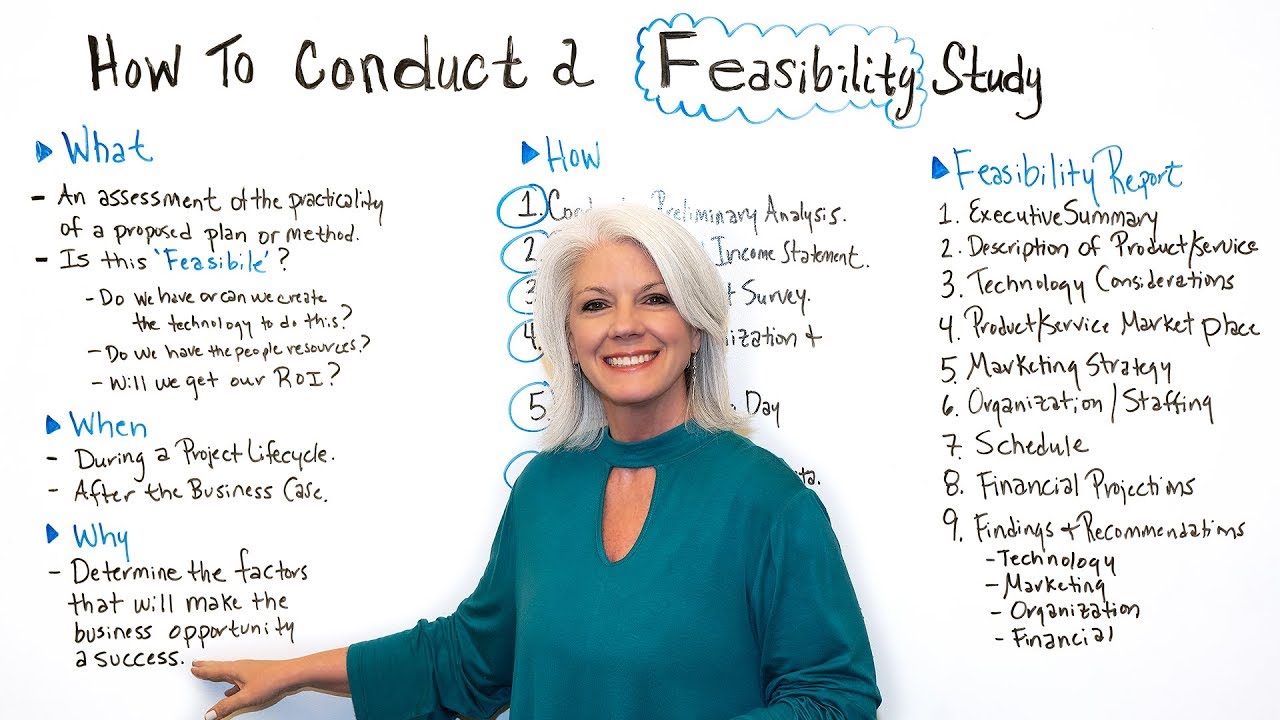

How to Conduct a Feasibility Study - Project Management Training

How to Answer 20 Mark 🖋 EDEXCEL A Level Business Question WITH AN EXAMPLE - A Level Exam Technique

5 CHAPTERS - 44 MARKS 🔥 Chapter wise weightage CLASS 11 ACCOUNTS | GAURAV JAIN

How much does it cost to raise 1000 Catfish (2024)

5.0 / 5 (0 votes)