How to Test Internal Controls | Revenue and Collection Cycle

Summary

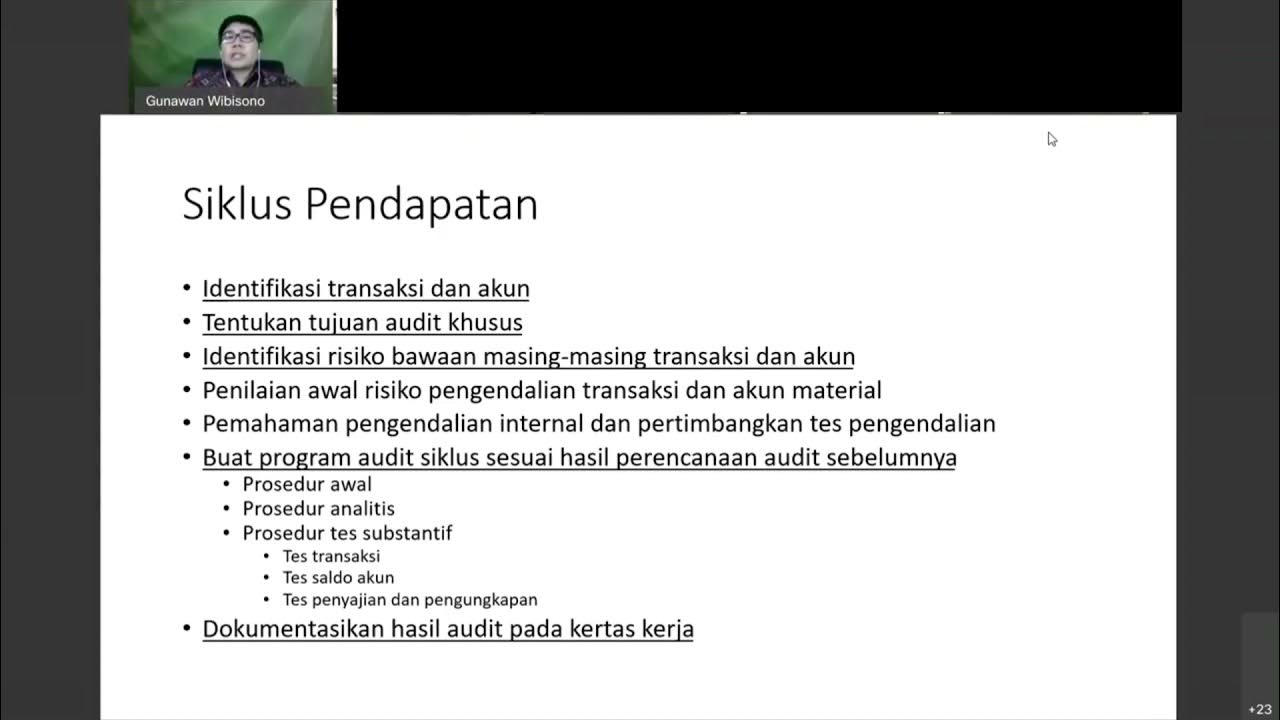

TLDRThis video explains the critical steps in testing internal controls within the revenue and collection cycle. The auditor evaluates whether internal controls are functioning as intended by performing various tests, such as asking questions, inspecting documents, and re-performing procedures. Key assertions like existence, completeness, accuracy, and classification are assessed through testing controls for both revenue and accounts receivable. If internal controls are found lacking, substantive procedures are increased. The video concludes by emphasizing the need to adjust the audit approach based on the effectiveness of controls, ensuring a thorough audit process.

Takeaways

- 😀 Auditors need to test the operating effectiveness of internal controls to determine if they are working as designed and being performed by authorized employees.

- 😀 Methods for testing controls include asking questions, observing the process, inspecting documents, re-performing controls, and conducting walkthroughs.

- 😀 If internal controls are ineffective, the risk of material misstatement increases, leading auditors to perform more substantive procedures.

- 😀 Dual direction tests, also known as dual-purpose procedures, can be used to test multiple assertions simultaneously, such as testing both existence and completeness of transactions.

- 😀 Audit software can help auditors examine entire journals and sequences of documents, identifying missing or duplicated numbers to check for control effectiveness.

- 😀 To test revenue controls, auditors verify that sales invoices are supported by customer orders and shipping documents, and check for proper segregation of duties.

- 😀 For the completeness assertion, auditors ensure there are no missing documents in the sequence and confirm that shipped goods are billed appropriately.

- 😀 Authorization controls are tested by checking the accuracy of prices against the price list and verifying customers do not exceed credit limits.

- 😀 Auditors check the accuracy assertion by verifying the matching of prices on invoices to the price list and quantities to shipping documents.

- 😀 When testing controls for receivables, auditors vouch accounts receivable to invoices, shipping documents, and customer orders, and check that receivables have not been sold.

Q & A

What is the next step after evaluating the design of internal controls?

-The next step is to test the controls. After learning how a company's internal controls should work, auditors need to test their operating effectiveness to ensure each control is functioning as intended.

How does the auditor determine whether an internal control is operating effectively?

-The auditor can test the operating effectiveness of a control by asking the client questions, observing the client performing the control, inspecting documentation, re-performing the control, or conducting a walkthrough.

What happens if an internal control is found to be ineffective?

-If an internal control is ineffective, the risk of material misstatement increases, requiring the auditor to increase the amount of substantive procedures to maintain acceptable audit risk levels.

What are dual purpose procedures in auditing?

-Dual purpose procedures are tests that serve to assess more than one management assertion at a time. For example, testing both existence and completeness by verifying sales invoices against shipping documents.

How can audit software assist in testing internal controls?

-Audit software can help by examining the entire sales journal to detect missing or duplicate sales documents, as well as checking the numerical sequence of documents for issues.

What is the purpose of testing controls related to management assertions for revenue?

-Testing controls for revenue assertions ensures that sales invoices are supported by proper documentation, the client is adhering to procedures like segregation of duties, and the billing process is accurate and timely.

What actions does the auditor take to test the completeness of revenue?

-The auditor checks the numerical sequence of documents to ensure nothing is missing, traces shipping documents to sales invoices, and reviews unfilled orders to identify shipments that haven't been billed.

What does the auditor verify for the authorization assertion related to revenue?

-The auditor checks that prices on sales invoices match the client's price list and verifies that customers do not exceed their credit limits.

How does the auditor verify the accuracy of sales transactions?

-The auditor compares prices on sales invoices to the price list and ensures the number of units shipped matches the quantity listed on the shipping documents.

What should an auditor check for the cut-off assertion related to revenue?

-For the cut-off assertion, the auditor verifies that the client bills customers shortly after goods are shipped and checks that the dates on sales invoices match those on shipping documents.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)