How Money Works: A Look At Monetary Policy

Summary

TLDRThis script explores the concept of money, its evolution from being backed by gold to today's fiat currency system, where value is derived from government rules. It explains the role of exchange rates, currency manipulation, and inflation in global economies. It delves into how monetary policy is used to manage economic growth, inflation, and employment. The Federal Reserve, with its dual mandate to maximize employment and control inflation, plays a crucial role not only in the U.S. economy but also in the global financial system due to the prominence of the U.S. dollar.

Takeaways

- 😀 Money is a universal tool used for transactions, both for needs and wants, and can take many forms such as paper or electronic messages.

- 😀 The modern currency system is based on fiat money, which is not backed by tangible assets like gold, but is instead given value through government regulations.

- 😀 Governments declare their currency as legal tender, meaning businesses must accept it for goods and services, creating a demand for it.

- 😀 Currency exchange is essential for international trade, as people and businesses need to swap currencies to make purchases in different countries.

- 😀 Exchange rates fluctuate due to economic factors, and some governments manipulate currency values to boost domestic industries or create jobs.

- 😀 Inflation can occur when the money supply increases too much, leading to higher prices for goods and services, and can be influenced by factors like wage demands and expectations.

- 😀 Inflation is not always negative, as it can help those in debt by reducing the real value of their obligations, making it easier to pay them off.

- 😀 Excessive inflation can harm an economy by making essential goods unaffordable, eroding savings, and causing uncertainty in future value.

- 😀 Deflation, or a decrease in the money supply, can reduce inflation but can also cause economic contraction by lowering demand and leading to less investment and hiring.

- 😀 Central banks use monetary policies, like expansionary and contractionary measures, to manage the money supply, balance inflation, and influence economic growth and employment.

- 😀 The Federal Reserve, as the central bank of the United States, plays a crucial role in not only managing the U.S. economy but also impacting global economies due to the widespread use of the U.S. dollar.

Q & A

What is the primary function of money in modern economies?

-Money acts as a medium of exchange, allowing people to buy goods and services. It is also a store of value and a unit of account, enabling people to trade and assess the value of items.

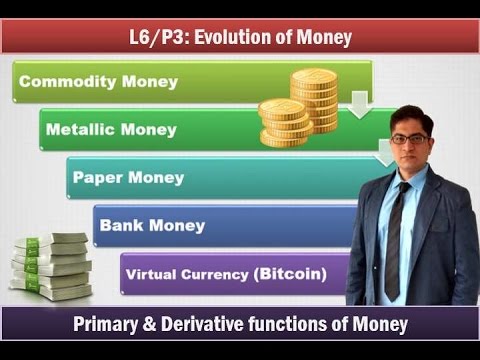

How did the concept of money evolve over time?

-Historically, various objects and materials, including gold, were used as money. Modern currencies, such as dollars, pounds, and yen, evolved from being backed by gold to being supported by government declarations, a system known as fiat money.

What is fiat money?

-Fiat money is currency that has value because a government declares it to be legal tender. It is not backed by physical assets like gold, but its value comes from the trust people have in the government's economic policies.

Why are exchange rates important in global trade?

-Exchange rates determine how much one currency is worth in relation to another, facilitating international trade. Businesses and individuals need to exchange their currency for one that is accepted in another country to purchase goods or services.

What is currency manipulation, and how does it affect the economy?

-Currency manipulation occurs when a government intentionally devalues its currency by flooding the market with it. This makes the country's exports cheaper abroad but can lead to economic tensions and retaliation from other countries.

How does the supply of money impact inflation?

-When the supply of money increases, borrowing becomes cheaper, leading to more spending and investment. However, if money supply growth outpaces the supply of goods and services, inflation occurs, causing prices to rise.

What is the relationship between inflation and wages?

-Inflation can drive wages up as workers demand higher pay to keep up with rising costs. However, if businesses raise wages, they may also increase prices for their products, contributing to further inflation.

What happens when inflation becomes too high?

-Excessive inflation erodes the purchasing power of money, making it harder for people to afford basic goods and services. It can lead to economic instability, reduce savings, and make future planning difficult.

What is deflation, and how does it impact the economy?

-Deflation occurs when the money supply decreases, leading to falling prices. While this can make goods cheaper, it also reduces consumer spending and investment, potentially leading to economic contraction and unemployment.

How do central banks control inflation and deflation?

-Central banks, like the Federal Reserve in the U.S., use monetary policies to manage inflation and deflation. They can adjust the money supply by lowering or raising interest rates, encouraging borrowing or saving to stabilize the economy.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)