Dorong Kredit Perbankan UMKM, Bank Indonesia Siap Luncurkan RPIM

Summary

TLDRBank Indonesia is preparing an inclusive financing ratio macroprudential policy to encourage bank credit distribution to micro, small, and medium enterprises (UMKM). This policy aims to expand economic inclusion through four strategies: broadening the definition of UMKM financing, expanding banking partnerships, innovating credit distribution options, and offering incentives for banks that support UMKM corporatization. The goal is to boost inclusive finance and support priority sectors in the economy, with Bank Indonesia set to launch this policy soon to facilitate greater credit flow to the UMKM sector.

Takeaways

- 😀 Bank Indonesia is working on a policy to boost banking credit to Micro, Small, and Medium Enterprises (UMKM).

- 😀 The policy focuses on inclusive financing ratios and macroprudential measures (RPM).

- 😀 This policy aims to increase financial inclusion for UMKM, promoting a more inclusive economy.

- 😀 Four key expansion points are emphasized in the policy: extending the definition of UMKM financing, expanding banking partnerships for credit distribution, innovating credit distribution options, and offering incentives to banks supporting corporate structures in UMKM sectors.

- 😀 One of the goals is to extend inclusive banking partnerships to help distribute UMKM credit more effectively.

- 😀 The policy includes innovative ways of distributing credit, such as indirect credit through inclusive security purchases.

- 😀 Banks that encourage corporate structuring for UMKM and priority sectors will receive incentives from Bank Indonesia.

- 😀 Bank Indonesia is preparing to launch the inclusive financing ratio macroprudential policy to enhance credit access to UMKM.

- 😀 The primary goal of the initiative is to foster more inclusive financing for businesses.

- 😀 The policy is aimed at encouraging broader credit distribution and supporting the growth of priority sectors, including UMKM.

- 😀 Bank Indonesia's initiatives are set to improve the overall economic inclusivity and support the development of small businesses in the economy.

Q & A

What is the main purpose of Bank Indonesia's new policy regarding inclusive financing?

-The main purpose of the policy is to encourage banking credit distribution to Micro, Small, and Medium Enterprises (UMKM) by implementing a macroprudential inclusive financing ratio (RPM), which aims to expand financing options and increase banking partnerships in UMKM.

What does the macroprudential inclusive financing ratio (RPM) policy aim to achieve?

-The RPM policy aims to increase inclusive financing by expanding the scope of financing options available to UMKM, making it easier for businesses to access credit through various banking innovations and collaborations.

What are the key components of the inclusive financing policy introduced by Bank Indonesia?

-The policy includes four key components: 1) Expanding the definition of UMKM financing, 2) Broadening banking partnerships for UMKM credit distribution, 3) Innovating credit distribution options, such as indirect purchases of inclusive securities, and 4) Providing incentives for banks that promote corporatization in the UMKM sector.

How does Bank Indonesia plan to expand the definition of UMKM financing?

-Bank Indonesia plans to redefine UMKM financing to include a broader range of economic activities, which will enable more businesses to qualify for financing and expand their access to banking services.

What is the significance of expanding banking partnerships in the context of this policy?

-Expanding banking partnerships is significant because it ensures that more financial institutions are involved in distributing credit to UMKM, which improves the accessibility of loans for small and medium enterprises and supports their growth.

How will innovation in credit distribution impact UMKM?

-Innovation in credit distribution, including indirect purchasing of inclusive securities, will allow banks to offer more flexible and accessible financing solutions, thereby supporting the financial needs of UMKM and contributing to their business growth.

What kind of incentives will Bank Indonesia provide to banks?

-Bank Indonesia will offer incentives to banks that promote corporatization in the UMKM sector and focus on financing priority sectors, encouraging them to play a greater role in supporting the growth of these businesses.

Why is corporatization of UMKM encouraged under this policy?

-Corporatization of UMKM is encouraged because it helps formalize businesses, making them more attractive for financing and improving their ability to access resources, which can lead to more sustainable growth and development in the long term.

How does the policy contribute to the broader goal of inclusive economic growth?

-By making financing more accessible to UMKM, the policy fosters inclusive economic growth by supporting small and medium-sized businesses, which are crucial for job creation, innovation, and overall economic development.

When is Bank Indonesia expected to launch the inclusive financing macroprudential ratio (RPM) policy?

