GAMBARAN UMUM MANAJEMEN MODAL KERJA KEL.10 MKI 2C

Summary

TLDRThis video presentation delves into the concept of working capital management, a key aspect of financial management. It covers the definition of working capital, its components such as cash, receivables, inventories, and payables, as well as its strategic role in ensuring liquidity, operational continuity, and balanced risk and profitability. The discussion also explores different approaches to managing working capital, including conservative, aggressive, and moderate strategies. Key performance indicators like the current ratio, quick ratio, and inventory turnover are highlighted to measure effective working capital management. Additionally, the video touches on optimal asset management and financing strategies.

Takeaways

- 😀 Working capital is the difference between current assets and current liabilities, representing the resources a company has to meet short-term obligations.

- 😀 The primary objectives of working capital management are to maintain liquidity, ensure smooth business operations, balance profitability with risk, and avoid cash shortages in daily operations.

- 😀 Key components of working capital include cash, receivables, inventories, and payables.

- 😀 Effective working capital management is essential for the company's financial health and involves functions like maintaining liquidity, optimizing cash conversion cycles, and reducing reliance on short-term loans.

- 😀 Companies can manage working capital using three approaches: conservative (focus on liquidity), aggressive (focus on high profits with higher risk), and moderate (balanced approach).

- 😀 Profitability in working capital management can be enhanced by quickly collecting receivables and optimizing inventory management, while reducing excess inventory to avoid storage costs.

- 😀 Poor management of working capital can lead to risks like insufficient funds for operations, uncollectible receivables, and excessive inventory leading to high storage costs.

- 😀 Financial performance can be evaluated using key indicators such as the current ratio, quick ratio, receivables turnover, and inventory turnover.

- 😀 There are two main types of working capital: permanent (the minimum amount required for day-to-day operations) and variable (changing depending on seasonal needs or business conditions).

- 😀 Companies must balance liquidity with profitability, as higher liquidity often leads to lower profitability due to less investment in higher-risk, higher-return opportunities.

- 😀 The choice between short-term and long-term financing strategies should consider the stability of cash flows, the nature of the business, and the company’s risk tolerance. Proper funding schedules can enhance profitability and reduce financial risks.

Q & A

What is working capital?

-Working capital is the difference between current assets and current liabilities, indicating how much liquidity a company has to cover its short-term obligations.

What are the main objectives of working capital management?

-The main objectives of working capital management are to ensure liquidity, ensure smooth operations without financial interruptions, balance profitability and risk, and avoid a shortage of funds for daily operational activities.

What are the key components of working capital?

-The key components of working capital are cash and cash equivalents, accounts receivable (money owed by customers), inventory, and accounts payable (money owed to suppliers).

What are the six key functions of working capital management?

-The six key functions are: 1) Maintaining liquidity, 2) Ensuring operational continuity, 3) Optimizing cash conversion cycle, 4) Reducing reliance on short-term debt, 5) Improving operational efficiency, and 6) Balancing risk and profitability.

What are the three main approaches to managing working capital?

-The three main approaches are: 1) The conservative approach, which focuses on maintaining high liquidity, 2) The aggressive approach, which aims for high profits but at higher risk, and 3) The moderate approach, which seeks a balance between risk and profitability.

What is the role of profitability in working capital management?

-Profitability can be improved by quickly collecting receivables and efficiently managing inventory. However, it must be balanced with risk to avoid operational disruptions.

What are some risks associated with poor working capital management?

-Risks include insufficient working capital leading to operational disruptions, uncollected receivables causing financial loss, and excessive inventory that leads to high storage costs and reduced efficiency.

How is the performance of working capital management measured?

-Performance can be measured using indicators like the current ratio (current assets divided by current liabilities), quick ratio (current assets minus inventory divided by current liabilities), receivables turnover (how quickly receivables are converted into cash), and inventory turnover (how quickly inventory is sold).

What is the difference between permanent and variable working capital?

-Permanent working capital is the minimum amount needed for day-to-day operations, while variable working capital fluctuates depending on seasonal or business-specific factors.

What is the matching or hedging approach to working capital financing?

-The matching approach aims to align the duration of financing with the duration of asset needs. Short-term funding is used for temporary or seasonal needs, while long-term funding is used for permanent assets.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Working Capital Management (Manajemen Modal Kerja)

What is Financial Management? Types, Functions, Objectives.

What is Working Capital? Working Capital Explained in Hindi

FINANCIAL MANAGEMENT class 12 ONE SHOT business studies | chapter 9

MS 03 - Working Capital Management - Basic Concepts (Part I)

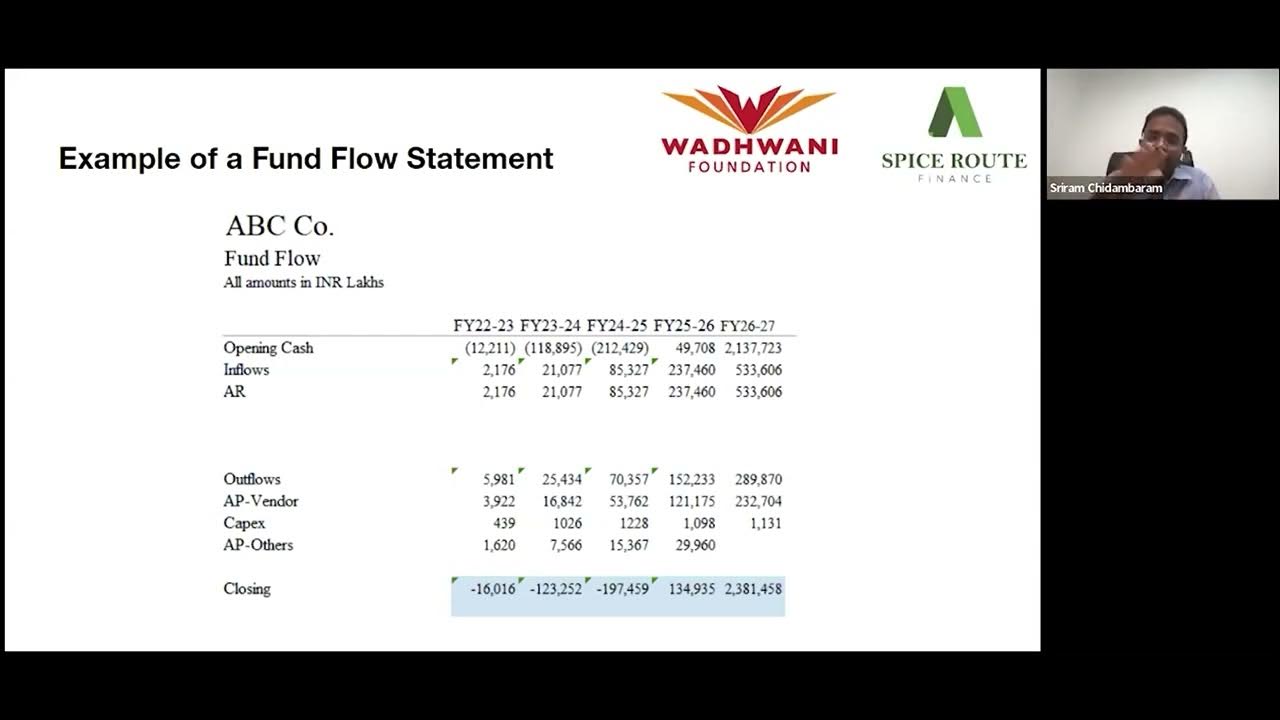

Week 9 Masterclass Sriram Chidambaram Crucial Financial Insights for Startups Success

5.0 / 5 (0 votes)