-Bank Indonesia is expected to launch the inclusive financing macroprudential ratio (RPM) policy soon, aiming to facilitate greater banking credit distribution to inclusive financing sectors and UMKM.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Celaka, Ratusan Bank di Indonesia Bangkrut!!! Krisis Ekonomi Di Depan Mata?

PR Baru Prabowo-Gibran, Digitalisasi UMKM Menuju Ekonomi Berbasis Teknologi

UMKM Carica, Solusi Atasi Kemiskinan Ekstrem Di Wonosobo - Right Angle

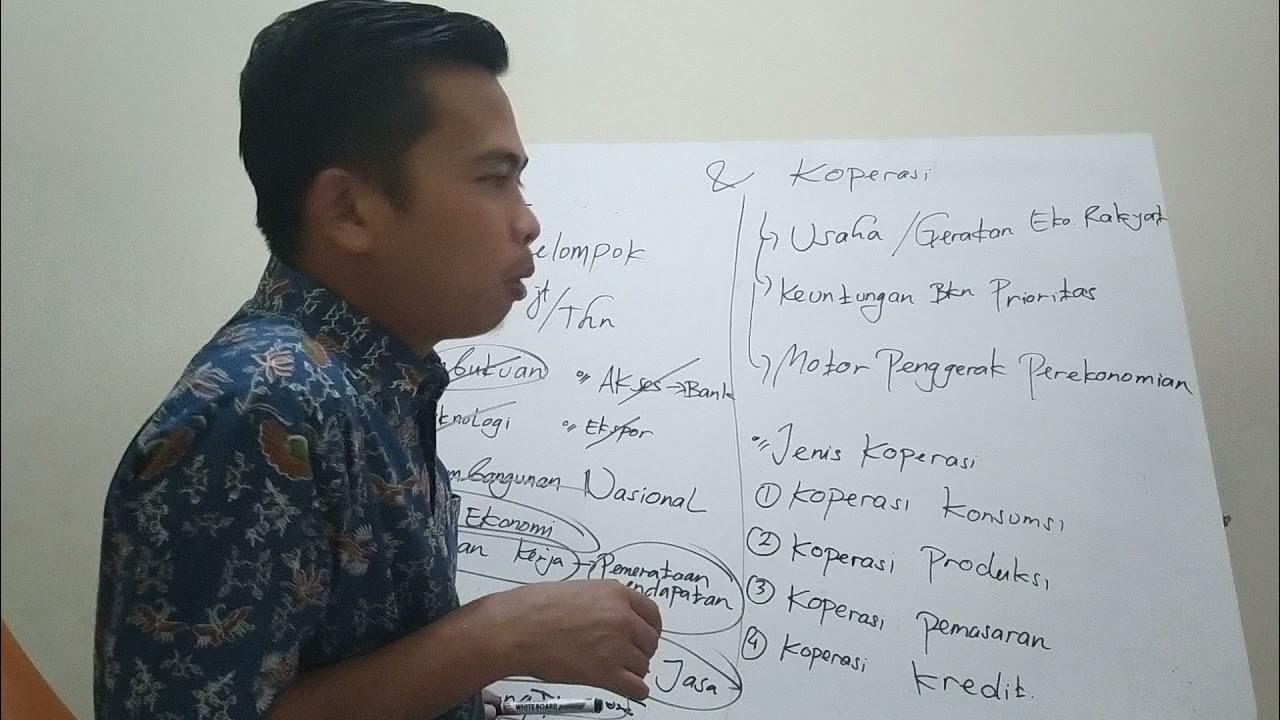

UMKM dan Koperasi

Maman Abdurrahman Paparkan Terkait Kebijakan Penghapusan Utang UMKM | IBF tvOne

𝐂𝐡𝐚𝐩𝐭𝐞𝐫 𝐈: 𝐊𝐨𝐧𝐬𝐞𝐩 𝐒𝐭𝐚𝐛𝐢𝐥𝐢𝐭𝐚𝐬 𝐒𝐢𝐬𝐭𝐞𝐦 𝐊𝐞𝐮𝐚𝐧𝐠𝐚𝐧 (𝐒𝐒𝐊) 𝐝𝐚𝐧 𝐊𝐞𝐛𝐢𝐣𝐚𝐤𝐚𝐧 𝐌𝐚𝐤𝐫𝐨𝐩𝐫𝐮𝐝𝐞𝐧𝐬𝐢𝐚𝐥.

5.0 / 5 (0 votes)